Did only Solana as an institutional favorite prefer?

SUI and Solana have recently topped the headlines with a noticeable shift in the institutional interest. Over the past few weeks, SUI has gained a large traction, bypassing Solana to become one of the origins of institutional flows.

The question that arises now: Is this a temporary trend, or did the institutions sincerely convert their focus towards SUI as a big competitor in Blockchain space?

Sui outperforms Solana

April has proven to be a decisive turning point for SUI, as it exceeded Solana in terms of institutional flows. She attracted $ 14.7 million in flows. Meanwhile, Solana witnessed $ 13.9 million in external flows during the same period.

Until another year, SUI offers a strong competition with Solana, with flows of $ 72 million. This shift in investor morale may indicate a wider change in the market, indicating that the institutions prefer SUI over their firm counterpart.

The trend is particularly interesting, given the performance of both origins. Although Solana has long been seen as a strong player in the Blockchain space, the last SUI’s rise indicates that investors may be diverse through the leading platforms.

Juan Pelic, chief research analyst at InTothheblock, shared similar views with Beincrypto regarding SUI.

“The diversity of institutions instead of replacing Solana with SUI. Some capital has turned, with signals that 60 % of Solana’s SONA flows are moved to SUI, which are offered by their growth capabilities and newer technology.

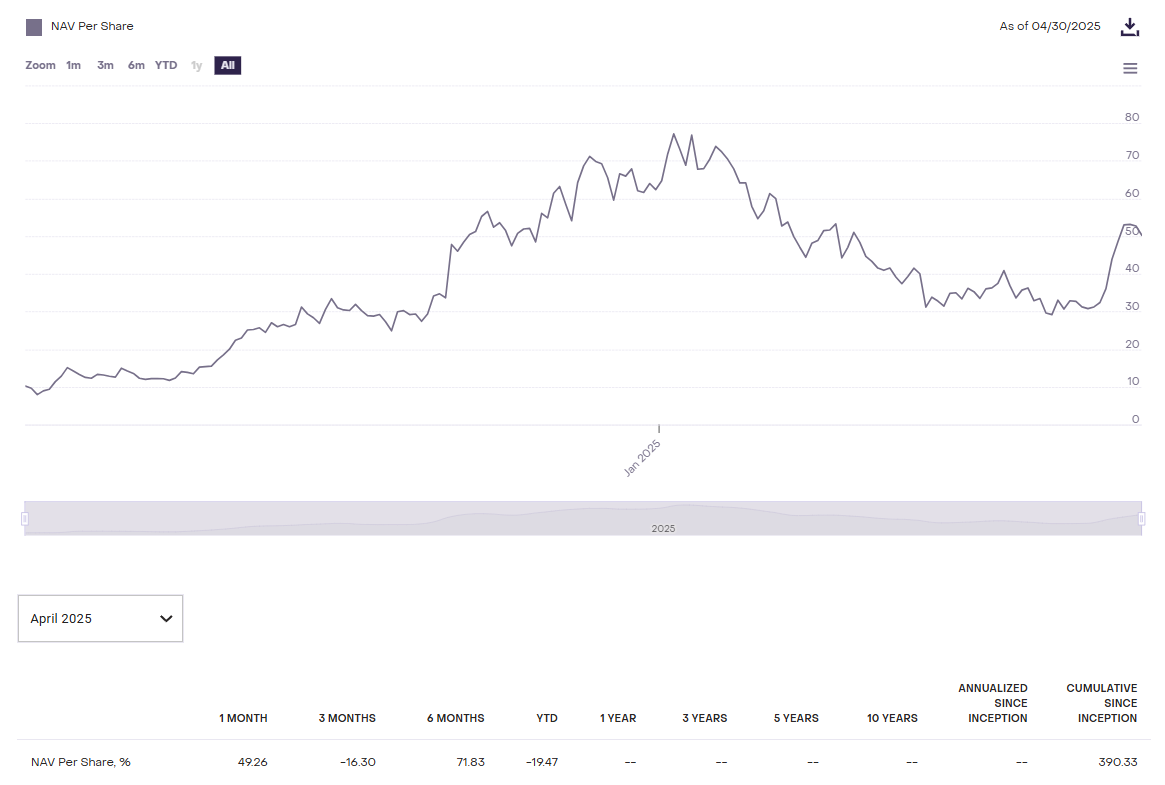

The total momentum of both assets is also worth looking, especially when comparing the gray boxes of Sui (Suifund) and Solana (GSO). Over the past six months, the NAV value of Grayscale’s sui Trust has witnessed a 71.8 % positive change, while Solana’s Nav remained flat.

This blatant contradiction in the performance highlights the diverse demand for these symbols and the subsequent effect on their associated investment vehicles.

Moreover, CBOE recently approved SEC on SUI ETF from Canary Capital. However, Pellicer believes that this may not happen any time soon.

“Sui ETF is unlikely to be approved in front of Solana ETF files. Solana in June 2024, $ 73 billion in the market, and major companies such as fidelity priority for mid -2015 decisions.

Sui vs. Solana Price Performance

Both SUI and Solana have witnessed a decrease in the price since the beginning of the year, as SUI has witnessed a decrease of 14 % and Solana by a 19 % decrease. However, April has turned into a major transformation of both symbols, as SUI increased by 56.6 % for trade at $ 3.54, while Solana recorded a 21 % more modest raising, reaching $ 151.

Despite growth in April, it is important to note the difference in the market value between the two. The market growth in the cost of $ 11 billion in April was equivalent to the maximum of the entire market market. This difference in the growth of the maximum market indicates that although the SUI Rally is impressive, the largest market value in Solana gives it a more firm presence in the market.

However, SUI’s strong performance in April highlights an original transformation of attention, driven by a more developmental chain and growing partnerships. This trend can continue, which leads to further growth for SUI in the Q2 and Q3, as it depends on its momentum. However, SUI is still out of Solana as an institutional favorite.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.