BTC is at risk after $ 250 billion, which was wiped from the encryption markets

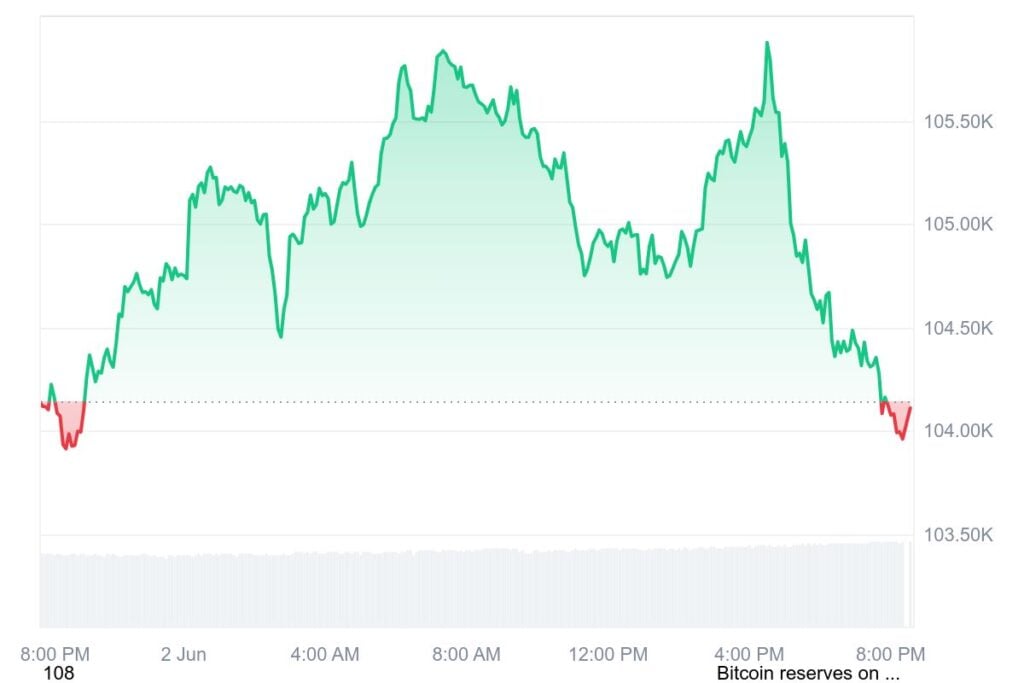

Bitcoin enters the week with increased fluctuations, and it is largely formed through macroeconomic developments and geopolitical tensions. At the beginning of June, Bitcoin is trading around the level of $ 105,000, but market morale reflects caution with the emergence of many major risk factors.

One of the main events that affect the market expectations is the upcoming Jooms report. Traditionally, the powerful market engine, this data version can affect how investors price in interest rate expectations and wider economic momentum.

In addition, inflation is still a major concern, as current readings associate about 2-2.1 % – a range considered by the federal reserve is acceptable. Although no immediate changes in politics this week are not expected, any indication is likely to be swinging to mitigate or emphasize the coming of Bitcoin and wider encryption markets.

Another factor that contributes to uncertainty is the ongoing trade tension between the United States and China. The last temporary suspension and the subsequent tariff, especially with regard to rare ground minerals, stopped the investor.

The successor between us and the Chinese officials has threw a shadow on the dynamics of global trade, which in turn leaks into digital assets.

Over the past week, the total market value of encryption decreased by more than $ 250 billion, as it fell from 3.5 trillion dollars to $ 3.25 trillion, and it is largely due to this geopolitical stability. Despite the uncertainty, there is also a feeling of optimism among some market monitors.

source – Austin Hilton on YouTube

Bitcoin prediction

The last basic procedure for Bitcoin was relatively stable but somewhat defeated, especially during the weekend when the trading volume tends to decrease. Despite the low -size environment, the market shows a constructive movement, although the condemnation of price changes seems limited.

Currently, Bitcoin maintains an important range of approximately 103,500 dollars and $ 105,000, which represents the main support and resistance levels based on the previous price behavior this year.

In the higher time frames, Bitcoin remains in a bullish direction in general, but the short -term momentum has been weaker, indicating a possible unification stage or trading related to the extent of the near future.

A fracture of more than $ 105,000 can significantly indicate a sign of a renewed batch, while a decrease of less than $ 103,500 may indicate more negative risks. Market basics provide optimistic expectations with caution, with support from the continuous positive trends in stock markets, but still uncertainty and fluctuations.

Traders should monitor large transformations in size and external factors such as upcoming economic data versions, including manufacturing PMI reports and employment numbers, which may affect the Bitcoin direction next week.

Currently, market expectations remain neutral while taking into account these decisive price levels to determine the next main step.

BTC Bull Bridges Bitcoin with a small cup growth capabilities-metabolism is approaching $ 7 million

At the same time, like bitcoin assets like Btc bull (BTCBUL) attracts attention, not only because of the explosive growth potential but also for the additional tool they offer – such as bonus holders with free bitcoin. BTC Bull has already raised more than $ 6.7 million in a period of between them, with the price of codes currently $ 0.00254.

Potential investors are investing 27 days to join before walking. The concept behind BTC Bull depends on providing a concrete value to the distinguished symbol holders by linking the interest of the distinctive symbol directly and bonuses to Bitcoin price movements.

With the height of Bitcoin, as well as the potential interest of BTCBULL holders. Since Bitcoin strikes human landmarks like $ 125,000, 150 thousand dollars, and beyond, BTC Bull will lead to the distinctive code burns and free Bitcoin distribution to its community. The most prominent event will be an additional Airdrop when Bitcoin reaches $ 250,000.

To submit BTC bonuses to Btc bull Society, a partnership has been formed with a wallet provider that provides advanced features. Best portfolioIt is a multiple encrypted wallet, which was smoothly combined with the sale of society.

This integration of Bitcoin enables to overcome the Multichain Governor for all pre -participants by applying the best portfolio to mobile devices.

While the Meme Coins and the volatile altcoins can provide fast bonuses and risks, BTC Bull provides a hybrid-overcoming the explosive growth capabilities of a new symbol with direct exposure to Bitcoin’s success.

With bitcoin prices of long -term prices ranging from $ 500,000 to more than $ 2 million by 2030, many analysts remain bullish.

Diversification becomes a key here; Instead of going to any one-whether bitcoin currency, Mimi currencies, or gold-can help a diversified approach across cryptocurrencies, traditional stocks and emerging symbols such as BTC Bull to increase the upward trend with risk management.

BTC Bull is designed to rise alongside the broader Bitcoin track, making it a convincing option for investors who want to benefit from the future of $ BTC without losing the effect of complications of symbols that it can offer. To participate in the distinctive code $ BTCBLL, Visit btcbulltoken.com.

This article was provided by one of our commercial partners and does not reflect the opinion of Cryptonomist. Please note that our commercial partners may use programs to generate revenues through the links in this article.