Division of encryption traders in the next step for BTC: $ 88,000 or reset 65 thousand dollars?

Bitcoin has repeatedly failed to overcome the resistance of $ 85,000 as the market is still free of upscale stimuli.

Since April 13, the leading cryptocurrency has been traded in a narrow range of $ 83,000 and $ 85,000, with price weight increased through a mixture of total economic factors.

When writing, Bitcoin’s weekly gains stood up slightly more than 4 % while the market cover hovering about $ 1.6 trillion.

What hinders bitcoin?

This week, many Haboodi forces entered into force, prompting investors to adopt a more cautious situation.

This is clear from the index of fear and greed, which hovers near the lower end of the fear area in 30, as of the time of the press.

One of the main factors weighing a feeling of renewed geopolitical tension between the United States and China.

On Wednesday, the markets turned to avoid risks after the Trump administration introduced new restrictions on NVIDIA chips exports to China.

The move shook global stocks and set fears of another escalation in commercial tariffs, withdrawing the technology sector and wider risk assets.

In addition to the uncertainty, reports that the Chinese authorities may be filtered with bitcoin confiscated through cruise exchanges.

While these reports are unconfirmed, these reports tend to investors and add more pressure to fragile encoding already.

It follows more pain, and US Federal Reserve Chairman Jerome Powell pointed out a more honest position than the markets expected.

During his speech on April 16, Powell stated that the Federal Reserve is not in a hurry to reduce interest rates, which enhances the “waiting and vision” approach amid the growing economic uncertainty.

His remarks increased the feelings of investors, especially after he supervised the inflationary risks posed by the newly announced definitions of President Trump.

Powell warned that the size of the tariff was “much larger than expected” and may likely lead to “high inflation and slow growth.”

What is the following for Bitcoin?

With a restricted monetary policy that is likely to remain in place for a longer period, the markets had no little reason to return to risk.

For Bitcoin, this means continuous repression about the main resistance levels, where traders weigh the broader economic view before eating more exposure.

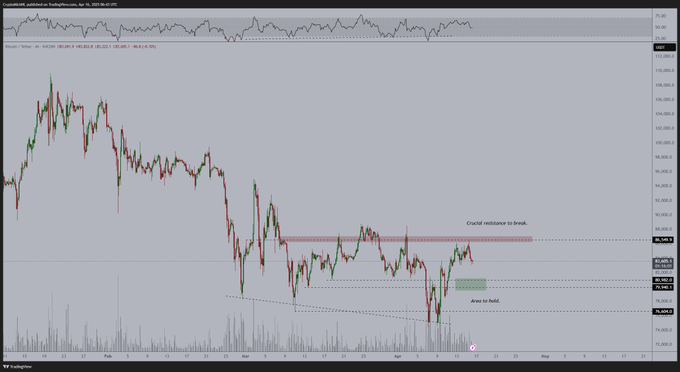

Technically, Bitcoin should turn the $ 86,000 resistance to support to support the bullish momentum about $ 90,000 and beyond.

According to Market Pundits, BTC first needs to restore EMA for 200 days at a value of $ 87,740, a level of loss on March 9 for the first time since August 2024.

On the negative side, the failure to restore the door levels open the door for more pain. The bears are likely to defend a sign of $ 86,000, which may push BTC to below $ 80,000.

According to the founder of the MN Capital Michael Van De Poppe, the loss of this main support may lead to more slip, as prices are likely to slip towards a scale of $ 74,400 – 76,600 dollars, which is the final line of defense before setting a deeper correction.

#Bitcoin It is still stuck in the range, and as long as it remains above 80 thousand dollars, I think we will be fine with more rising momentum in this.

Weak weakness may lead to a decrease in the value of election day in the United States at $ 67,817, erasing the gains from the so -called “Trump pump”.

According to the analyst James Check, the real Bitcoin bottom lies about 65,000 dollars based on the average cost of active investors and a long -term major support zone.

This is the average cost for active investors, mainly reflects the price that most participants in the BTC market got. As such, it is a long -term important support area.

He added: “75 thousand dollars is the place where the bulls need defense. If not, we return to Chop – and science in the sea of sand is 65 thousand dollars.”

A decrease to 65 thousand dollars can restart the cluster ascending

However, according to some, the correction towards the mid -$ 60,000 can be Bitco Shakew that needs to reset morale and the following leg fuel higher.

For example, Trader Altstein shared a contradictory view indicating that a decline to a region of $ 69,000 to $ 65,000 may precede a renewable bull stage that could eventually send BTC to $ 150,000.

BTC/USD Weekly Chart. source: Tastin

While the target is $ 150,000, it may seem ambitious, the idea of a healthy correction before continuing is compatible with the wider market courses.

Historically, Bitcoin has often reconsidered the main cost levels during the macro uncertainty before carrying out strong recovery operations.

Such a scenario would also be in line with the dynamics of the basic view that is currently being developed throughout the market.

Cryptoquant data shows that bitcoin reserves on exchanges have continued to decline, now sitting near their lowest levels in several years.

Historically, these conditions have preceded large price pools, especially when their association with a high demand or a transformation in investor morale.

On the other hand, if Bitcoin avoids deeper correction and keeps more than current support levels, the last penetration may gain over the 2025 traction line.

There will be more than $ 88,000, which is likely to be the way to move about $ 90,000 and beyond as suggested by Crypto Caesar in a modern X publication.