Dogecoin (Doge) is preparing for a 21 % piece, and confirmed the bond preparation?

Although prices have decreased by 16 % recently, Dogecoin (DOGE), the largest encryption currency in the world, is preparing to continue its declining momentum. The reason behind these speculation is to form a decreased work pattern on the daily time frame amidst the continuous downside morale.

Dogecoin (Doge) and upcoming levels

According to Coinpedia’s technical analysis, Doge appears to be declining because it has a head similar to textbooks and the pattern of price work on the daily time frame. In addition, the price of the MIM currency is about to collapse.

Based on the latter price momentum and historical patterns, if the Mimi coin violates the neck line of the dumping style and closes a daily candle less than $ 0.16, it may decrease by 21 % to reach the level of support of $ 0.13 in the future.

As of now, DOGE is traded without the Si -SIA moving average (EMA) on both daily time frames and four hours. This indicator indicates that the MIM currency is in a strong declining direction and follows a declining momentum.

However, traders and investors often use this preparation to sell or shorten the original whenever its price shows any signs of upward movement.

Current price momentum

At the time of the press, DOGE is trading near $ 0.168 and a 1 % decrease over the past 24 hours. Meanwhile, during the same period, the trading volume decreased by 60 %, indicating the decrease in participation of traders and investors – and of course due to the morale of the Habbiya market.

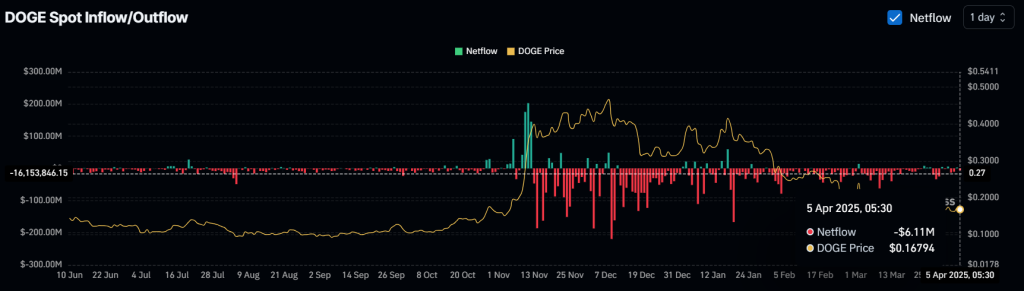

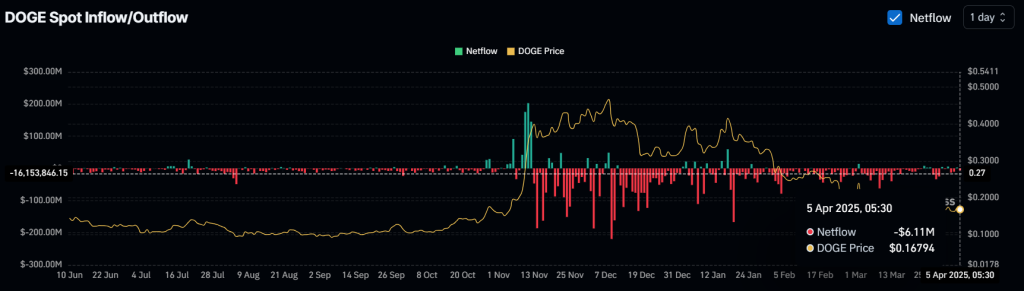

At a value of $ 6 million of external flow

However, amid this landfill, investors seem to accumulate symbols, which may indicate a classic purchase strategy, according to the series of analyzes on the series Coinglass.

Data reveals immediate flows and external flows that exchanges have seen an external flow of about $ 6.11 million from Dog over the past 24 hours. This large external flow indicates a potential accumulation and can increase the purchase pressure.

However, although this huge external flow has the ability to stimulate a roll up, the dominant market morale may make it difficult to maintain such bullish momentum.