Dogcoin 75 % jumps with Bitcoin drop to less than $ 89,000 and Solana Dips less than $ 135

Dogcoin (DCOIN), which is an ETHEREUM, is 75 % in just 24 hours, which led to heavy stumbling like Bitcoin (BTC) and Solana (Sol).

Bitcoin decreased to less than $ 89,000, while Solana decreased to less than $ 135, reflecting a shrinkage in the broader market that left investors to reeling from a long rank of place.

Why the bitcoin price decreases?

Bitcoin, the king of cryptocurrencies, faces a rough patch. Its price has decreased to 88,940.89 dollars, a decrease of 7.25 % in the past 24 hours, more than $ 65 billion in trading volume with a feeling of landing.

Several factors conspire against BTC.

While the strategy recently strengthened its shares to approximately 500,000 BTC through a $ 1.99 billion acquisition process, which is funded by convertible notes, indicating confidence from senior players, this did not save the broader market flows in the market.

ETFS in the United States Bitcoin has recorded $ 516 million in withdrawals, hinting that the investor has declined.

$ Mstr It acquired approximately 20,356 BTC for approximately $ 1.99 at approximately 97,514 dollars per bitcoin and made BTC’s return by 6.9 % YTD 2025. As of 2/23/2025, @Stragegy Hodls 499,096 $ BTC It was obtained for ~ 33.1 billion dollars at $ 66357 per bitcoin.

Strategy.com/press/strategy ..

The overall economic opposite wind is also in play.

The uncertainty about the proposed tariff from the Trump administration in countries such as Canada and Mexico led to the outbreak of traditional and digital markets alike, while the constant tightening of the Federal Reserve indicates that high interest rates will continue, which spoils liquidity from risk assets such as encryption.

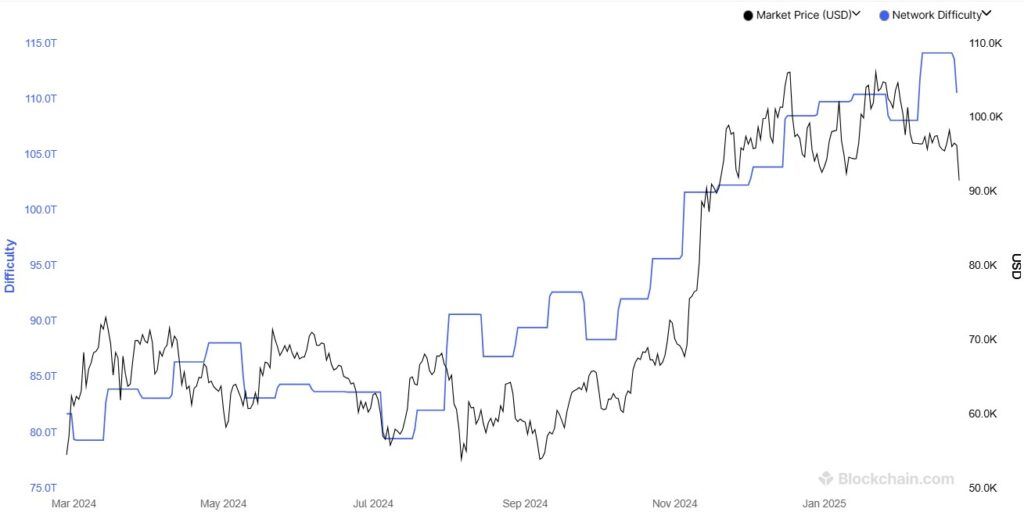

On the technical front, the difficult Bitcoin mining has decreased by 3.2 % to 110 trillion, which is a tablet to keep the ban times stable, but this was not done to overcome the buoy prices.

Together, these developments draw a picture of the driving of the market under the siege, struggling to restore its foot after it reached its highest level at 109,114.88 dollars just one month ago.

Bitcoin can test fewer support in the event of deepening macroeconomic fears, although US state moves such as Bill 228 from Georgia or 10 % allocation of public funds of South Dakota may indicate a lifeline.

Solana On

Likewise, Solana is also wrestling with a range of her problems, sliding to $ 134.68 – 15.23 % in 24 hours – such as selling pressure.

Seoul, whose network is famous for its high -speed transactions, was severely struck by an event waving on the horizon: the largest opening symbol in its history, which was appointed on March 1, 2025.

the The distinctive symbol opened 11.2 million Sol icon, at a value of approximately $ 1.53 billion, will be released to a trading, with an additional 15 million swords (about $ 2.5 billion) and $ 1 billion of inflation to follow during the next three months.

The timing cannot be worse. Solana’s price has already decreased by 40 % over the past month, as it decreased from the peak of $ 294.33 in mid -January.

It is worth noting that many of this unlawful supply stems from FTX auctions, as companies such as Galaxy Digital, Pantera Capital and Figure Sol have made $ 64 per code.

With the presence of double prices now or three, analysts fear that these institutions may fade, the market and the leadership of Sol are submerged to less.

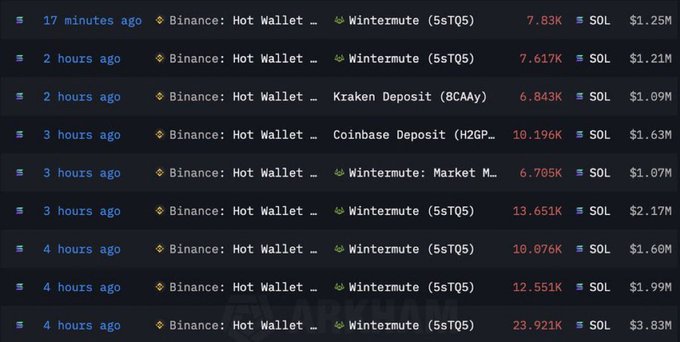

winter withdraw 38 million dollars from Binance on February 24, which increased imminent sales speculation.

It is worth noting that some encryption exchanges, including Binance, were selling Solana Holdings before opening the distinctive symbol.

Beyond the abolition of the lock, the feelings are more severe due to the scandals of the ecosystems such as Balance Carpet CarpetWhich erases $ 107 million and paid 94 % value, is based on its Solana -based projects.

Technical indicators screaming diligently, although some conditions that can raise a recovery if the storm declines.

Currently, the $ 66.89 billion market ceiling from Sol feels unstable as trading volume extends by 215.65 %, which reflects panic rather than the promise.

Solana’s fate depends on the opening of March 1. Flood of institutional sale may pay about $ 100 or less, although recovery is not out of the table if they contemplate ETF or ecosystem innovations to restore traction.

Dogcoin (DCOIN) Memecoin contradicts the general direction

Unlike Bitcoin (BTC) and Solana (Sol), which are under institutional and structural pressures, Dogcoin ascending It seems that a different dynamic: flexibility and community spirit in the face of the mechanical massacre.

Most Meme coins have lost 50 % or more in the current market reset, however Dogcoin challenged gravity. Whale holders seem to have a major motor, as they spread the wild price confrontation for contraction – a sign of smart installation or desperate manipulation.

Built on Ethereum with a fully decentralized frame, unprepared, and supply the distinctive symbol 1 billion closed in liquidity, Dogcoin declares itself as a pure project driven by society.

This narration resonates with fairness and transparency in a strained market of central fraud and control.

Perhaps the ambiguity with “Dogcoin”, which is similarly called Solana, has ignited the water in the past, but it did not prevent Doin believers from gathering behind his vision to become an iconic micoin.

A modest rate of 1.73 million dollars in the market and the trading volume to the maximum market of 387.44 %, the small dogcoin volume increases the gains, making it a speculative lover in the midst of the debris.

Postcoin jumps by 75 % while Bitcoin slides to less