Ethereum jumps 10 % a week, but the trend shows fragile signs

ETHEREUM (ETH) has increased by more than 10 % over the past seven days as the market shows signs of renewable activity. However, the main technical indicators reveal a mixture of weak direction and caution optimism from buyers.

ETH is currently fighting critical resistance areas that can determine whether the gathering is continuing or fading. With a momentum still fragile, it may be a decisive month for the next main movement of Ethereum.

ETHEREUM direction weakens sharply as bears are approaching

The DMI chart of Ethereum currently appears on 24.91, a sharp decrease of 39 days ago. ADX, or an average trend index, measures the strength of the trend, whether it is up or down.

In general, ADX’s reading above 25 indicates a strong direction, while values of less than 20 indicate that the market enters a period of weakness or trading related to the extent.

The sharp decline in ADX indicates that the last ETHEREUM momentum quickly loses strength. Without renewing buying or selling pressure, ETH can remain stuck in a more volatile style, in the short term.

Meanwhile, direction indicators show a clear shift. +Di, which tracks the upper pressure, decreased to 22.71, and decreased from 31.71 three days ago and 27.3 yesterday.

On the contrary, the declining pressure rose to 17.68, up from 7.16 only three days ago and 15.64 yesterday. Yesterday, the gap between buyers and sellers was almost closed, with Di +at 20.91 and -Di at 20.1, indicating that the sellers almost regained the market control.

This growing downtown momentum and weak direction strength increases the risk of ETHEREUM price decreased if buyers are not able to defend key levels. However, if Bulls managed to stick to the momentum, ETH can still install another attempt to recover.

ETH RSI climbs after a sharp drop: Will it be drawn?

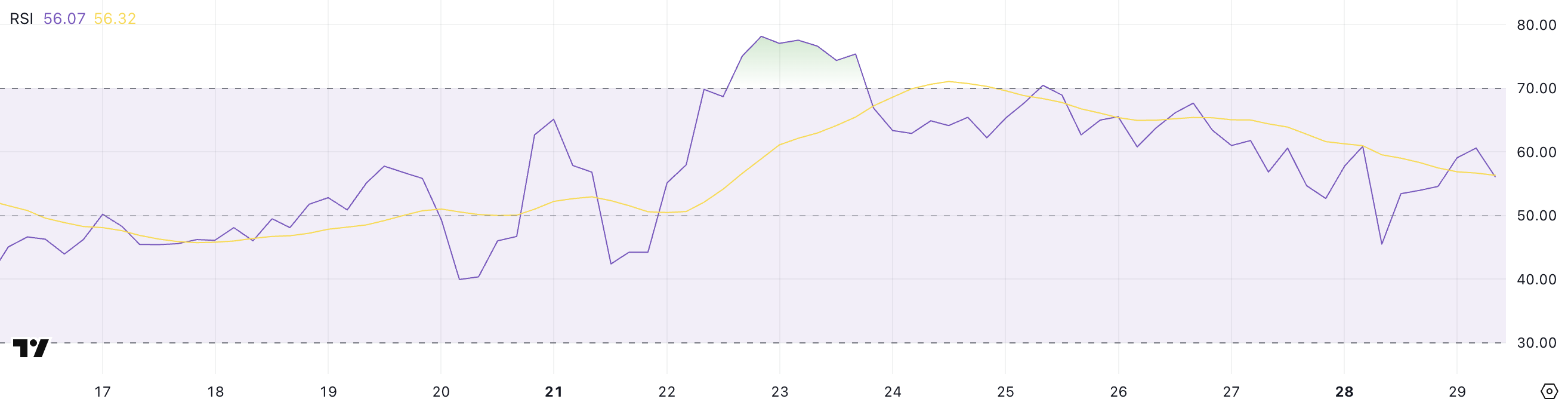

Rsi’s ethereum currently sits in 56 years, an increase of 45.5 a day ago, after reaching 70.46 four days ago. RSI is an index of momentum that measures the speed and size of price movements.

RSI usually indicates that the original has been clarified and may be due to a decline, while the relative strength index indicates less than 30 to the conditions of sale and the need for a recovery.

Readings that range from 30 and 70 are neutral, as levels indicate about 50 to the market at a decision point. The sharp swing in the ETHEREUM lineage index for the past few days reflects the recent volatile feelings about ETH.

With the RSI reserves up to 56, ETHEREUM has regained the momentum after declining in a neutral area to good. Reading, which exceeds 50 upwards, tends to indicate that buyers have begun to reaffirm some control, but not overwhelmingly.

If RSI continues to climb about 60 and beyond, it may indicate an increase in the renewal of ETH prices.

However, if the momentum stops again and the relative strength index decreases back, this may indicate that recovery loses steam and that Ethereum may return to wider unification or even a correction stage.

Ethereum battles, key resistance with looming on the horizon collapse or collapse

PRICE ETAREUM has made several attempts in the past few days to fracture above the resistance level at $ 1828. If ETH is able to break it and keep it over this level decisively, it may open the door to a stronger move up.

The next main goal will be 1954 dollars, and if the sample momentum remains strong, the increase of more gathering may reveal about $ 2,104. Ethereum can finally test $ 2,320 in a more aggressive upward trend, which represents a significant upward extension.

These levels will be a key to watching because it can determine the strength and sustainability of any outbreak in the coming days.

On the negative side, if Ethereum fails to keep its current levels and the direction is reflected, then the first decisive support for watching lies at $ 1749. A break below can lead to a decrease of about $ 1,689.

In the event of a condensation of the sale pressure, the eth can extend the declining direction further, with main support levels at 1537 dollars and $ 1,385.

The loss of these levels would indicate a much deeper correction, indicating that recent attempts to recovery were only temporary before the most striking landmark groups.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the conditions, conditions, privacy policy have been updated and the evacuation of responsibility.