Elon Musk fades up on the role

- summary:

- Tesla Stock Steadies after the profits of the first quarter, while Elon Musk announces a decrease in DOGE. The focus turns into 2025 Model 2 Launch.

Tesla Stock (NASDAQ: TSLA) hosted after the results of Q1, with feelings improved with the announcement of the CEO Elon Musk’s announcement of plans to reduce his role in the Ministry of Government efficiency (DOGE). The company also reaffirmed that the development of the next generation of EV remains on the specified date, which helps to turn attention to the road map after months of political distraction.

Musk said that his work with Dog “will fall greatly” in May, noting that most of the initiative’s efforts were complete. The update followed an increasing concern from the shareholders during its divided time, especially since its share in the global market in Tesla faced pressure from the high competition.

The stock decreased by more than 30 % on an annual basis, weighing weak delivery numbers and margin pressure. But Musk’s comments seem to have bought some breathing room – at least now.

Tesla re -focuses on the basic processes before the launch of Form 2

Tesla confirmed that it is planning to introduce a new low -cost electric car in the next two months. Production is expected to start in the first half of 2025, which represents a critical step in the company’s efforts to expand to more sensitive markets.

It is often referred to as “model 2”, the car is expected to become a major pillar in Tesla’s batch to restore the land against aggressive prices from Chinese car manufacturers. This step indicates a shift to the basics, even with questions about implementation and timing.

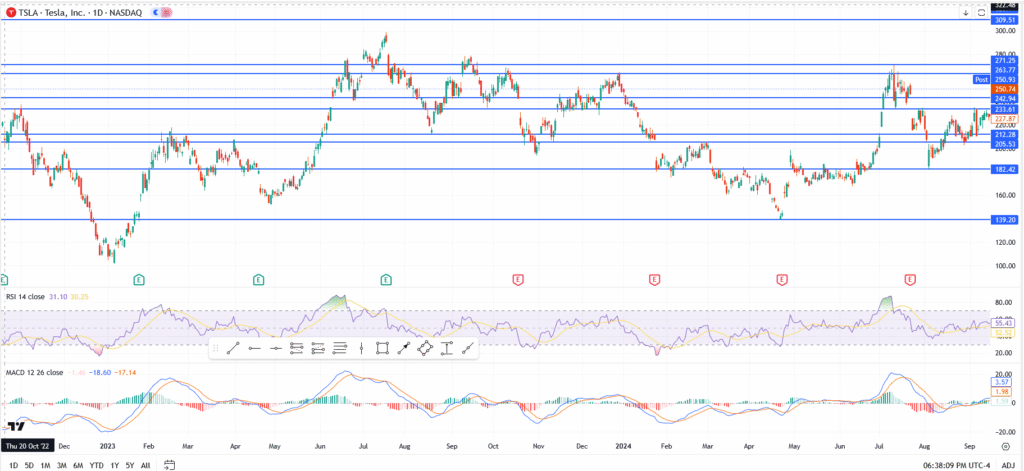

Technical expectations Tesla: levels of viewing

Tesla wore support at $ 227.87 after profits. The price is now testing $ 233.61-a simple axis that must be recovered to bulls to restore control in the short term.

Above it, the resistance is $ 242.94 and $ 250.74. The collapse behind these areas will open an area of about $ 263.77, but the momentum is still cautious.

On the negative side, a closure of less than $ 227 can lead to a re -test of $ 212.28, with $ 182.42 as the next main floor if feelings deteriorate.

RSI remains silent near 43. Macd flat. The momentum improves, but away from confirmation.

Conclusion: The feelings settled, but there is no outbreak yet

Musk’s decision to decline from government work to remove one layer of suspicion in the market. The Model 2 schedule helped enhance the long -term story.

But the graph is still stuck in the range. The bulls need to break $ 243 to turn the direction. Until then, this still bounces relief, not a reflection.