Distinctive symbol gatherings HBAR 20 % after the death of the cross

The death cross appeared on the daily HBAR chart on April 14, indicating the potential negative side. However, the symbol has challenged the declining expectations, as it mobilized by 20 % over the past two weeks amid a wider market recovery.

While the upscale momentum has just cools in recent days, the bulls are still in control. If the demand increases this, the HBAR code may be ready for more bullish direction.

Hbar’s bulls remain in control after the death of the cross

The death cross occurs when the moving average moves in the short term-50 days on its head-less than the long-term moving average, is usually 200 days.

This intersection means that the latter price momentum of the original weakens, and the downward trend may form in the long run. The pattern often indicates increased pressure pressure as traders usually explain as a sign of a negative transformation in market morale.

However, this is not always the case, especially in volatile or recovered markets where price procedures can challenge traditional technical signals. For example, the HBAR value has increased by 20 % in the past two weeks.

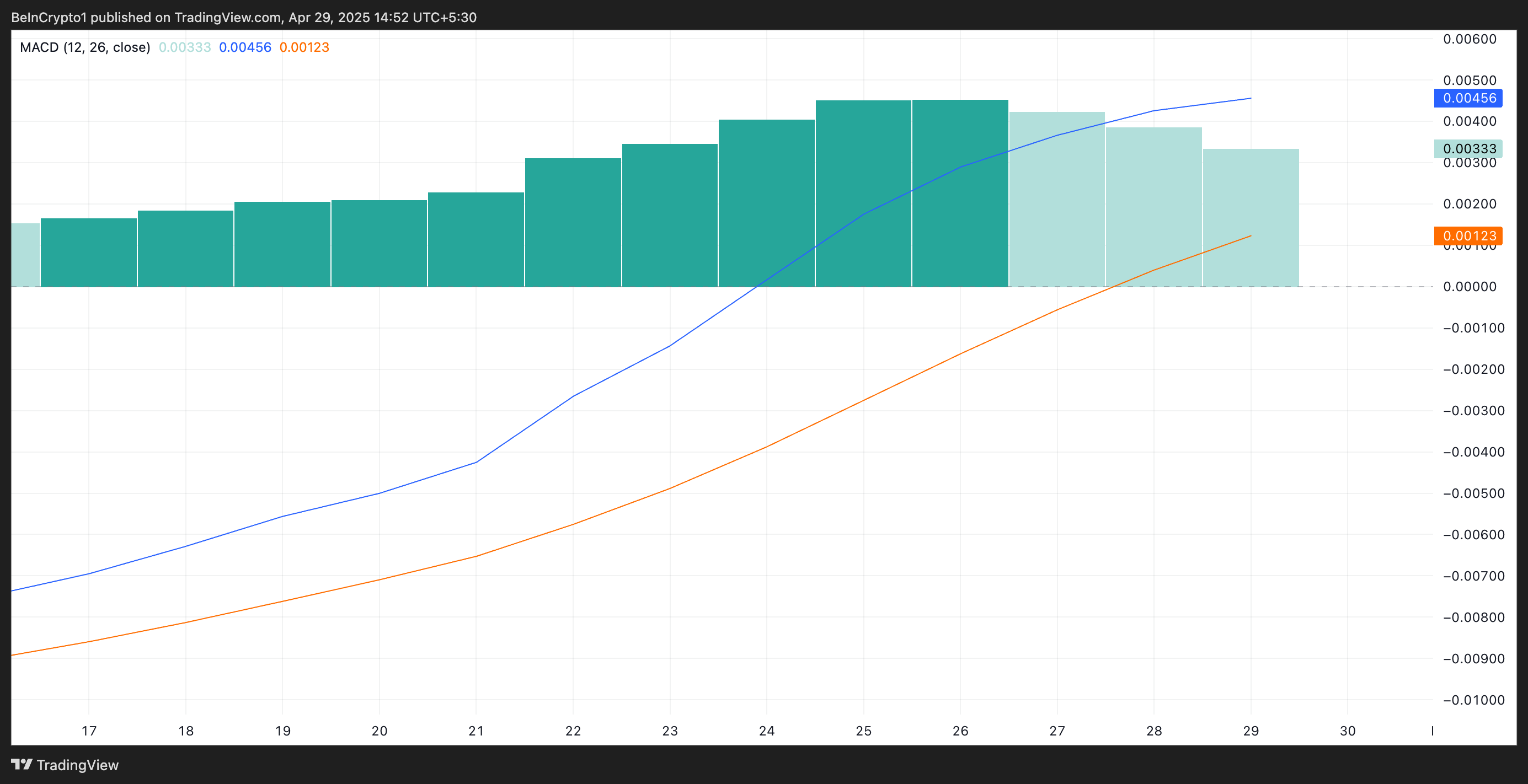

Although the upscale momentum declined slightly during the last three trading sessions, the bulls are still in control. Readings from the HBAR (MACD) moving rapprochement index confirm this.

While the bars that make up this indicator have decreased during the past three days – they are reflected in the slowdown in the bullish momentum amid the unification of the broader market – the MACD line remains higher than the signal line, indicating that the purchase of pressure still prevails among merchants.

This preparation is alluded to the possibility of other gains despite the death of death.

Hbar climbs steadily – will you carry the line or slip to $ 0.15?

Since April 16, HBAR has been trading along the upward trend line, a bullish pattern that has been formed when a continuous origin is spread its lowest level over time. This indicates the investor’s increasing confidence and continuous upward momentum, even amid the short -term decline operations.

For HBAR, this trend indicates that buyers continue to enter into increasing price points, which enhances support levels. If the direction persists, the way may pave the way to achieve more gains, especially if the market morale remains positive.

The HBAR price can break $ 0.19 in this scenario and the gathering about $ 0.23.

On the contrary, if it resumes sales, the HBAR code price may decrease to $ 0.15.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.