Bitcoin miners pressure the lowest level since 2024 – what is happening?

After reaching the highest level in three months, it reached 103,800 dollars on Friday, May 9, the bitcoin price was a slow start for the weekend before resuming about 014,000 dollars. While the first cryptocurrency continues to stick to $ 100,000, the market participants appear to trust the currency to play to play for the highest new levels in the coming weeks.

Interestingly, bitcoin miners, who have become increasingly reactionary since the fourth half in 2024, seem to have renewed confidence in the BTC price. The latest data on the series shows that miners have been adhering to their assets in recent weeks, and coincided with the last prices of the coin.

Are bitcoin miners preparing an extended crowd?

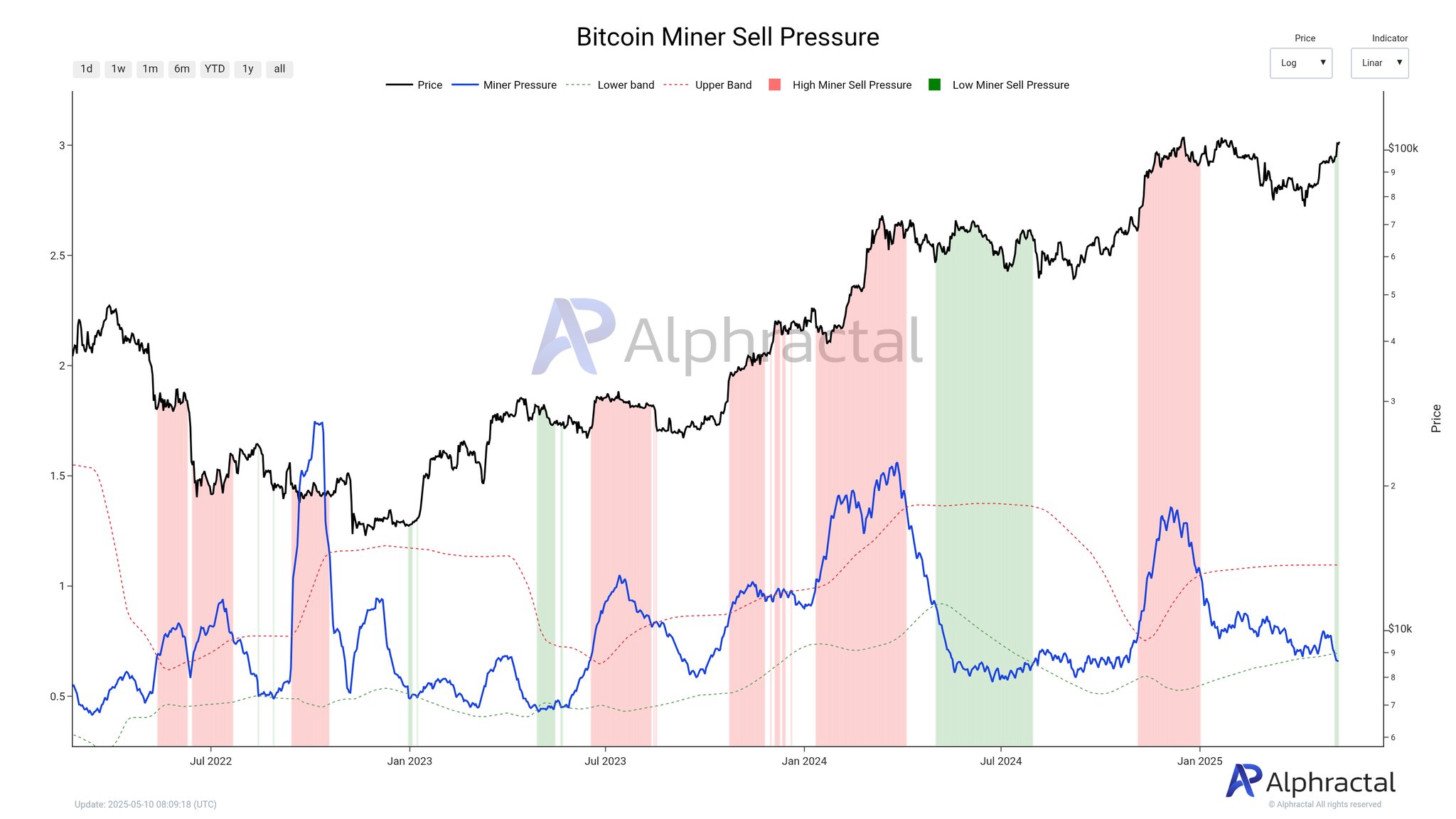

In the May 10 publication on X, Crypto Alphractal analysis platform open Bitcoin miners have become less active in the market, where they accumulate mining rewards instead of selling them for profit. The relevant indicator here is the Menner pressure scale, which measures the power of selling bitcoin mines over a certain period.

This scale compares the total BTC flows of miners over the past thirty days with the average amount of coins in their reserves during the same period. The Miner’s pressure indicator provides an insightful look at the behavior and feelings of a group of participants in the relevant network.

In the distinctive graph, the red is high pressure for sale between Bitcoin miners and is often associated with the slow market condition. On the other hand, green reflects low pressure to sell miners, which may be a positive sign of bitcoin price.

Source: @Alphractal on X

As shown in the graph above, the mining workers ’pressure scale enter the Red Region when the average pressure of miners (blue line) crosses over the upper range (red line) – indicating intense declining pressure from miners. Meanwhile, the mining line crosses under the bottom range (green line), indicating a decrease in sales pressure from miners.

According to the data provided by Alphractor, through the mining line recently under the lower range, indicating that the network mining workers have been on their work in recent weeks. The Analysis Company added on the series that this scale is at its lowest level since 2024, as it seems that miners are waiting for bitcoin to demand the highest new levels.

Although the Bitcoin market has been somewhat matured so that the sale of miners does not have a significant impact on prices, a long period of low sale pressure from the participants in the network can be naturally optimistic about the first cryptocurrency. However, Alphraractal indicated that the market may see the use of interest in selling interest with the transfer of prices in the coming weeks.

Bitcoin price at a glance

As of this writing, the BTC price is about 104,250 dollars, which reflects an increase of more than 1 % over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Distinctive image from Istock, tradingvief chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.