Dogecoin (DOGE) lands on decisive support, the US dollar index (DXY) indicates an increase in Bitcoin, ETHEREUM (ETH) is the worst 10 best performance

Leave responsibility: The opinions that our book expresses are their own and do not represent the opinions of U.today. Financial information and the market provided to U.today is for media purposes only. U.Tode is not responsible for any financial losses that incurred it during the trading of encrypted currencies. Perform your research by contacting financial experts before making any investment decisions. We believe that all content is accurate from the date of publication, but the presentations that have been mentioned are no longer available.

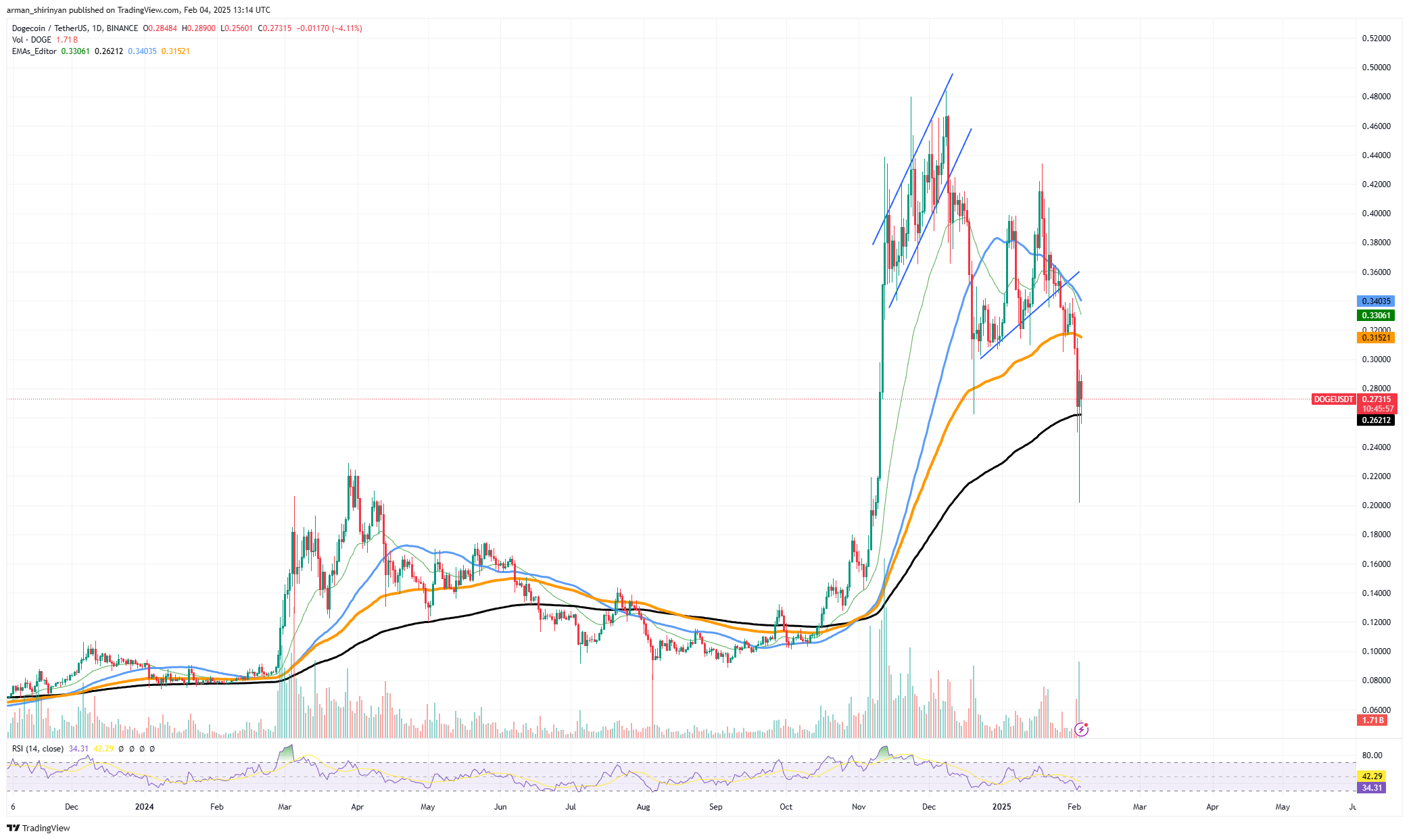

Dogecoin is currently located in 200 EMA, a region of historical importance to the reflections of the direction, as it has reached the level of decisive support after a long decrease. Dogecoin has previously used this level as a decisive turning point, making it an important field as a large recovery or additional collapse may occur.

Adherence to more than 200 EMA: Retainment Road is scenario 1. The downward trend may end and a relief march may be operated if Doge can maintain its location above 200 EMA, which is currently $ 0.26. If this level is successfully defended, buyers will intervene to stop the additional losses.

The next resistance area in this scenario is $ 0.34, and recovery is about $ 0.30 to $ 0.32. A return to 0.36 dollars may occur to $ 0.38 if the momentum picks up the speed. In order to confirm the reflection of the trend, Doug must appear larger and purchase.

Screen 2: Continuing with a break with a break less than 200 EMA. A large declining signal will be created that pave the way to a more comprehensive correction if Dogecoin decreases below 200 EMA. A rapid decrease can produce about $ 0.22, which is the next important support level, from a break less than $ 0.26.

In the worst case, Dog may return to $ 0.18, giving a large part of its recent gains. Meme will be in risk fraudulent mode as a result, and traders will closely monitor any possible signs of recovery. This is a position or break in Doug. While keeping 200 EMA may lead to a brief gathering, the collapse would increase the pressure pressure and cause the asset to enter a more severe correction stage. The coming days will determine whether the bulls can defend this decisive level or if Doge will enter another leg down.

DXY pushes bitcoin

After a modern gathering, the US dollar index (DXY), a decisive measure of the power of the dollar for other major currencies, is currently at 108.60, indicating fluctuation. Bitcoin (BTC) and DXY historically had a reverse relationship; When the dollar rises, BTC usually fights, and when it falls, Bitcoin rises frequently.

With the help of 50 and 200 Emas, which indicates its continuous power, the DXY was in a strong upward direction. Bitcoin may be able to restore momentum, although the last rejection at 109.50 indicates a possible weakness. An additional decrease can occur about 106.40 or less if the DXY cannot maintain support at 107.70, providing a bullish preparation for Bitcoin.

Bitcoin may become stronger and try to come out about $ 100,000 if DXY starts to decrease, assuming that it remains at its current levels. However, BTC may suffer from pressure and a short -term decrease again about 92,000 dollars to $ 90,000 if DXY recovered and more than 109.50 explodes. Federal reserve policies and upcoming economic data will be major factors in determining how DXY moves.

The dollar may weaken and open the door for the upcoming biomal bitcoin movement if inflation slows down and high interest rates are affected. However, if the economy proves that it is more flexible than expected, the DXY may rise while BTC struggle.

The worst ethereum performance

Ethereum suffered greatly, as it was worse than the ten most popular cryptocurrencies. Although XRP and Bitcoin have shown signs of stability and recovery, ETH still collapses and has a problem to find support. It is currently the worst major digital assets, with a recent decrease in less than $ 3000, which indicates a critical collapse.

In just a few days, ETH decreased by approximately 30 % and decreased to less than a number of important support levels. This is usually a strong dynamic support, 50 EMA ($ 3328) and 200 EMA ($ 3,192) have been broken. If buyers do not interfere, Ethereum, which is currently circulating at about $ 2,796, may lose more money.

ETH faces a difficult time to recover unlike Bitcoin, which is still trading over $ 95,000, and XRP, which witnessed a great recovery after a significant decrease. The lack of momentum indicates poor interest in the purchase, leaving Ethereum vulnerable to pressure the negative side.

The next important support, which corresponds to previous demand areas, is about 2600 dollars if Ethereum is unable to recover $ 3000. ETHEREUM may reach $ 2,300, an unprecedented level in months, if it has ended to less. However, ETH may have a relief summary, however, if it regains $ 3000 and rises above $ 3200. To confirm the bullish reflection, more than $ 3,328 still has to break.