Coinbase becomes the largest ETHEREUM node operator, controls 11.42 %

Coinbase has become the largest individual knot operator in the ETHEREUM network, holding 11.42 % of the total ether (ETH), according to a new report issued by Crypto Exchange.

The performance update has revealed that Coinbase currently has 3.84 million ETH, at a value of about $ 6.8 billion, with their broths.

While the Staking Lido platform has a larger collective share than Ethereum stokeing, each of the individual node operators has a much smaller share.

Anthony Sassano, host Daily JoyHighlighting this distinction, with emphasis on the dominant position of Coinbase as an independent independent entity.

We now know the amount of ETH Coinbase (11.42 % of the total share), of course, Coinbase makes the largest unilateral knot operator on the network (Lido is larger as collectively, but each knot operator has a smaller % class) to the Coinbase for transparency!

Coinbase’s endorsements excel

I reported Coinbase, which exceeds the time of the auditor’s operation and participation objectives, reflecting the strong operational efficiency of the platform.

The company recorded the average audit time by 99.75 %, exceeding its internal goal by 99 % while maintaining high security standards.

The stock market attributed this performance to the upgrade of the 2024 system, which allows continuous verification operations even while maintaining a beacon knot.

This promotion has strengthened Coinbase and contributed to its position as the most important ETHEREUM knot operator.

Besides operating time, the participation rate – the auditor in the ETHEREUM consensus mechanism – 99.75 %, outperformed the average network of 99.52 %.

Coinbase’s success rate in signing and offering blocs through MEV 99.76 %, which exceeds the network standard 99.38 %.

Coinbase expands the auditor network

Despite the work of a central exchange, Coinbase has carried out an infrastructure to distribute geographically to be in line with the principles of decentralization in Ethereum.

According to the report, Coinbase is spreading in multiple regions, including Japan, Singapore, Ireland, Germany and Hong Kong.

This distributed approach helps to reduce central risk and ensures that the ecological system of ETHEREUM is flexible.

While concerns are continuing regarding the influence of large entities, Coinbase’s global presence aims to enhance the stability and security of the network.

The company also highlighted its efforts to improve the efficiency of the auditor through improved infrastructure, and to help improve performance and maintain reliability through different market conditions.

This development puts Coinbase as a leading power in the Ethereum scenery.

ETH prices after $ 2000

Coinbase’s dominance in Ethereum stokeing coincided with an increase in ETH prices, driven by increasing accumulation by adult holders.

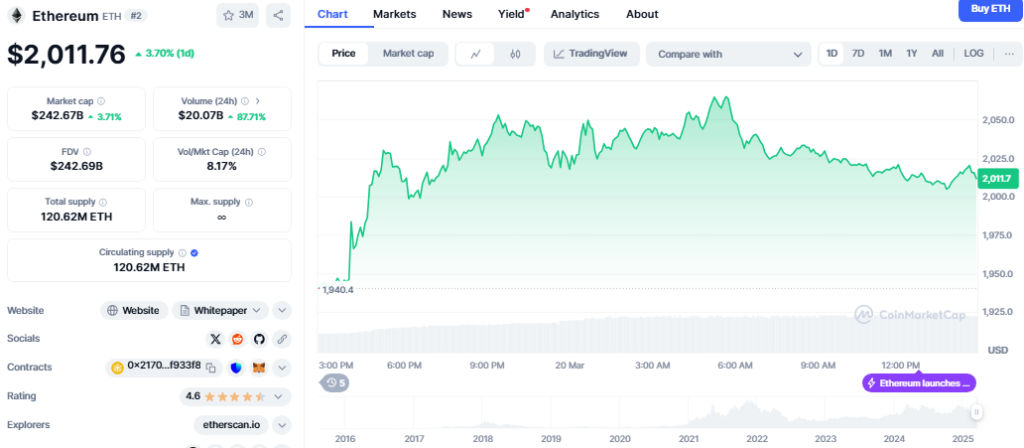

On March 2, Al -Atheer reached the highest weekly level of $ 2060.73, which reflects 12.3 % profit over seven days.

By March 20, the ETH daily trading volume increased to $ 2.07 billion, as the assets rose over the threshold of $ 2000.

source: Coinmarketcap

Increased prices come at the time of the mixed market for ETAREUM.

Earlier in March, Vice President Blockchain at Yuga Labs warned that ETH might decrease to $ 200 in the extended bear market.

However, the last height indicates strong confidence in the investor, and may be fueled by the increasing impact of Coinbase in the ecosystem to give up ETHEREUM.

Analysts refer to restricted ETHEREUM growth and increased network activity as the main engines behind eth momentum ascending.

Since more investors share their property, the circulating of ETH is decreasing, which may lead to high -term prices in the long run.

Post Coinbase becomes the largest knot operator in Ethereum, where 11.42 % stake first appeared on Invezz