Jpmorgan Chase Files brand for Stablecoin “JPMD”

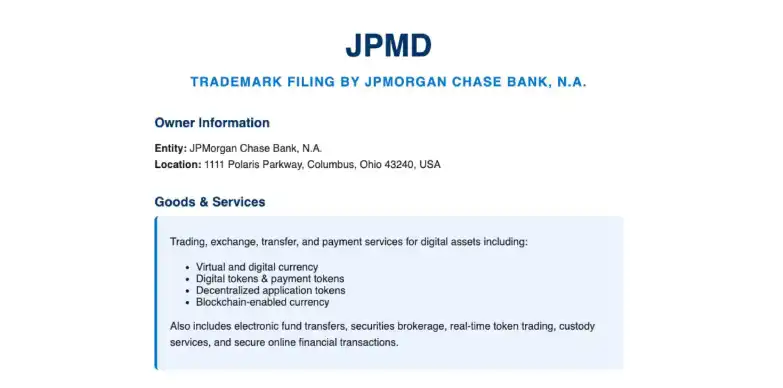

JPMorgan Chase has applied for a brand for “JPMD”, which raised rumors that he might prepare to launch a new American Service -backed Stablecoin, called JP Morgan Dollaar. According to the deposit, the service will cover a wide range of digital asset activities, including trading, exchange, payments, custody and money transfer.

Jpmorgan is ready for the Stablecoin Plan

JPMD brand JPMD files with JPMorganDollar – Stablecoin’s new intended.#jpmorgan #Stablecoin pic.twitter.com/hmyhsysrm8

– Martyplement (Martyparthymusic) June 16, 2025

This step represents another major shift in JPMorgan’s advanced position on encrypted currencies. Although CEO Jimmy Damon expressed his suspicions for a long time, as Bitcoin recently described the “Bonzi Plan” without fundamental value. However, the bank gradually adopted encryption. It now allows customers to buy Bitcoin and began accepting the traded investment funds as a guarantee of loans.

If JPMD appears as a complete stablecoin, this will indicate a deeper commitment to digital assets from one of the most influential players in Wall Street. Stablecoin can help JPMorgan to compete with the original encryption exporters such as Tether and Circle, and it may serve as a tool for local payments and lessons across the fastest limits-and according to what was reported, the traction strategy has gained between major American banks.

The brand file comes in a pivotal time for the American Stablecoin sector. Only last week, the Senate developed the direction and creation of the national innovation of US Stablecoins (Genus) with the support of the two parties. When the draft law is approved, it will put a regulatory framework for Stablecoin and can be signed on President Donald Trump’s law.

The current Stablecoin market is estimated at more than $ 251 billion, led by Tether (USDT) and Circle’s USDC, according to Defillama. As a result, many companies and central entities direct their attention towards Stablecoin.

This rapid growth was not noticed by anyone. More and more companies, and even traditional banks, turn their attention towards Stablecoins.

Banks such as Bank of America, Citi and Wells Fargo are said to be studying cooperative currency projects. When it comes to companies, retail companies such as Walmart and Amazon also launch their distinctive symbols, indicating that Stablecoins has become an indispensable part of digital financing strategies.

Governments also take action. South Korea and Hong Kong, in particular, multiply on their regulatory frameworks. Only yesterday, Hong Kong Chan Chan Moo Financial Secretary announced that the Hong Kong Monetary Commission (HKMA) will speed up the license for Stablecoin Exporters as soon as the upcoming “Stablecoin Decree” is involved.

Meanwhile, South Korea is pressing forward with the “Basic Law of Digital Assets”. This legislation aims to provide a clear legal basis for Stablecoins. A draft law related to review currently in the National Association for the Organizing Stablecoin linked to the Korean victory or the US dollar.