Etf Bitcoin ETFS sees $ 96 million in external flows amid market withdrawal

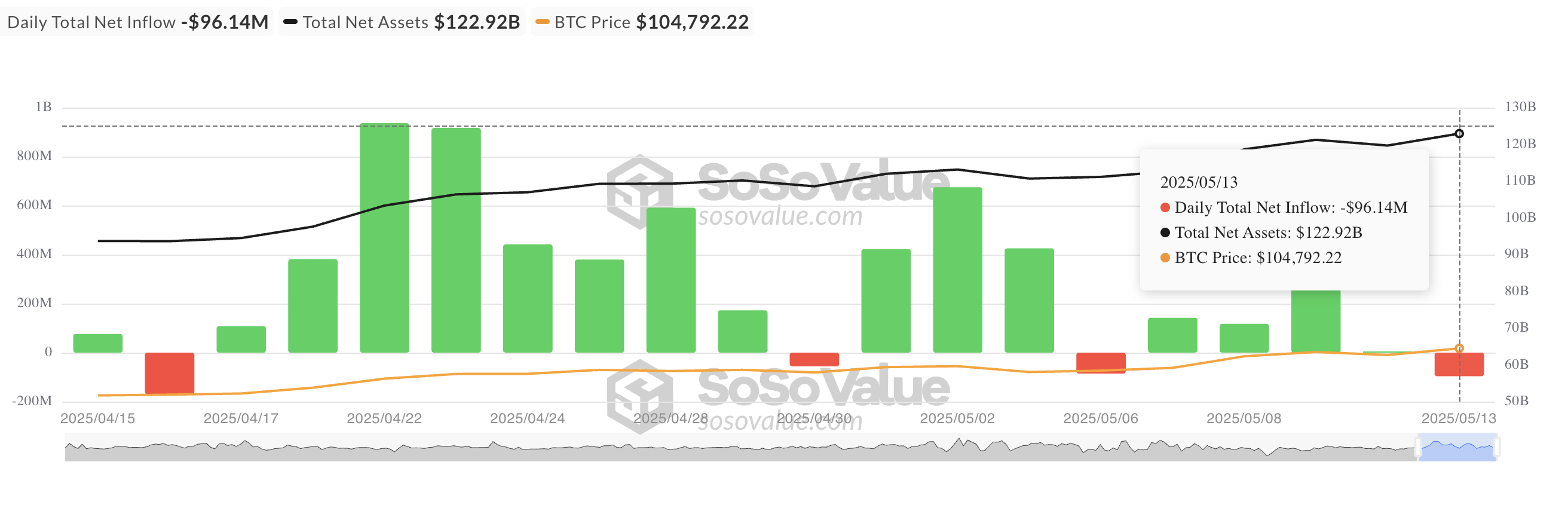

On Tuesday, the Bitcoin Spot investment funds recorded a clear collective flow of $ 96.14 million, with no net flows over the twelve listed money.

This is due to a moderate withdrawal in the general activity in the market, which prompted the price of BTC to the lowest level during the day 101,429 dollars.

ETFS Bitcoin $ 96 million in daily external flows

On Tuesday, the Bitcoin -backed investment funds witnessed a $ 96.14 million, which represents the largest net flow for one day since April 16. The external flow came in a slight decrease in the public encryption market, which witnessed the low price of BTC to the lowest level within the day at the lowest level 101,429 dollars.

This decline is likely to be an investor from institutions, many of whom were waiting for to see if the currency could build momentum over the mark of $ 105,000, especially amid the recent signs of progress in the trade relations between the United States of China.

Yesterday, the FBTC’s FBTC led this exit, where he recorded the highest external flows among all ETF exporters. The total Fund’s capital flow was 91.39 million dollars. As of the writing of these lines, the total historical net flow is 11.61 billion dollars.

With every twelve investment funds circulating in BTC, no flows were recorded yesterday, it was clear that the feelings had turned into risk, at least temporarily.

BTC derivatives indicate optimism

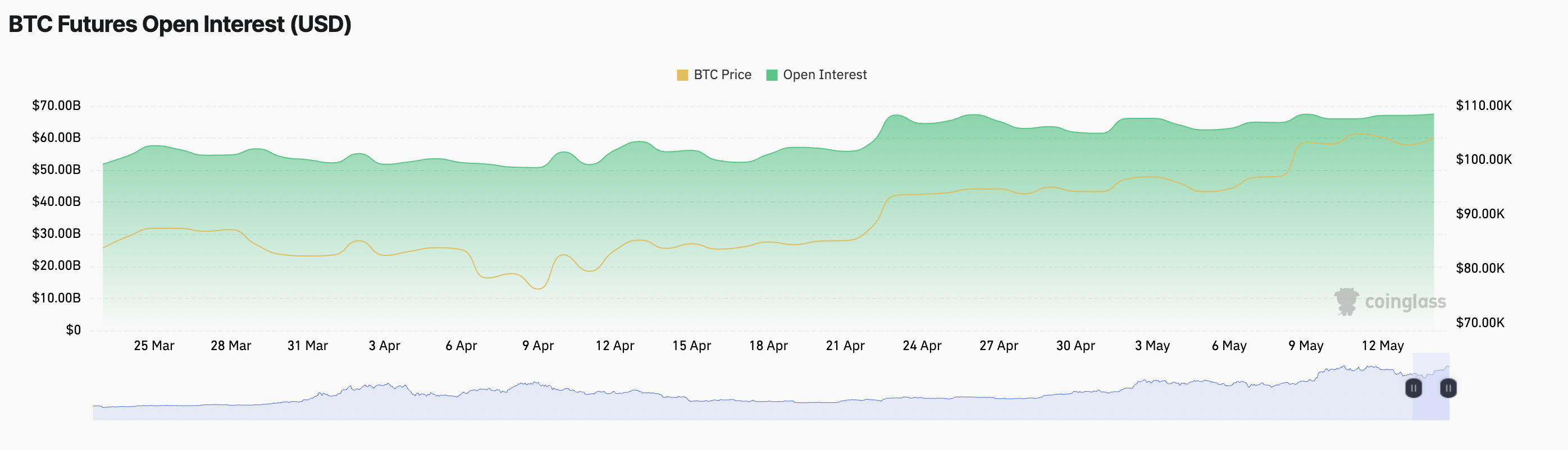

During the past 24 hours, BTC has organized a modest recovery, climbing 1 %. This gathering is fueled by the steady rise in trading activity over the past day. In the future contract market, this is reflected in the open interest of the currency, which is currently 67.47 billion dollars, indicating a 1 % increase.

While the price of BTC and the open benefits gatherings are modest, the trend indicates a gradual return of confidence among merchants. The rise in open attention indicates that the market participants are returning to the market with new sites, which may expect more upward trend.

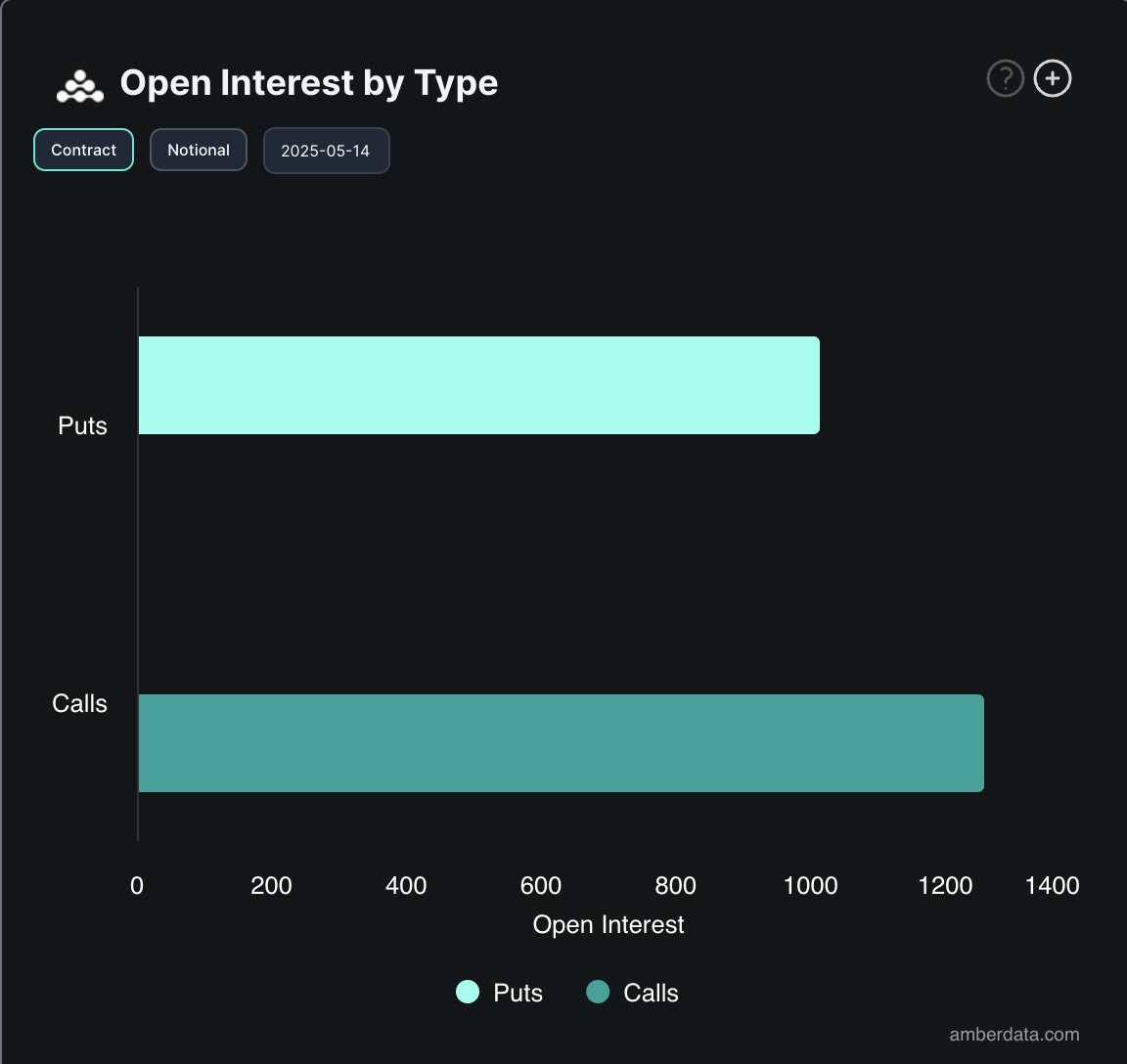

Moreover, the BTC Options Market confirms these upward expectations. The highest demand today indicates the calls that merchants put themselves in the potential upward trend in the currency price.

The flexibility shown in the BTC Destruction Market indicates that the market is still ready to take advantage of any positive momentum.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.