Cheniere Energy Frenzy: What you need to know – Cheniere Energy (Nyse: LNG)

I have taken the whales with a lot of money to spend it Cheneree Energy.

Look at the history of options for Cheniere Energy LNG We discovered 10 deals.

If we look at the details of each trade, it is precisely to mention that 40 % of investors have opened trading with upward expectations and 50 % with landing.

Of the aesthetics that were monitored, 3, with a total amount of $ 238,910 and 7 calls, is placed with a total amount of $ 1,697,999.

Expected price movements

When analyzing the size and open interest in these contracts, it seems that the big players are looking for a price window from $ 220.0 to $ 240.0 to Energy Energy during the past quarter.

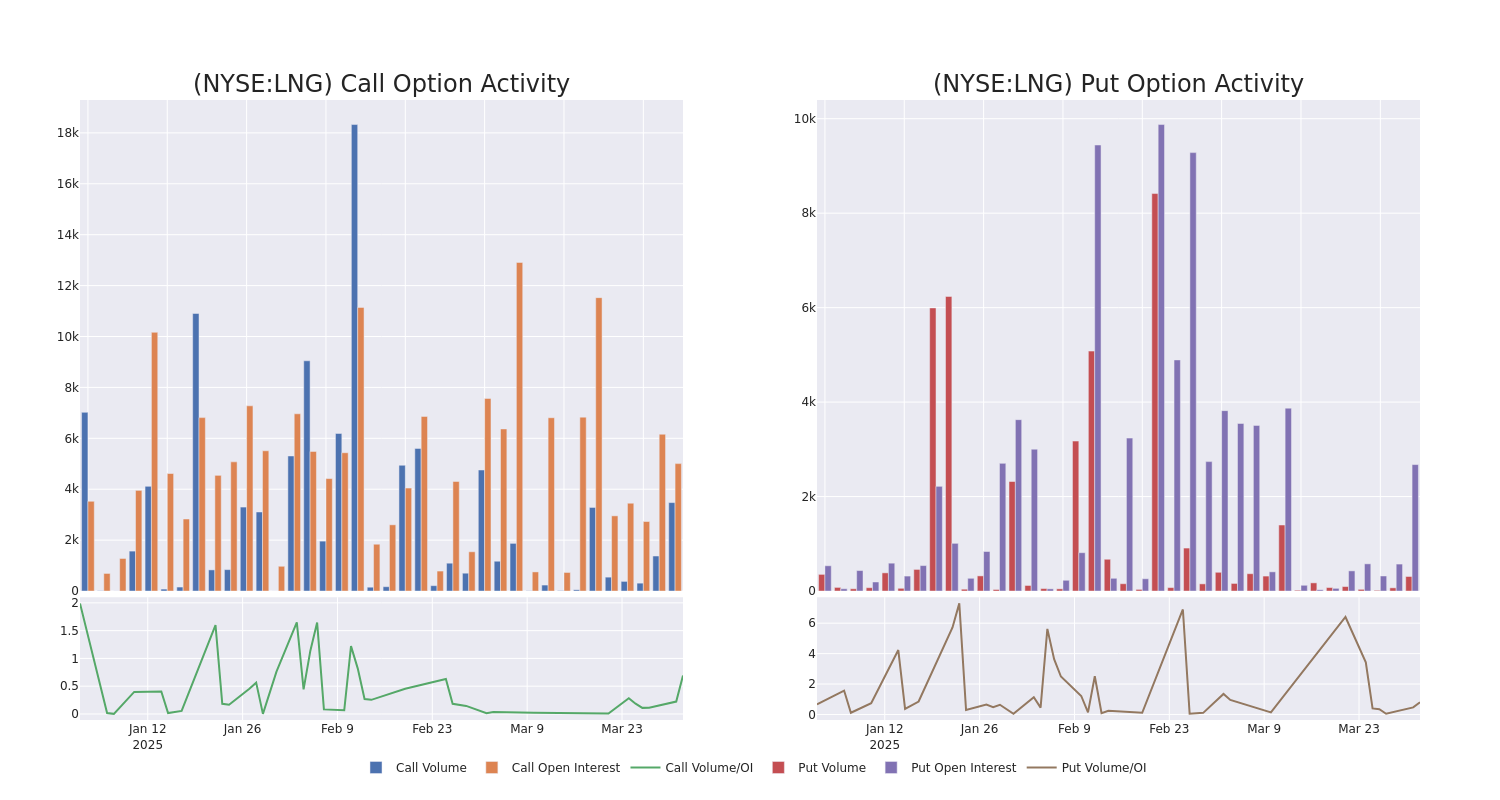

Size and develop open attention

With regard to liquidity and benefits, the average open interest of the Cheniere Energy Talling trading today is 1097.57 with a total size of 3,783.00.

In the next chart, we can follow the size of the size and the open benefit of calls and put options for large money trading in the Cheniere Energy within the strike price range from $ 220.0 to $ 240.0 over 30 days.

Cheniere Energy Call and Size Size: 30 -day Overview

The largest monitoring options:

| code | Set/call | Trade type | Feelings | Earn. date | Asking | tender | price | Strike price | Total trade price | Open attention | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LNG | Call | commerce | bearish | 01/16/26 | 23.4 dollars | 22.8 dollars | 22.8 dollars | 240.00 dollars | $ 1.3 million | 617 | 600 |

| LNG | Put | commerce | Climb | 01/16/26 | $ 29.1 | $ 27.1 | $ 27.6 | 240.00 dollars | 168.3 thousand dollars | 112 | 66 |

| LNG | Call | Sweep | neutral | 03/20/26 | 28.2 dollars | $ 26.6 | $ 26.6 | 240.00 dollars | 143.6 thousand dollars | 32 | 51 |

| LNG | Call | Sweep | bearish | 04/17/25 | $ 2.8 | $ 2.6 | $ 2.6 | 240.00 dollars | 46.8 thousand dollars | 3.9K | 459 |

| LNG | Call | Sweep | bearish | 04/17/25 | $ 2.8 | $ 2.6 | $ 2.6 | 240.00 dollars | 46.8 thousand dollars | 3.9K | 819 |

About Cheneree Energy

Cheniere Energy is a liquid natural gas, or liquefied natural gas, produced with two attached to Corpus Christi, Texas, SABINE PASS, Louisiana. It generates most of its revenues through long -term contracts with customers on the structure of fixed and changing fee payments. It also generates revenues by selling non -corresponding liquefied natural gas on a short basis or once. Cheniere Energy Partners has a SABINE PASS facility and trades as a limited major partnership.

After a comprehensive review of the options around Chenierere Energy, we move to examine the company in more detail. This includes an assessment of the current market condition and its performance.

Cheniere Energy’s current market status

- Currently traded 790,276, the LNG price has decreased by 0.0 %, and now at $ 231.4.

- RSI readings indicate that the stock may currently approach the peak of purchase.

- The expected profit version is in 31 days.

What analysts say about Chenere Energy

Market experts recently issued rankings for this stock, at a total targeted price of $ 254.0.

Transfer 1000 dollars to $ 1270 in only 20 days?

TRADER Pro Options for 20 years reveal the technique of one line that shows the time of purchase and sale. Copy his deals, which amounted to 27 % profit every 20 days. Click here to arrive. * Mizuho analyst decided to maintain his superior classification on Cheniere Energy, which is currently sitting at $ 254. * In accordance with their evaluation, a ScotiaBank analyst maintains the sector to classify the Cheniere Energy rating at a targeted price of $ 254.

Trading options offer higher risks and possible rewards. Smart traders manage these risks by constantly educating themselves, adapting their strategies, monitoring multiple indicators, and closely monitoring market movements. Keep aware of the latest energy options in Cheniere with alerts in the actual time from Benzinga Pro.

batch92.32

growth82.37

quality–

value51.78

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.