ChainLink Ethereum is at the top of GitHub, while RWA Integration nourishes 8 % link link

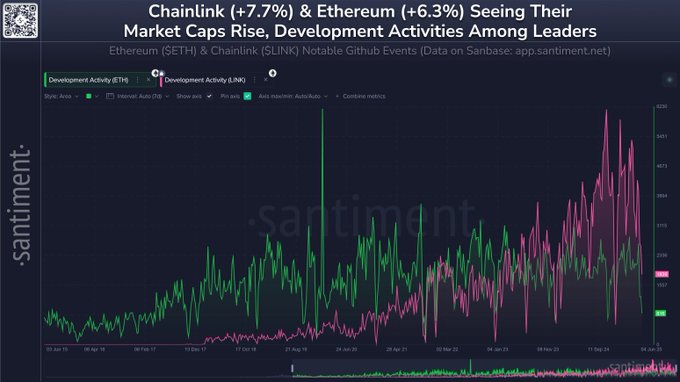

ChainLink (Link) ethereum (ETH) has exceeded the development activity, as it appeared second in the active project on GitHub over the past thirty days.

The increase in the network reflects the network on the distinctive symbol of the assets in the real world (RWA) and its increased involvement in institutional financing.

From her participation in E-HKD+ CBDC in Hong Kong to high-level cooperation with companies such as Visa, Anz and Fidelity, Chainlink enhances its demand as a decisive infrastructure provider to adopt Blwchin projects.

The momentum helped pay the LINK price of more than 8 %, with short -term technical indicators indicating a continued rise.

ChainLink acquires a land in Blockchain space

According to the series’s analysis platform, Chainlink now ranks second in the total GitHub activity, bypassing ETHEREM, which is eighth.

This increase confirms the participation of the developer’s increasing importance in Chainlink in Blockchain space, especially as institutions explore the distinctive symbol strategies.

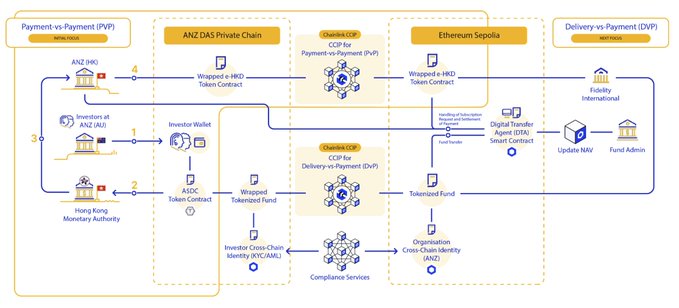

There is a CCIP operating protocol (CCIP) in the center of this batch, allowing smooth communication between Blockchains and financial systems.

On June 9, CCIP was published from Chainlink at E-HKD+ CBDC by Hong Kong Cash Authority (HKMA).

The test included a transaction between the digital dollar in Hong Kong and the Australian dollar payment, which is facilitated by ChainLink’s infrastructure.

It is worth noting that the transaction included the participation of Visa, Anz, Fidelity International and China AMC, adding great credibility to the technological capabilities of Chainlink.

In a post on the X, the reaction of the co -founder of Chainlink Sergei Nazarov was to the visa report on Blockchain’s infrastructure, focusing on how to meet three basic needs: secure data extracts, cross -chain functions, and compliance.

Very enthusiastic about this report from Visa, where it offers how ChainLink can solve the three major problems of smart contracts for the next generation of institutional transactions, all on one platform. 1. Provide the important data needed to pricing assets in

He referred to a recent example that includes anz and fidelity, which was implemented within the regulatory HKMA framework, as evidence of the institutional chainlink.

The rate of association increases by 8 % on RWA’s withdrawal

CBDC Pilot has an immediate impact on market performance. The distinctive symbol jumped from $ 13.90 to $ 14.60 after a short period of advertising, and it was trading at $ 15.28 at the time of writing this report – by 8 % in less than 24 hours.

We are excited to share that Chainlink facilitates the safe exchange of CBDC in Hong Kong and Stablecoin Australian dollar as part of the continuous use in stage 2 of the E-HKD+ Pilot program. Congratulations to the participants @VisaAnd anz, China Amc and Fidellery

This basic procedure is in line with wider confidence if the network is used in real financing. Technical indicators also show positive signs.

The simple moving average has turned for 50 days (SMA) to support it at $ 15.07, and SMA provides for 100 days at $ 14.35 a safety net below. The RSI (RSI) index has moved above the level of 50, indicating the bullish momentum.

Analysts also highlight that LINK is approaching a critical resistance area between $ 16.04 and $ 17.43. A lounge above this range may lead to a possible 57 % mobilization based on the formation of the visible falling sorry for the graph for one day.

This style is often associated with bullish repercussions and is considered more reliable when supported by the high relative power index and moving averages.

It adds the momentum of development to the RWA leadership novel

The increase in GitHub activity does not reflect more than the developer’s interest – it supports Chainlink’s position as an actual infrastructure provider in the distinctive symbol of RWA.

By driving in smart tools and inter -employment tools, the network has become an indispensable bridge between traditional and general finance.

The ChainLink development team is constantly ranked most active in the area.

More importantly, the value of ChainLink series is to unify Blockchain’s institutional reactions.

Since more financial entities adopt their infrastructure, the counter -feeding ring increases the effect of the network and enhances the long -term value.

It can limit resistance from the bonding gains if Trendline is suspended

Despite the bullish expectations, LINK should overcome the resistance at the top of the chopping configuration. If the distinctive symbol fails to close over $ 16.70 in the next sessions, it will risk a reflection that may return it to the level of $ 14.35.

It can see a deepest correction in the demand area between $ 10.78 and $ 11.46.

This risk multiplies by achieving profits about $ 15 to 17 dollars, as the historical size often leads to corrections.

The rest of SMA for 100 days will weaken the momentum in the short term, and the holders of the links may search for re -entering the lower support zone if the decline pressure.

However, at the present time, technical preparation, institutional news and the speed of development indicate the continuation of ChainLink’s bullish trend because it pushes forward with RWA integration.

Post ChaINLONK ETAREUM series is at the top of the GitHub activity, as RWA Integration Rallly Rally Rally first appeared on Invezz first appeared

Here is the best assets of the real world in Crypto (RWA’s) through development. The directional indicators represent an increase in each project in arrangement or decline since last month:

Here is the best assets of the real world in Crypto (RWA’s) through development. The directional indicators represent an increase in each project in arrangement or decline since last month:  1)

1)