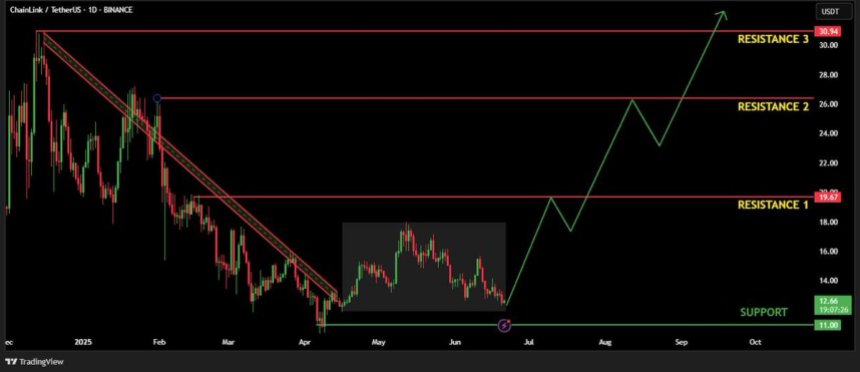

Chainlink recovers the main structure – a calm accumulation that may be provided with $ 25 to $ 30

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Chainlink (Link) increased by 21 % of its lowest levels on Sunday, as it gains momentum in an unconfirmed Macro and geopolitical environment. While global tensions continue to stimulate fluctuations across the markets, Chainlink has emerged for its pollution, with the support of a series of strong partnerships and increasing basics on the series. The recent price movement indicates a possible transformation in the direction, but analysts warn that a certain outbreak is needed before the bulls can take over it completely.

Related reading

The great analyst Henry Lord of Alts has highlighted that LINK may bear months of continuous landing and unusually calm price. However, modern movements indicate that there is something that changes below the surface. The size of the size increases, the fluctuation is picked up, and Link creates a basic structure that can mark the end of the accumulation phase.

Despite this force, Chainlink is still technically closed in the scope of unification. It will be important to have a clean outbreak higher than the main resistance levels in the next stage of upward momentum. Until then, traders are optimistic with caution because LINK raises a greater step.

Chainlink is preparing for a decisive movement

ChainLink is currently trading more than 25 % of May, which reflects the broader market impact of the high overall economic uncertainty and geopolitical tensions, especially recent conflicts in the Middle East. Despite these pressures, LINK managed to adhere to the scope of fixed unification, indicating flexibility as the encryption market awaits its next decisive step.

Maintaining prices is higher than current levels. A collapse here can open the door for deeper corrections. but, Analyst Henry believes The tide may turn. According to Henry, Chainlink has endured months of the landmark and silence, but the structural shift is now underway. Its analysis highlights that the long -term declining trend has been broken, and Link has entered into a clear accumulation and unification stage.

“These areas often come before the highest moves,” Henry notes. Historically, such stages have preceded explosive gatherings, and this time they may not be different. If the momentum rises, the range will not be from 25 to 30 dollars.

Henry also indicates that the periods of non -activity often create smart funds – the net quietly before holding the broader market. Although it is easy to overlook the assets during the quiet stages, it is often when the foundation is laid for the main movements. Currently, Chainlink is still on monitoring.

Related reading

Correction price analysis: Signs of reflection appear

ChainLink shows early signs to reverse the direction after months of consistent decline. As shown in the graph for 12 hours, LINK has recently recovered from $ 11.50 and is now trading over $ 13.20. This recovery follows a sharp decrease that represents a new domestic decrease, but the bounce pushing the price above the simple moving average for 50 days (SMA), which now works as short -term support at $ 13.50.

More importantly, LINK is now testing SMA for 100 days (about $ 14.65), which was resistance in late May and early June. If Bulls managed to break and standardize this level, the next goal is near SMA for 200 days at $ 14.16-a meeting zone that may act as a critical decision point for the continuation of the direction or rejection.

Related reading

While the total structure remains declining, the short -term accumulation indicates an increase in demand, especially since the price begins to form its lowest levels. A clear break above $ 14.65 can confirm the penetration volume and the indication of a larger move towards a range between $ 17 and 18.

Distinctive image from Dall-E, the tradingView graph