Crown dealers watch $ 3.3 billion in validity option

More than $ 3.3 billion in Bitcoin (BTC) options and ETHEREUM (ETH) ends today. This comes after consumer price data (consumer price index) and PPI data (producers price index).

How will the expiration options today affect the prices of these digital assets and wider encryption market fluctuations?

More than 3 billion dollars of the end options – the reaction of the encryption market

According to Deribit, more than $ 2.76 billion was assigned to Bitcoin options, with the maximum of $ 100,000 paint. This collection of options includes 26,543 contracts, an altitude of the open interest of 25,925 in the previous week.

The connection mode ratio is 1.02, which means that merchants buy more nails (sales rights) more than calls (purchase rights), which reflects the low market morale.

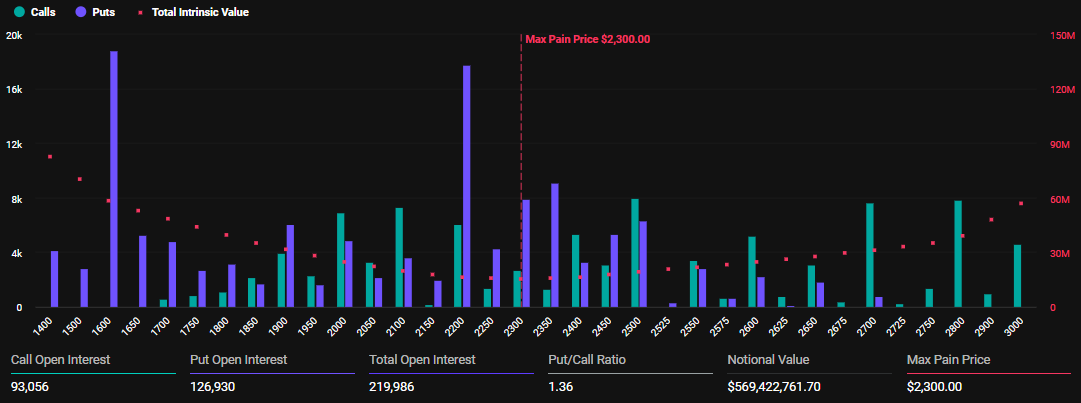

For Ethereum, $ 569.42 million is valid, which includes 219,986 contracts, which is a noticeable increase from last week’s contract of 164,591 contracts. The maximum pain point is $ 2,300, with a summons mode 1.36, indicating the expenses of the ETH.

The “maximum pain point” in encryption options is very important. It represents the level of the price that the option holders experience the most important financial discomfort.

As of the writing of these lines, Bitcoin was traded at $ 103,912, while Ethereum exchanged hands for $ 2,572. This means that both digital assets are higher than the prices of the strike with the market’s morale mostly.

It is worth noting that the markets tend to be attracted towards the strike price or the level of maximum pain after the limits to reduce payments.

“BTC SKEW neutral … the price procedure can become interesting,” books.

Greeks.live analysts note that Bitcoin’s rejection of $ 105,000 came in an excessive market. Analysts also notice caution in the market, with defensive strategies, and merchants prefer to sell momentum rather than chasing.

“Many traders get profits on long calls and are going in more defensive sites because they feel everyone is rushing.” Notes.

How does the U.S. and the last PPI price index affect the encryption options market?

Meanwhile, these expired options showed after the US CPI data for the month of April, cooling inflation to 2.3 %, the smallest reading since February. 2021. Likewise, the producers’ price inflation in April decreased to 2.4 %, less than 2.5 % expectations.

According to analysts, while April data has turned on the narration, the markets may be unstable to this shift. Low inflation and syndrome can pressure the federal reserve to reduce prices sooner, despite the previous federal reserve signals to maintain fixed rates amid 2 % uncertainty and inflation goal.

“Price discounts are due to play, and markets are not ready for what will happen,” books Merlijn Trader.

This usually enhances risk assets such as Bitcoin and Ethereum, and increasing demand for encryption options as investors seek to benefit. Low inflation reduces pressure on cash tightening, which enhances market liquidity, which increases option installments.

However, the encryption prices have noticed slightly fluctuations in the short term after the consumer price index and PPI, with the vision of increased activity options, increased sizes, and more strict differences.

While the option expiration can cause sharp price movements, the effect is usually temporary. The market generally settles the next day, which compensates for the initial fluctuations.

However, merchants must analyze technical indicators and morale in the market carefully before investing in this volatile environment.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.