Data appears on the Dogoin series at a decisive turning point

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

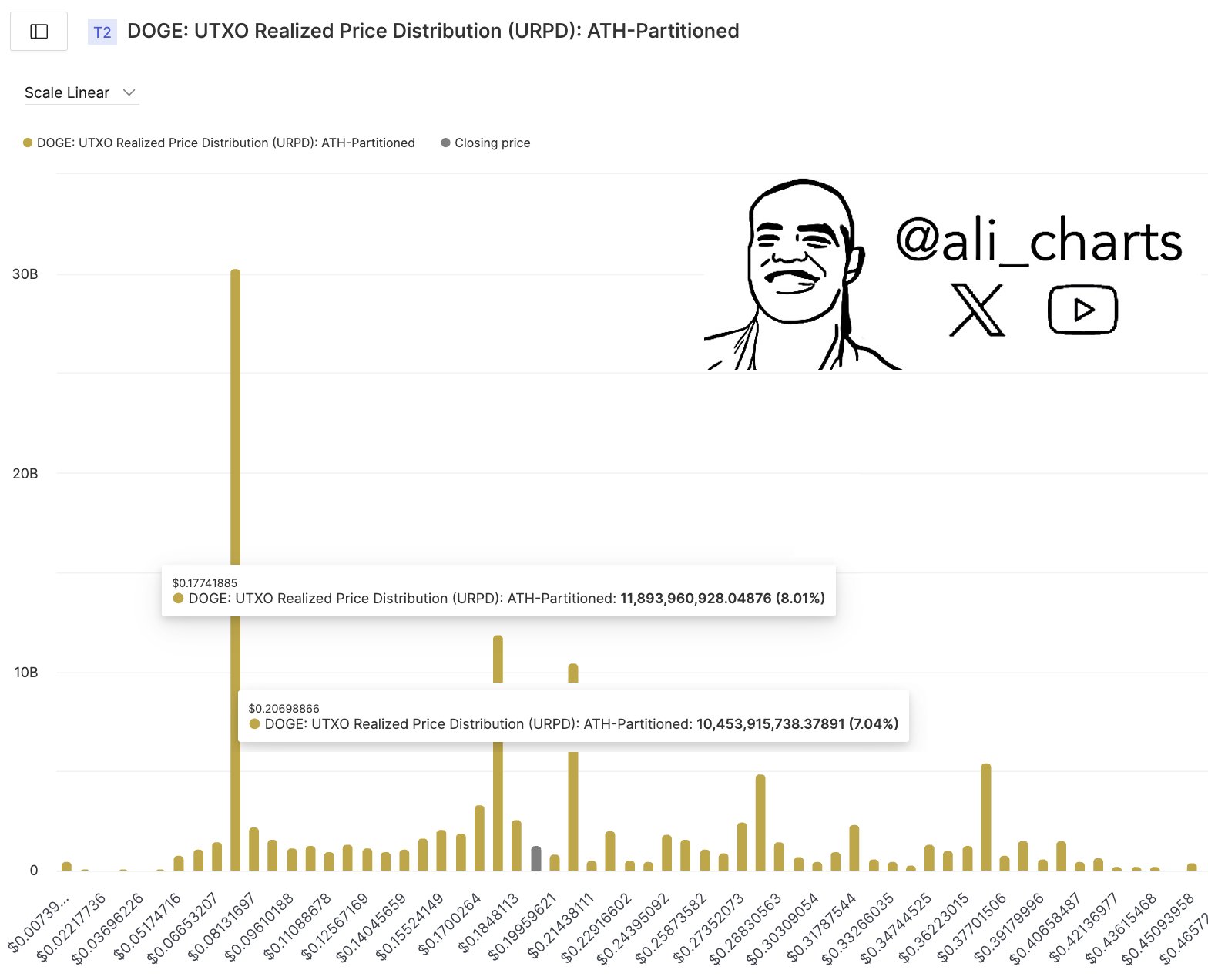

The Ali Martinez (@ali_charts) has posted a new Utxo (URPD) price distribution plan on the place where the large parts of DOGE changed. This graph shows distinctive sets of activity on the chain, which spoils the most important price levels that can determine the main step next to meme.

Martinez specifically sets $ 0.177 as strong support and $ 0.207 as a noticeable resistance, indicating that Dogecoin is effectively located among these two basic barriers. While $ 0.177 and $ 0.207 highlights immediate trading decisions, the graph also reveals other clear price levels that require careful inspection.

What does this mean for Dogecoin traders

The graph reveals the largest URPD group in Dogcoin at about $ 0.177, which represents about 8.01 % of the total DOGE supply (about 11.89 billion icons). This focus indicates a high size of coins in this range. Because of the large number of Doge holders who have a cost -cost rules of about $ 0.177, analysts usually look at this level as an important support zone – where buyers can intervene to defend their sites.

Related reading

Another prominent group appears at $ 0.2069, representing about 7.04 % of the total offer (about 10.45 billion icons). Martinez describes a major resistance, which reflects a large group of their holders who got a doge at this price or near it. If the market approaches $ 0.207, some participants may look to break or lock small gains, which may create the sale pressure.

One of the most striking notes is the significant rise at $ 0.06653, with about 30 billion symbols dealt with. This is much higher. Many smaller groups are drew on the graph, indicating that a huge size of Doge Supply has turned this price in the past.

Related reading

Although the market currently exceeds $ 0.06653, this level may be large if the prices will work sharply. It mainly represents a large cost of a large part of his holders, which turns it into a strong field of support if Dogecoin tests a deeper negative step less than $ 0.177.

On the upper side, the graph highlights two main concentration above the current prices. About $ 0.2753, a little less than 5 billion symbols have been handled, at a rate of $ 0.3622, slightly more than 5 billion symbols. These long bars may be major resistance obstacles if Dogecoin can break the shorter ceiling at $ 0.207.

Once Dog maintains gains exceeding $ 0.207, buyers may search for a momentum to carry the distinctive symbol about $ 0.2753, as new resistance can appear. If the upscale emotions remain strong, the region may become about $ 0.3622, the next important level for viewing.

At the time of the press, Dog was traded at $ 0.196.

Distinctive image created with Dall.e, Chart from TradingView.com