Chainlink monthly soon to determine the fate of LINK, $ 19 after that?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Amid the market correction today, Chainlink (Link) lost its recent gains, as it returned to the level of decisive support. The analyst suggests that a monthly closure above its current range can place the cryptocurrency to an increase of 35 %.

Related reading

Chainlink Re -Test the Decisive Price area

ChainLink 9.1 % in the past 24 hours have recovered the main support zone at $ 14 again. The cryptocurrency increased by 15.7 % of its lowest level last Friday to the highest level in 16 days of $ 16 on Wednesday, as it regained 35 % moments of the lowest level of this month.

However, correction of the last market stopped the momentum of most cryptocurrencies, as Bitcoin (BTC) returns to the 83,700 dollar support brand (ETH) to the $ 1,860 support zone.

Today, LINK decreased from $ 15 to $ 14.07, and lost all gains on Wednesday. Previously, analyst Ali Martinez indicated that the cryptocurrency has been in an upward parallel channel since July 2023.

ChainLink has been hovering between the upper and lower boundaries of the pattern for the year and a half last year, and the upper direction line of the channel every time the lower area is re -tested before retreat.

Amid its last performance, the cryptocurrency is re -testing the lower boundaries of the channel, indicating that the bounce to the upper range can come if it maintains the current price levels.

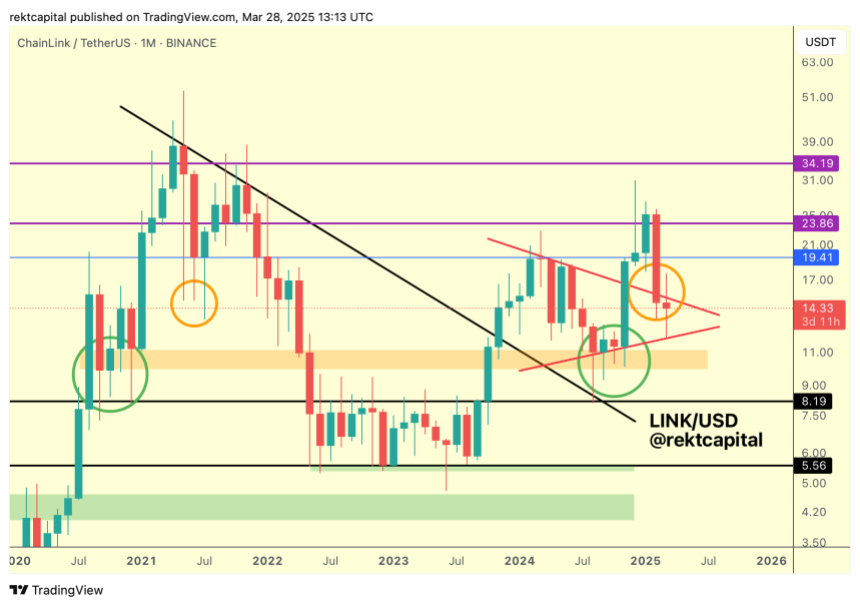

Meanwhile, Rekt Capital High The distinctive symbol tests the multiple multi -triangle style, which can determine the next step for the encrypted currency.

As the analyst explained, Chainlink was unified inside the “Triple Triangle Market” for most 2024 before leaving the style during the market gathering in November.

During the Q4 2024 period, the cryptocurrency reached the highest level in two years at 30.9 dollars, but it failed to keep this level in the following weeks. As a result, it has been in the direction of a decline during the past three months, with the low price of LINK to the macro triangle.

“Link’s main goal here is to re -test the upper part of the pattern to secure a successful re -test,” adding, adding, “This could be a post -breakdown re -test.”

The link needs to keep this level

Rekt Capital pointed out that, historically, Chainlink had deviations on the negative side of this price range: “In mid -2011, LINK produced a negative deviation in this price area in the form of multiple monthly pies.”

However, the encrypted currency deviates from the negative side “but in the form of actual candles bodies it closes instead of the negative wick” this time.

The analyst also highlighted that, as in 2021, LINK is traded within the historic demand area, about $ 13-5 and $ 15.5, to test this region as support. Based on this, the cryptocurrency must be successfully retained in this field “to” put itself to move forward. “

Related reading

Moreover, the re -test is the key to restoring the top of the triple market structure. Breaking this level and its recovery “would” re -test the successful post -seize “and enable the price to target the resistance of $ 19 in the future.

The analyst concluded that if LINK closes the month higher than the top of the triangle, it “will put the price for a successful test, despite the negative deviation.”

As of the writing of these lines, Chainlink is trading at $ 14.09, a decrease of 6.9 % in the monthly time frame.

Distinctive photo of Unsplash.com, Chart from Tradingview.com