WTI slides while Trump falls behind Iran’s response, the risk hormone strait fades

- WTI fell raw after it reached $ 75.54 on Thursday, and pressed the geopolitical risk reduction.

- Geneva speaks among Iranian diplomats and the European Union a diplomatic momentum, a refrigeration of a hormone fears.

- Trump delays the decision on the US direct participation, and turns the focus on the market to provide the basics.

Crude oil is trading in West Texas Intermediate (WTI) on Friday, as it slipped to about $ 73.80 a barrel after touching a height of $ 75.54 on Thursday.

The decline reflects the low geopolitical risks after diplomatic talks between Iran and the European authorities in Geneva, which helped relax the risk -based risk in the Middle East.

WTI slipping as the Geneva diplomacy calms down fears of Hormuz, and Trump’s delay work

The European Union diplomats from France, Germany, the United Kingdom and the European Union met with Iranian Foreign Minister Abbas Aragichi in the first official participation since the escalation of hostilities between Israel and Iran. While no ceasefire agreement was reached, the meeting indicated a mutual preference for diplomacy over the confrontation.

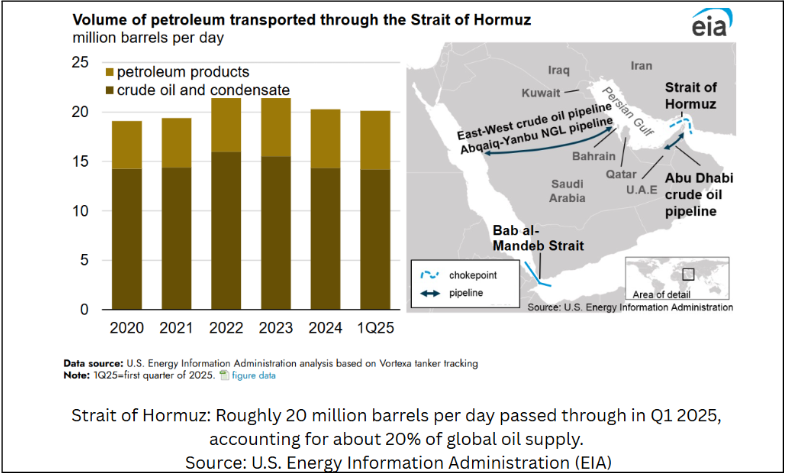

This helped calm the investor concerns about potential display disorders, especially about the Strait of Hormuz – a major transit point for about 20 % of global oil shipments.

The talks followed statements from senior Iranian legislators Beheham Saidi, who said that Tehran could consider closing the strait “if the vital national interests are in danger,” but stressed that it will be the last resort. Although the risks still exist, the absence of new threats during the Geneva talks helped reduce fluctuations in raw markets.

Meanwhile, President Trump delayed a decision on direct US military participation, and turning the focus in the market towards the basics of supply and broader spirits.

Oil stock data draws a more strict supply image

At the front of the data, the US inventory numbers that were released this week added upward pressure. The American Petroleum Institute (API) was a 10.13 million barrels for the week, while Energy Information Administration (EIA) showed a greater decrease of 11.47 million barrels, with both numbers that exceeded expectations and indicates more strict supply conditions in the United States.

Technical Analysis: WTI merges after gaining more than 22 % in June

Technically, WTI is still higher than the main simple moving averages (SMA), with SMAS for 100 days and 200 days strong support at $ 65.78 and $ 68.40, respectively.

Initial support appears in the brand of $ 72.00, followed by a 61.8 % Fibonacci alternative from April to April at $ 69.98. The resistance is at an altitude of 75.54 dollars in June, with the outbreak of the highest that offered the highest level in January near 79.37 dollars.

The RSI (RSI) index roams above 69, indicating a little lower conditions that can push a short -term decrease.

Wti crude oil daily chart

In general, crude unifies recent gains with diplomatic progress and narrow American stockpiles that pull the market in opposition directions. Traders will remain alert for more developments from Geneva and the regional addresses of signs on the next step of oil.

WTI oil questions and answers

WTI Oil is a type of crude oil that is sold in international markets. West texas intermedition, which is one of three main types including Brent and raw Dubai. WTI is also referred to as “light” and “sweet” due to its low attractiveness and sulfur content, respectively. High quality oil is easily improved. It is obtained in the United States and is distributed through the Kushing Center, which is considered “the world lines lines in the world”. It is a standard for the oil market, and the price of WTI is frequently transferred in the media.

Like all assets, the supply and demand are the main engines of the oil price in WTI. As such, global growth can be a driver to increase demand and vice versa for a weak global growth. Political instability, wars and sanctions can disrupt supply and influence prices. OPEC decisions, a group of main oil -producing countries, is another major drive. The value of the US dollar affects the price of crude oil in WTI, given that the oil is often traded in the US dollar, and therefore the weakest US dollar can make oil more affordable and vice versa.

The weekly oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) affect the price of WTI oil. The changes in stocks reflect fluctuations and demand. If the data shows a decrease in stocks, it can indicate an increase in demand, which increases the price of oil. Top stocks can reflect the increase in supply, which leads to low prices. The API report is published every Tuesday and effect evaluation operations the next day. Its results are usually similar, as it falls within 1 % of each other 75 % of the time. Environmental impact evaluation data is more reliable, as it is a government agency.

OPEC (the Organization of Petroleum Exporting Countries) is a group of 12 oil -producing countries that collectively decide production classes for member countries in meetings twice annually. Their decisions often affect the prices of WTI oil. When Opec decides to reduce the shares, it can tighten the supply, which increases oil prices. When OPEC increases production, it has an opposite effect. OPEC+ refers to an expanded group of ten additional members without OPEC, most notably Russia.