ChainLink sees a month of external expenditures – Altcoin to see it?

The data on the series shows that Chainlink (Link) has seen a month of consistent external flows, something that can prove that it is optimistic about the Altcoin price.

ChainLink Netflow has been exchanged recently

In new mail In X, the InTOTHEBLOCK market intelligence platform discussed the trend in Exchange Netflow for ChainLink. “Exchange Netflow” refers to a scale on the series that tracks the net link that moves to or outside the portfolio related to central exchanges.

When the index has a positive value, this means that investors deposit a net number of distinctive symbols of the original on these platforms. As one of the main reasons why holders of transporting their currencies to exchanges are for the purposes of selling them, this type of direction can have a decreased impact on the price of the original.

On the other hand, the scale under the zero mark indicates that external flows of exchange exceeds the flows. In general, investors take their coins away from custody of these central entities when they want to stick in the long run, so this trend can have a bullish effect on the encrypted currency.

Now, here is the chart that the analysis company shares the trend in Chainlink Exchang Netflow during the past month:

The value of the metric seems to have been negative recently | Source: IntoTheBlock on X

As shown in the graph above, the Netflow Chainlink Exchange was inside the negative area almost the past month, which implicitly means that investors are constantly withdrawing net.

In total, the stock exchanges recorded net external flows of $ 120 million in this period. Given this trend, investors are likely to be in a stage of accumulation.

During the past few days, Link has enjoyed some recovery in its price, which may have an effect on this purchase activity. Exchange Netflow now can be monitoring in the coming days, as it can have an effect on the currency on the currency.

Of course, the exterior flow chain will be a thunderbolt sign for the chainlink series, while the indicator witnessing a reflection in the positive area may mean a declining end to operate the recovery.

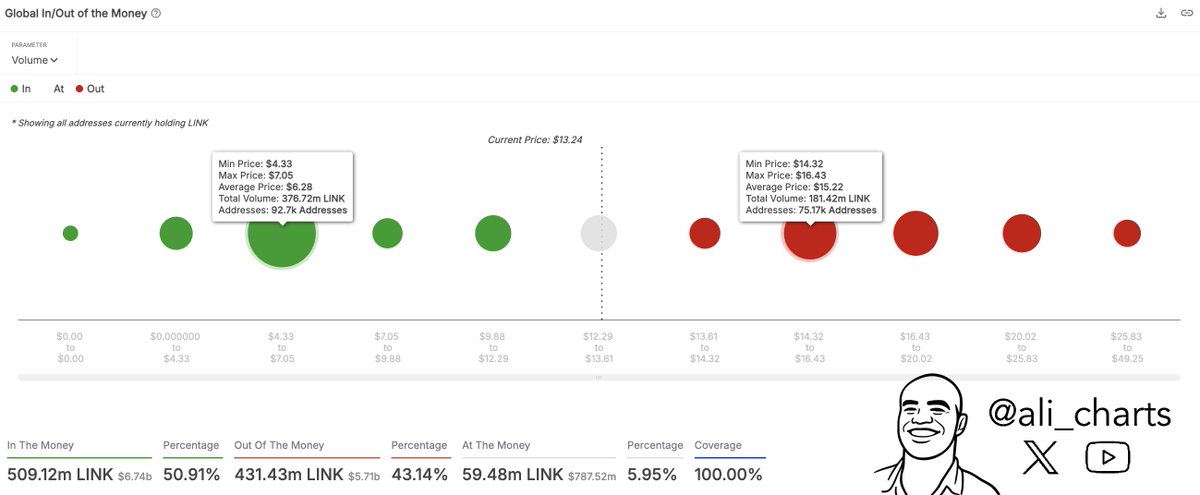

When talking about price recovery, the data on the chain can be alluded to where the next main resistance wall can lie in Link, the analyst Ali Martinez explained at X mail.

The cost basis distribution of the LINK supply across the different price ranges | Source: @ali_charts on X

From the above graph, it is clear that Chainlink investors have bought a total of 181.42 million links within the 14.32 dollar range to $ 16.43. These investors, who are currently underwater, may provide price resistance in the event of a re -test, as they may be desperate to go out in the tie period.

Link price

At the time of this report, Chainlink is trading about $ 13.74, with an increase of more than 10 % in the past seven days.

The trend in the LINK price during the last five days | Source: LINKUSDT on TradingView

Distinctive image from Dall-I, IntothBlock.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.