Bitcoin’s possessions near the peak – is it coming?

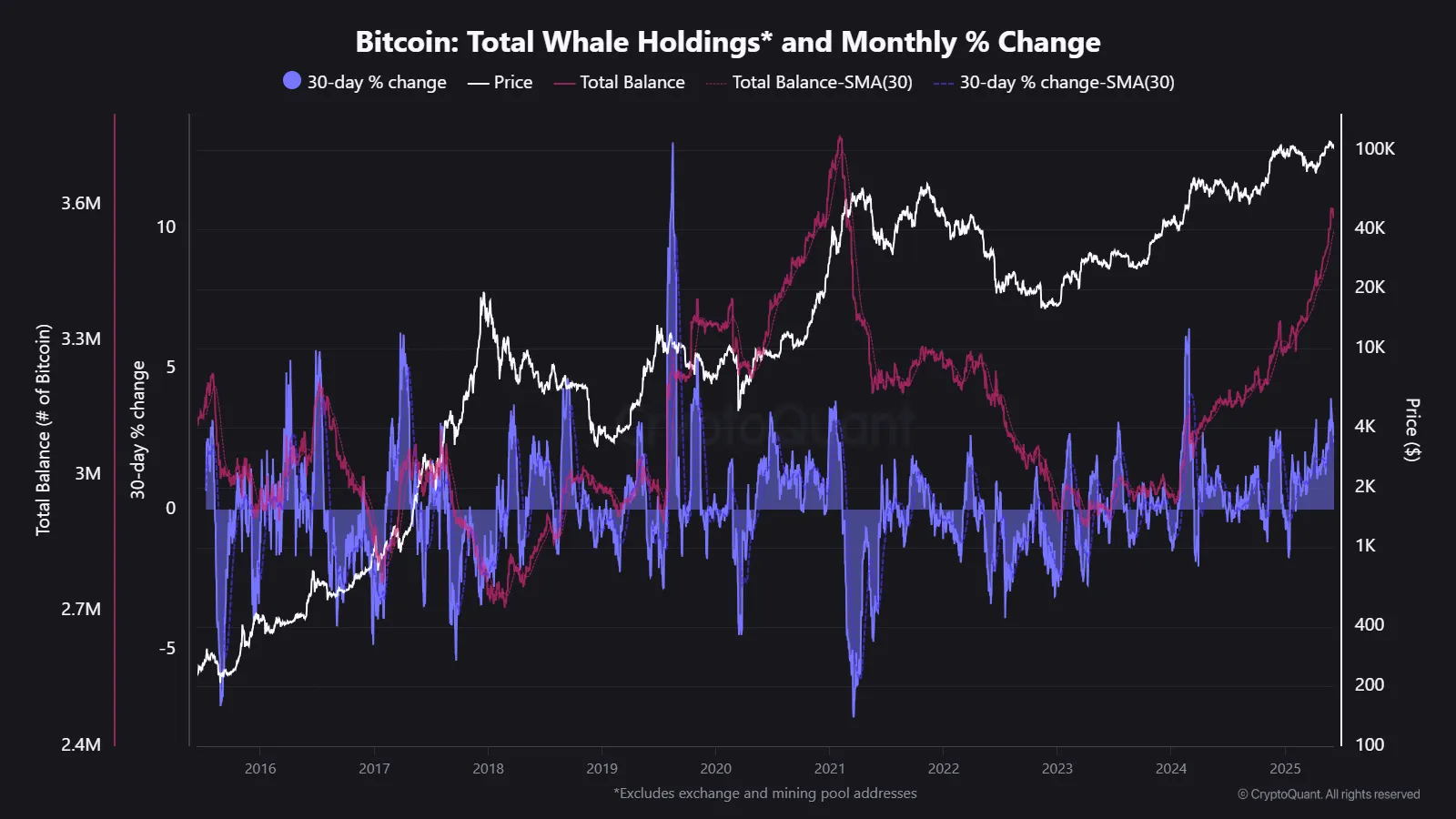

Signs of whales and miners to Bitcoin indicate a possible gathering on the horizon. New data from Cryptoquant reveals that large Bitcoin holders now have a 3.57 million BTC balance.

This is close to the highest level of 3.74 million BTC specified in early 2021.

Bitcoin whales increase their holdings

When whales steadily add to their reserves, they work with strong demand lamps. It reduces its increasing accumulation of available supply and provides price subsidies.

The current upward trend in Pisces holders It indicates that high -value institutions and investors see declines as opportunities to buy and expect prices to rise in the future.

“This scale reflects the true balances of adult holders by excluding the stock and mining addresses. This provides a clearer vision of strategic accumulation by big investors. Growth in whale holdings often indicates institutional confidence and strong basic demand, which are major converts to bulls in the long term.”

But not all indications indicate the top. according to CryptoquantRetailing bars scale – working stress – generally flashing a purchase signal.

This usually reflects the short -term disorder where miners face profitability issues, forcing some to sell bitcoin to stay at work.

Historically, these short -term pressures often determine the way for continuous gatherings. The surrender of miners can lead to the low prices.

But in the end, he wipes the weakest players than the market and tightens the offer.

Last week, the price of bitcoin showed a remarkable volatility. Due to a hot general conflict between Elon Musk and Donald Trump, Bitcoin fell shortly to less than $ 101,000. This paid approximately $ 1 billion in liquidation.

However, Bitcoin quickly recovered to more than $ 105,000, indicating a flexible purchase pressure.

Technical analysts are also optimistic. They highlight the formation of “cup and acceptance” on the daily chart of Bitcoin, indicating the outbreak of the rise if prices exceed $ 108,000.

Moreover, institutional activity supports this upward view. Bitcoin’s open interest has increased by more than two billion dollars in recent days, while financing rates remained low.

This scenario creates fertile ground for possible short pressure.

Will BTC carry psychological support worth $ 100,000?

Currently, the accumulation data and the drainage of mining workers are determined by a clear trading scope. Strong support sits between $ 100,000 and 102,000 dollars.

This means that BTC will likely keep its psychological level of $ 100,000 even during short -term corrections.

Meanwhile, the resistance is awaiting a 108,000 -$ 110,000 area, as the completion of the speed of prices can speed up about $ 120,000.

Traders should be seen closely with stimuli, such as further selling miners, as this can quickly affect price procedures.

In addition, the total economic headlines that involve the Federal Reserve and World Trade dynamics are possible.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.