Today’s encryption prices: Bitcoin slides below 95 thousand dollars, Altcoins struggle to survive green

Bitcoin showed an increasing volatility today, as a post -bybit and a huge process led by ETHEREUM holders.

Investors have been in a risk overcoming, as the total market value of encryption decreased more than 3 % to $ 3.1 trillion.

Fear and greed index fell to 49 at neutral levels.

For Altcoin market, today the losses were distinguished, as only a few distinctive symbols were able to stay in Green by late Asian trading hours.

Why bitcoin decreased today?

Bitcoin remained stuck in a narrow range of 95,113.37 dollars – 96,480.93 dollars, as traders remained cautious, and hesitated to inject liquidity amid uncertainty in the market.

The frequency stems from the repercussions of the BYBIT penetration, which has seen more than $ 1.4 billion of ETH symbols and ETH-related symbols as the largest theft of encryption ever.

The accident sparked a huge sale, as Ethereum led the shrinkage.

ETH has decreased by 5 % over the past 24 hours, and slipped to less than 2700 dollars.

Panic spread quickly in the market, pulling bitcoin and other main codes down with it.

What made the clay worse, the sales process led to a large qualifier in the derivative market.

More than 268 million dollars have been eliminated from the positions of this, including $ 40.13 million of long ETH sites – at least twice 21.4 million dollars in Bitcoin Longs.

Moreover, the markets were already suffering from increased concerns about inflation and commercial tariffs.

The next version of the Personal Consumption Expenditure Index on February 28 is to keep merchants on the edge of the abyss.

The markets are also tense about a more strict monetary policy in 2025.

According to the Fedwatch Group for the CME group, there is a 97.5 % chance of the Federal Reserve that will maintain fixed rates in March and the possibility of not changing 73 % in May.

For encryption investors, this means that pressure from high interest rates and tightening monetary policy will continue, which limits market liquidity and appetite in the short term.

What is the following for Bitcoin?

Some market analysts have turned into a decreased work on bitcoin prices in the next few days and expected a decline to $ 90,000.

In the February 24 publication, analyst Roman indicated that Bitcoin has repeatedly failed to collapse despite multiple attempts.

He pointed out that the lack of momentum indicates that the market loses steam and may prepare for a decrease.

“It seems that the 90K support touch is to come. This is nullified if we break 98.4 with closing above.

Likewise, his trading colleague Bustry believes that a correction to 92 thousand dollars is likely to consider “panic, depression and bear” currently prevailing in the market.

Just another refusal in the medium term, where we find ourselves again in the short term support. Patience test continues. Imagine the smell if we see something like this … it will be panic, depression and publishing at 92 thousand wild dollars.

Rekt Capital, another known analyst, has been added to a cautious outlook.

According to the analyst, Bitcoin is in the midst of a volatile re -test of the bull science style on the monthly graph.

To confirm this bullish trend, Bitcoin must start from a monthly closure above the bullfield at 96,700 dollars.

When writing, Bitcoin was hovering slightly over $ 94,500, a decrease of 1.2 % over the past day.

Altcoin Market down

Over the past 24 hours, the Altcoin market has decreased by 5.2 %, as it decreased from 1.33 trillion dollars to $ 1.26 trillion in this period.

The Altcoin season index fell to the lowest level in 3 months from 26 during the past day, a sign that traders have moved away from Altcoin’s investments due to the broader uncertainty that prevails currently across the markets.

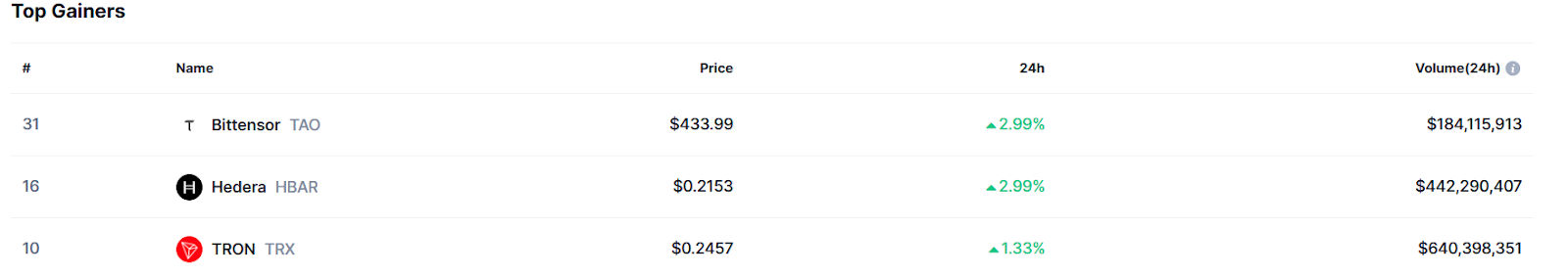

Among the best 100 cryptocurrencies depending on the maximum market, only a few managed to stay in green.

BitTensor (TAO) and HEDERA (HBAR) both have modest gains of about 3 %, while Tron (TRX) managed to stick to 1.3 % of profits.

source: Coinmarketcap

For HBAR, the gains were run after the Canary Capital to get ETF HBAR, while other symbols did not have a clear reason behind today’s performance.

Post -encryption prices today: Bitcoin slides less