Distinguished code struggles HBAR, risk of up to $ 0.12

Despite the increase in the broader market this week, the original distinguished symbol of HEDERA is HBAR has cleared the trend, as it recorded a 5 % decrease over the past seven days.

With the construction of the landfill, the HBAR code is now risked back to its lowest level of the year.

Hbar slides below the main indicators

HBAR declines comes as many cryptocurrencies in the higher ranking determines modest gains this week, which reflects their difference from the morale of the public market.

Readings from the HBAR/USD scheme indicate that this landmark can continue in the short term. For example, from writing this report, HBAR is traded below the points that make up the equivalent SAR (stop and reverse).

This indicator measures the trends of the original price and determines possible entry and exit points. When the price of the original is traded without SAR, it indicates the declining direction. It indicates that the market is in a declining stage, with the possibility of low prices.

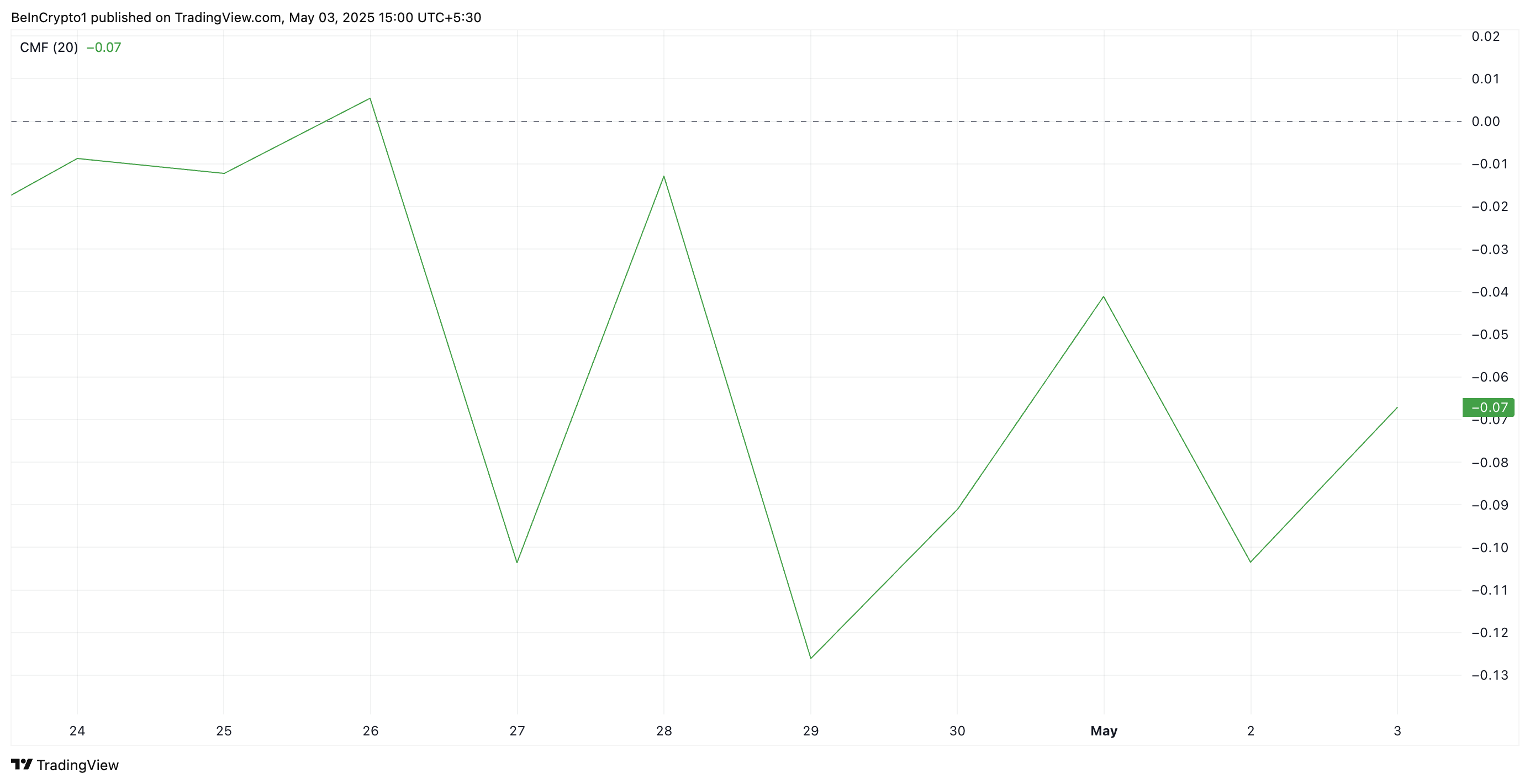

By supporting this landmark, HBAR (CMF) money is still in the negative area, indicating a decrease in the purchase of volume and increased presence of sellers in the market. He currently stands at -0.07.

The main momentum index measures this money flows inside and outside the original. CMF reading is negative, such as HBAR, indicates that selling pressure dominates the market. This means that more investors empty the distinctive symbol instead of its accumulation, which is a pattern associated with weak price direction.

HBAR EMA tests for 20 days: Will you stick or go about $ 0.12?

The daily graph shows that the HBAR’s decline has pushed it near the SIA moving average for 20 days (EMA). This main moving average is the average price of the original during the twenty days of trading, which gives weight to modern changes.

When the price drops near the EMA for 20 days, it indicates a potential support level that is tested. However, if the price is decisively broken in EMA, the continuous declining momentum and more negative risks may confirm.

Therefore, the HBAR break is less than EMA for 20 days can reduce its price to its lowest level from the year to $ 0.12.

However, if the demand for missiles and HBAR from EMA increases for 20 days, its price may accumulate over $ 0.19.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.