Dow Jones acquires the land while investors ignore the threats of the new tariff

- Dow Jones rose on Thursday, testing near 44,750.

- The arrows are optimistic with caution after the PPI numbers have reduced inflation.

- The markets continue to ignore US President Donald Trump’s threats.

Dow Jones Industrial Malce (DJIA) found some space on the high side on Thursday, where about 350 points rose and a level of 44,750. The shares were strengthened by some sharp ups in inflation numbers, the product price index (PPI), but the total print reached a softer tone of inflation numbers in the Consumer Prices Index (CPI) for this week. A rise in inflation concerns has subsided, and price markets are now pricing in reviews when it is expected that the Federal Reserve (FED) is expected to reduce the next rate.

The President of the United States (the United States), Donald Trump, handed over his latest group of identification threats on Thursday. The “mutual tariff” on most trade partners in most of the United States are now on the bloc, as well as a specific flat tariff against Canada and Mexico, as well as penal import taxes on things such as cars, fine chips and pharmaceutical preparations. The markets are accustomed to emptying the threats of Donald Trump’s trade war, and this represents the fourth consecutive time when the Trump administration threats were announced to impose highly imported import taxes on foreign goods and then postponed them until some time in the future.

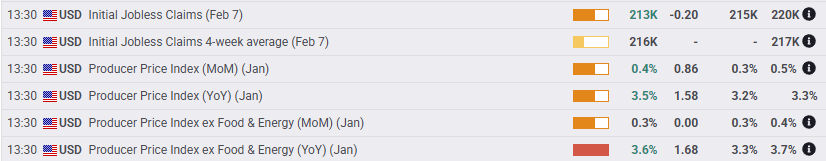

The basic inflation of the PPI program was recorded at 3.6 % on an annual basis in January, which is much higher than the 3.3 % expectations. The previous period also witnessed a sharp review of 3.7 % of 3.5 %, but the bottom total of decline helped reduce the market fears of the widely returned inflation pressure. According to the Fedwatch tool for the CME, the price markets are now pricing in better possibilities to connect the Federal Reserve at least 25 basis points in September compared to the expectations of Wednesday in December.

Dow Jones News

Dow Jones saw a late emerging break in all areas on Thursday, and almost every amphitheater finds space on the green side for today. NVIDIA (NVDA) gathered by 3.0 % to $ 135 per share on the stronger low demand than expected, giving the total technology sector a leg. Merck & Co (MRK) fell by 1.35 % to $ 84.50 per share.

Dow Jones price expectations

44,500 has become a familiar area of the Jones. The Mega-CP index has been within an intermittent range between 45,000 and 44,000 since mid-January with the inability of the offers to find a foothold at the highest level in the records, but the short pressure is still unable to hit DJIA lower.

The basic procedure is still in favor of buyers with bids that cut north of the 50 -day SIA moving average (EMA) near 43,850. The gap has closed between the prices during the day and the EMA for 200 days in the long run near 41,800 in the past weeks, but Dow Jones is still heading up to the highest closed Jones higher for all except three of the last 14 months in a row.

Dow Jones Daily Plan

Economic indicator

The price of the former food and energy producers (YOY)

Product price index EX Food & Energy, which was released by Labor Statistics Office, Ministry of Labor The average price changes in the primary markets of the United States are measured by commodity producers in all treatment cases. These volatile products such as food and energy are excluded in order to capture an accurate account. In general, high reading is seen as positive (or ascending) for the US dollar, while low reading is negative (or declining).

Read more.