Dogecoin alert alert! This can lead to an “equivalent” increase

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Ali Martinez, the famous encryption dealer, released a new update indicating that Dogecoin can prepare for a large price. In its last joint scheme on X, Martinez draws attention to RSI shares on the weekly time frame.

RSI of stocks seems ready for the upscale intersection, a sign historically preceded by Major Dogecoin. “Dogecoin is about to go equivalent. Historically, when RSI stocks have a bullish intersection on the weekly graph, DOGECOIN tends to turn a large cost,” Martinez States. It indicates that when the oscillator crosses this ascension on the weekly graph, Dog is usually suffers from a high prices.

Related reading

For example, in October 2023, when the RSI inventory had a bullish intersection, Dogecoin rose by 88 %. A bullish intersection.

Dogecoin on the edge of penetration

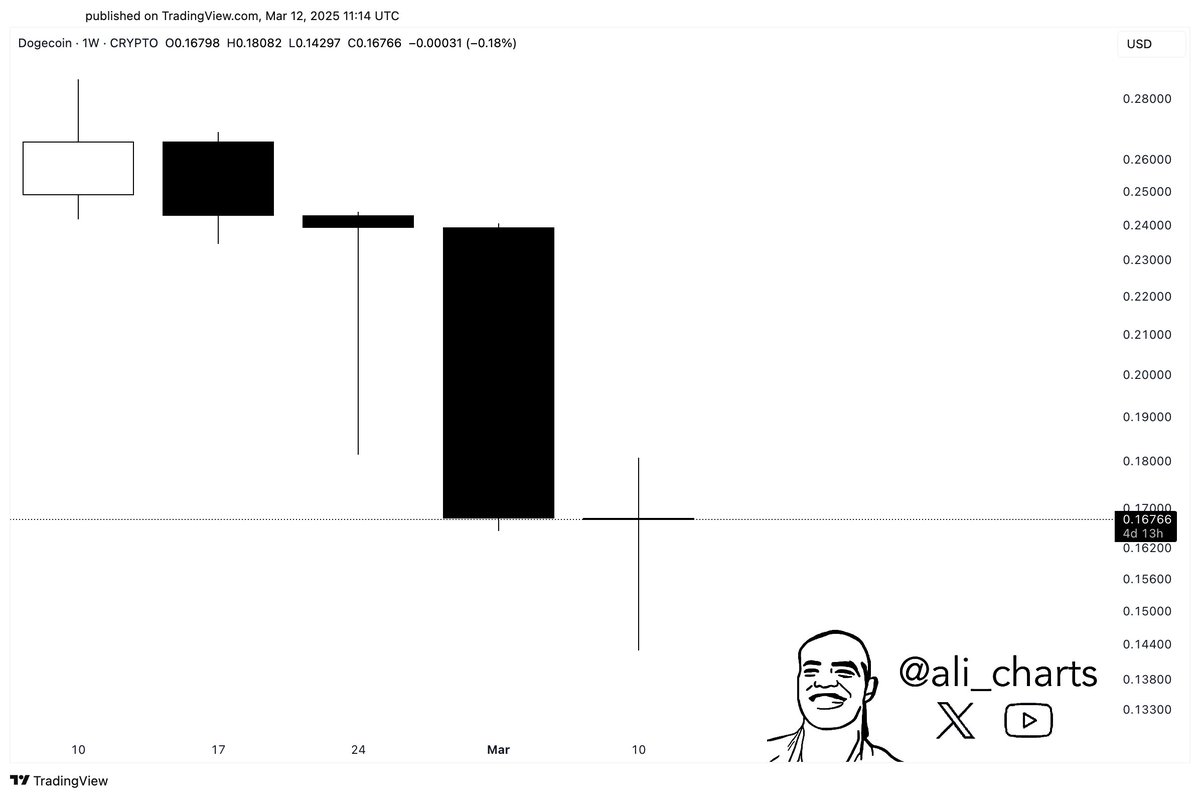

Martinez also indicates that the current weekly candlestick is trying to form Doji, a very small real body candle that often indicates a possible reflection of the direction, especially when it is followed by a second confirmed candle. “Dog is printing Duji, the potential upcoming reversal of the weekly graph!” Martinez He writes Via X.

Although it is still too early to call the Doji star pattern because the weekly candle will not be officially closed until Sunday, the second candle required to confirm has not yet been formed, it’s a promising sign of Doge Bulls. If the ongoing candle keeps its true, slim body by the end of the week, and if the candle confirmed next week this training, Dogecoin may be prepared for the bullish reflection scenario.

Related reading

From the perspective of the pure price work, Dogecoin opened this week near $ 0.16798, a height of $ 0.18082, and decreased to $ 0.14297, and since then about $ 0.16766 has recovered. The narrow pure change so far explains the reason for the emergence of the current candlestick like Duji, which reflects the frequency between buyers and sellers.

However, four days remain until weekly closure; The fluctuation inside the day may expand or tighten the real body and potentially deny the pattern. Since Doji candles often arise during the transitional market stages, any escalating momentum or landing can quickly distort the shape of the candle.

Although Martinez’s analysis emphasizes a possible equivalent step, it is important to emphasize that emphasis is very important. The second weekly candle of the Doji star has not been formed yet, and the current Doji -like candle can fade if the market has faced a major shift before Sunday.

Traders who watch Doge during the weekend will need to pay close attention to whether he can keep current prices near current price levels, thus maintaining the minimum difference between open candlestick and closure. If this occurs, a candle next week emphasizes the renewal of the purchase pressure, the pattern of the Doji star will be confirmed, which may warn the explosion to the upward direction.

At the present time, the market remains in waiting and vision. Since RSI seems ready to exchange ascension, the coming days may prove a pivotal in determining whether Dogecoin is really on the threshold of another equivalent height.

At the time of the press, Dog was traded at $ 0.16996.

Distinctive image created with Dall.e, Chart from TradingView.com