The eyes of the collapse 30 % gather in the cup and the collapse pattern

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

After restoring a decisive level during the past week, Avalanche (Avax) face resistance near the 27 dollar sign. Some analysts suggested that restoring this area can start the gathering towards the next main resistance levels.

Related reading

Avalanche targets 32 dollars resistance

Avalanche witnessed an increase of approximately 40 % over the past week, as it jumped from the $ 19 sign to the highest level in three months at 26.84 dollars on Monday. The cryptocurrency was its lowest level in 18 months at $ 14.66 during early April, but it recovered about 37 % before its last outbreak.

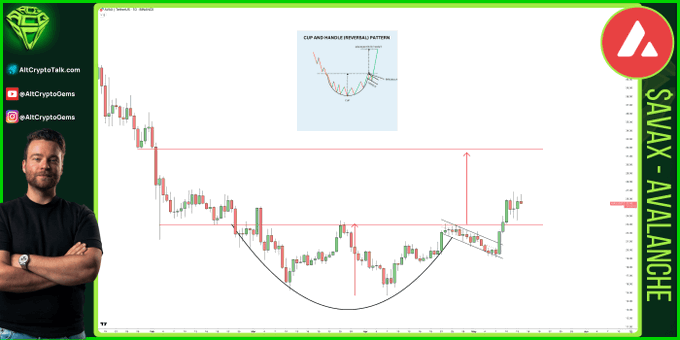

Amid the market recovery, AVAX erupted from the drop -out direction for a period of five months, which saw that the cryptocurrency recovers more than 73 % of the Q4 2024 height. Moreover, Avalanche made a two -month pattern of a cup and handle, with the neckline when resisting $ 23.

Analyst Sjuul from Altcryptogems indicated that the composition had a “very clean” goal and was “in convergence with the next resistance level”, at about 32 dollars. This area, which was lost in early February, was a decisive resistance and support area before the Q4 2024 and Q1 2025 Shakeouts.

After the eclipse of the neck and the restoration of this level during the weekend, the analyst indicated that the goal is “now clear.” As such, Avalanche is likely to see another 30 % mobilization towards a brand of $ 32.

Meanwhile, analyst CW High AVAX has a main sale wall near the 27 dollar level, as it has faced resistance during the past few days. However, if this barrier penetrates, it may rise to the level of $ 36 before facing the next sale wall near the $ 38.5 region.

Another wall between $ 42.5-46.5 dollars awaiting us. On the contrary, if the cryptocurrency is rejected from the first resistance, the price can reconsider the levels of penetration and the downtown direction line on the mark of 20 dollars, with a wall of sale under it that can serve as support.

Avax to repeat BTC and Sol’s Playbook?

Amsterdam encryption Proposal Many altcoins, including Avalanche, constitute a setup in Bitcoin (BTC) and Solana’s (SOL). According to the analyst, the preparation follows the Macro range, divided into five stages of the course.

The first stage, which was appointed during the Taurus market, sees a coded currency quickly towards altitudes, setting the upper limits of the domain. During the second stage, at the beginning of the bear market, the code price records “decreased low and higher” towards the low range before moving to the third stage, the accumulation stage. At this stage, the cryptocurrency records less deviation than low range.

The fourth stage believes that the cryptocurrency records the first higher height and restore the low range again. Finally, the cryptocurrency moves towards the height of the last session during the fifth stage, and exceeds the high range after restoring the central region.

Crypto Amsterdam explained that the AVAX chart is “another example throughout the clean mini cycle.” After reaching its highest level (ATH) of $ 146 in November 2021, Avalanche set its range between levels between 20 to 130 dollars, less than the lowest level in mid -2012.

The cryptocurrency has regained the low range in late 2023, where it ended the third stage and entered the fourth stage during the early 2024.

Related reading

If Avalanche continues to follow this setting, the average range must be recovered, at about 75 dollars, to raise to the upper limits and may hit a new ATH. However, the analyst also suggested that the decrease under the local bottom would lead to nullifying the preparation.

Distinctive photo of Unsplash.com, Chart from Tradingview.com