Dow Jones is in red in the rising Middle East tensions

- Dow Jones fell about 1000 points from the closure of the day before Friday.

- Israel launched a surprise round of attacks on Iran late Thursday.

- These attacks, in the middle of the already elaborate Middle East, may erase the gains of the week on Dow.

The DJIA Industrial Index (DJIA) decreased on Friday, as it got more than 1,000 points from the closure of the day before the investors fell after the unexpected wave of Israel from Iran. Consumer feeling data recovered more than expected, which helped reduce negative momentum on Friday.

The stock markets, which installed the technology gathering fed by artificial intelligence that it kept supported in the afternoon environment, seized the opportunity to cancel the risks and take a little summit. This is what wiped the gains of the week and cut the Dow series, which she won four days.

Read more stock news: American stock indicators decreased after the Israeli attack on Iran

The Michigan University’s feelings of consumer (UOM) has increased for the month of June with firm Climate From 53.5. Consumer inflation forecasts also decreased for one year, as they decreased to 5.1 % of 6.6 %, while consumer inflation forecasts decreased for 5 years to 4.1 % from 4.2 %.

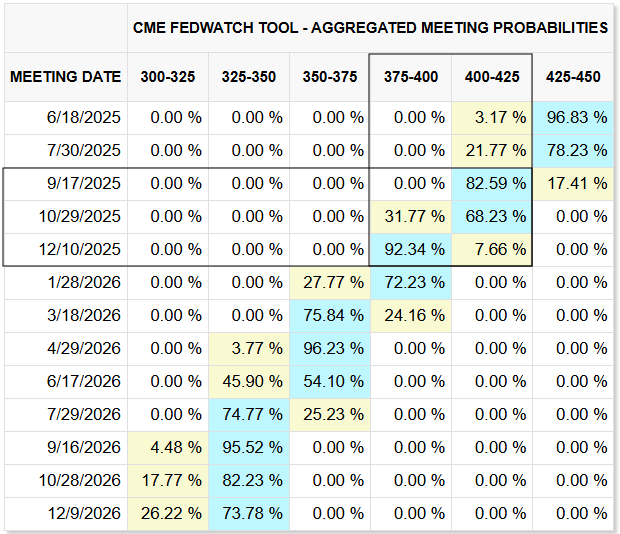

The latest federal reserve price will come next week. The Federal Reserve is expected to remain widely in waiting and vision, as the central bank is awaiting possible repercussions from the Trump administration’s approach to commercial policy. In the wake of the best inflation publications expected this week, the price markets priced about 70 % of the chances of reducing a quarter of a point in September, with an immediate pruning of follow -up in October, but it is likely to come in December.

Dow Jones price expectations

It was a difficult week for position holders on the industrial average. Four consecutive days of difficulty gains, the main stock index returned to a modern Tawhid area, putting a bullish momentum on stopping.

DOW is still trading over the 200 -day SIA moving average (EMA) near 41,800 despite the short -term weakness, and EMA can be for 50 days in the process of completing the cross ascending to the long -term moving average, which means that the fresh leg can be in business if there is a procedure that corresponds to technical support from an area of 42,000.

Dow Jones Daily Plan

Economic indicator

Consumer feelings index in Michigan

Michigan’s consumer morale index, which was released on a monthly basis before Michigan UniversityIt is the morale of scanning between consumers in the United States. Questions cover three broad areas: personal financial affairs, working conditions and purchase conditions. Data shows a picture about whether consumers are ready to spend money or not, and it is a major factor because consumer spending is a major engine for the American economy. The Michigan University’s survey has proven to be an accurate indication of the future cycle of the American economy. The poll publishes a preliminary reading in the middle of the month and final printing at the end of the month. In general, the high reading of the US dollar (USD), while low reading is declining.

Read more.

The latest version:

Friday, June 13, 2025 14:00 (Introduction)

repetition:

monthly

actual:

60.5

consensus:

53.5

former:

52.2

source:

Michigan University