ETHEREUM (ETH) records the worst decrease for one day in four years, shake the encryption markets

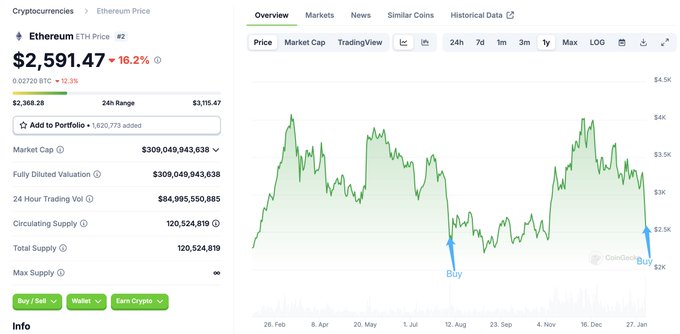

ETHEREUM (ETH) witnessed its largest daily loss in four years, and decreased by approximately 27 % in one period 24 hours.

This decrease raised the ETH price slightly higher than $ 2100 before a slight recovery to about $ 2544 at the time of the press.

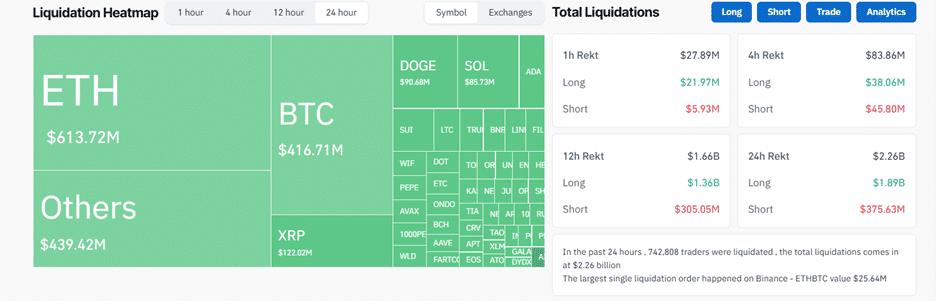

One of the largest liquidation events in modern history

The decrease in the value of Ethereum was not isolated; He was accompanied by significant declines across other major cryptocurrencies.

Bitcoin (BTC) decreased by 6 %, XRP by 22 %, Solana (SOL) by 8 %, and Dogoin (DOGE) by 23 %.

This large -scale sales process contributed to more than $ 2.24 billion in liquidation, affecting more than 730,000 traders.

The largest individual liquidation request was observed on Binance Crypto Exchange, where ETH/BTC trading pair was filtered for $ 25.64 million.

ETHEREUM (ETH) merchants were the largest losses in the encryption market qualifiers today, as the long eth sites lost about 613.72 million dollars, highlighting the volume of stakes learned that have become sour as the market turns into a decline.

The total encryption qualifiers for this day has already exceeded those that were seen during the important past events such as the Covid-19 market and FTX collapsing, which exposes the intensity of the current market shrinkage.

Why did Ethereum decrease a lot?

It seems that the catalyst for this market disposal is rooted in geopolitical tensions, specifically the announcement of the new US tariffs by President Trump, who targets imports from China, Canada and Mexico.

These definitions introduced fears of the escalation of global commercial wars, prompting investors to retreat from the most dangerous assets such as cryptocurrencies.

The impact of these policies was immediately, as the markets recorded great losses shortly after the advertisement.

Investor feelings

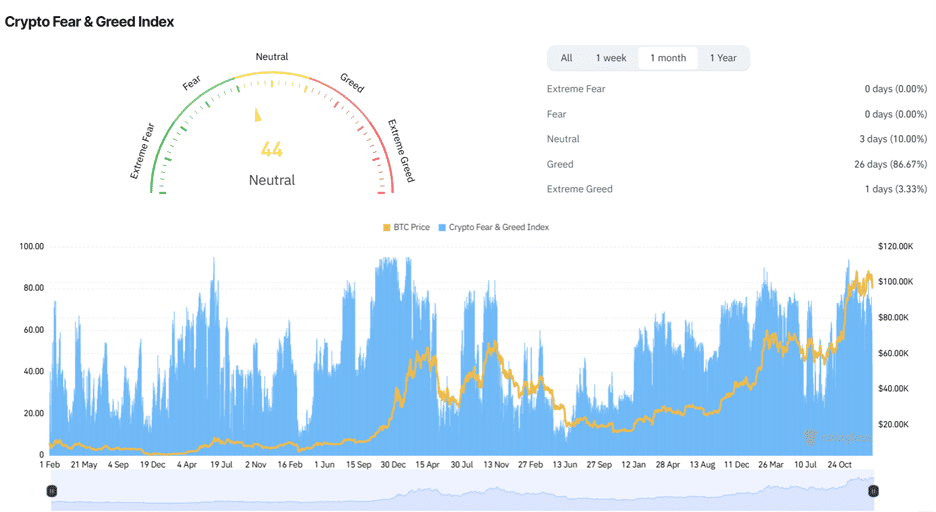

After the encryption market collapsed, investor morale in the encryption market quickly moved to “fear”, before returning to “neutral” as shown in the Crypto Fear & Greed index from Coinglass.

This fear is not baseless, given the rapid value and losses.

However, historical patterns indicate that such fear can often lead to opportunities for those who believe in the basic value of encrypted currencies.

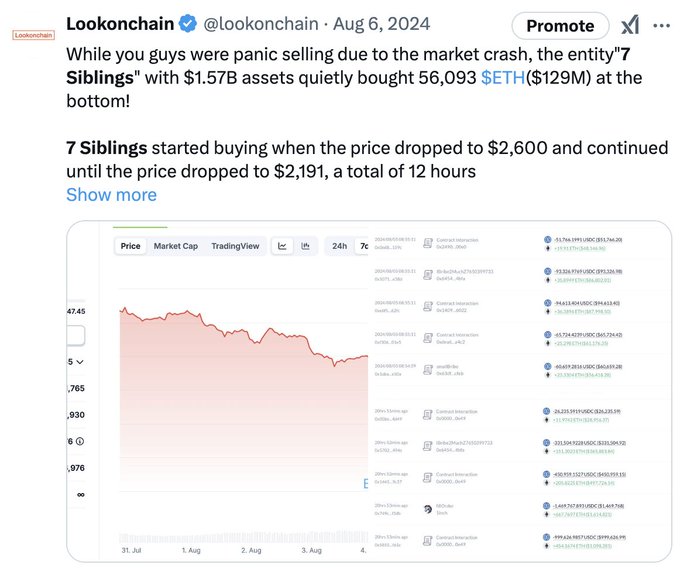

For example, the “7 siblings” group, known for its large property, has purchased a 5382 ETH strategy, which amounted to $ 14.5 million, which increased its total to 50,429 ETH at a value of about $ 126 million.

Another portfolio of “7 brothers” bought 5,382 $ ETH(14.5 million dollars). Buy 7 brothers, a total of 50429 $ ETH(126 million dollars) today. The last time he bought 7 brothers a large amount of $ ETH Below was on August 6, 2024, when the market crashed.

x.com/lookonchain/st …

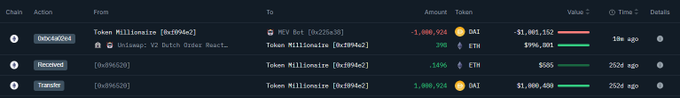

The last whale used $ 1 million to buy 398 ETH at $ 2515, after keeping Dai for approximately 2.5 years.

This accumulation of ETH can be explained because it decreases as a vote for confidence in the future of Ethereum, especially given that important acquisitions often coincide with the market recovery.

Can Ethereum (eth) recover?

Analysts are divided into the direct future of Ethereum.

Some, such as Incomesharks, believe that this decrease is a potential purchase opportunity, setting optimistic price goals exceeding $ 3,000.

$ ETH – You cannot pass the purchase of one of the largest liquidation events that we have seen. Selling greater than expected, but this is a rare opportunity to give bids.

Others, like Benjamin Quinn, indicate that ETH has reached the main level of support in the long run, A possible recovery proposal.

On the artistic side, Ethereum moved to less than 50 days and 200 days, indicating a strong, short -term trend, although excessive RSI may hint to reduce the pressure pressure.

It is worth noting that Ethereum (ETH) has a history of recovery; After a similar crash in 2021, it rose to $ 5,000, indicating his resilience.

However, the recovery is not guaranteed.

The market reaction depends greatly on global economic developments, especially how the tariff situation is revealed.

If the tensions are escalating, Ethereum may face more downward pressure.

The Post ETHEREUM (ETH) records the worst decrease in one day in four years, the encryption markets first appeared on Invezz