Cardano Traders on Edge as clash technical signals

Cardano was traded less than one dollar for a month, struggling to restore the momentum that was at the end of 2024. While ADA showed signs of recovery, technical indicators remain mixed. Bbtrend has turned positively, but is still far from its previous levels.

Ichimoku cloud suggests a decisive stage, as ADA tries to stabilize but lacks a strong upward affirmation. With the key resistance at $ 0.83 and support at $ 0.65, its next step will be it is very important in determining whether it can get out of its scope or face the negative side about $ 0.50.

Ada Bbtrend returned to positive after touching negative levels for a short period

Cardano’s Bbtrend is currently at 1.12, and recovers from a brief decline to a negative area on -0.77 yesterday. Between February 13 and February 18, BBTRand remained positive, as it reached its peak on 12.3 on February 14, indicating a strong upscale momentum during that period.

However, the recent decline and subsequent apostasy indicate that ADA has witnessed an increase in volatility, with price fluctuations between the ups and dramatic stages.

Although BBTRand is now returning to a positive area, it remains much lower than its last peak, indicating that the ADA momentum has weakened but it has not completely turned into a declining direction.

BBTREND, or Bollinger Band Trend, is an indicator that helps measure the strength of the direction based on Bollegerer. It fluctuates between positive and negative values, with positive readings indicating the direction of ascending and negative readings that indicate the homogenous conditions.

Bbtrend in ADA in 1.12 indicates that the assets stick to a weak rising structure but lack a strong upscale momentum. If the BBTREND continues to rise, it may confirm the renewal of the purchase pressure, and the continuous support of the upward trend.

However, if it becomes negative again, it will indicate that ADA is struggling to maintain the bullish momentum, which increases the risk of more monotheism or even a new declining direction.

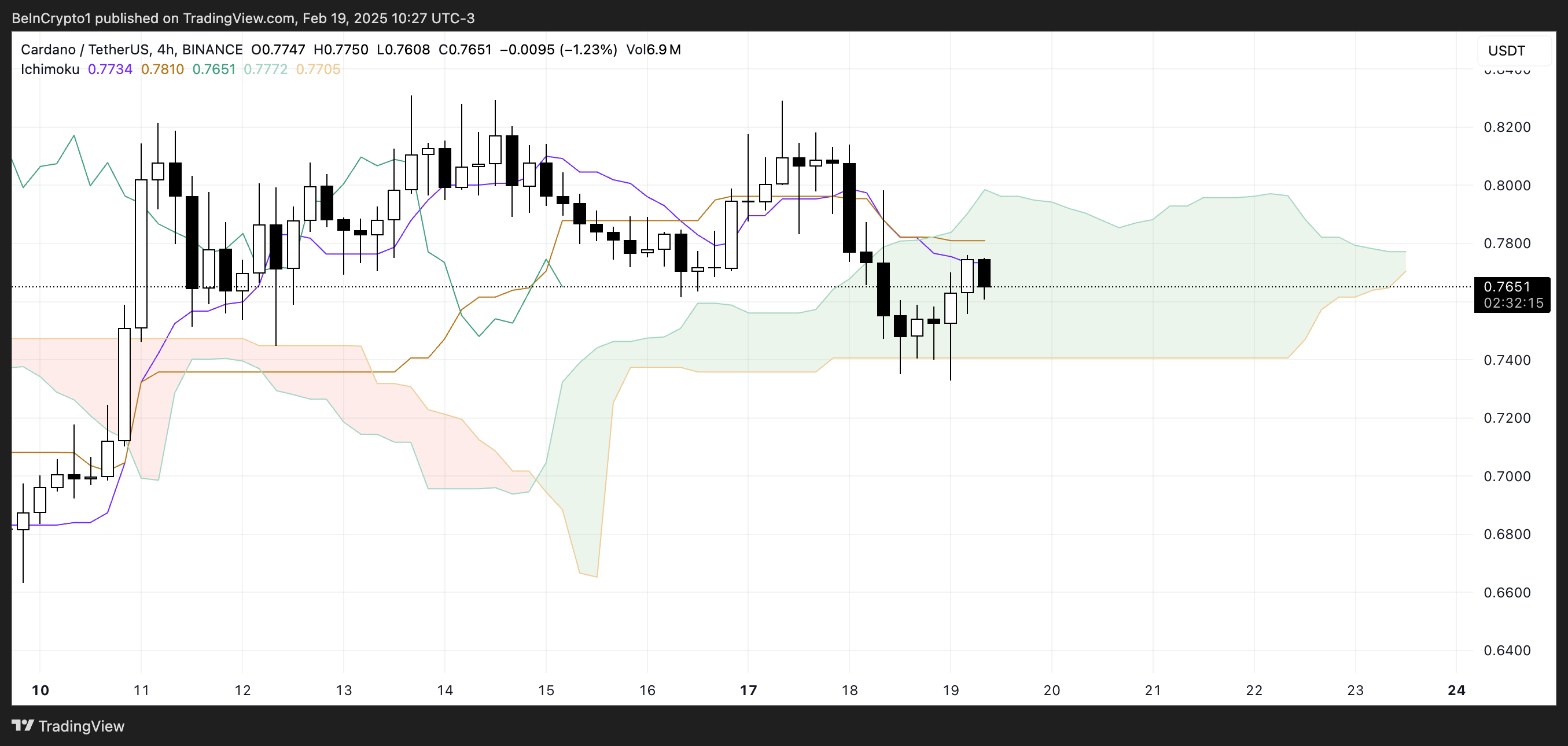

Ichimoku Cloud displays a mixed scenario for Cardano

The Ichimoku Cloud scheme for Cardano currently displays mixed preparation. The price is traded inside the green cloud, indicating the frequency state.

The green cloud (Kumo) indicates that ADA is trying to settle, but with the surface of the Orange Sinkou Span B, the market lacks a strong momentum in either direction.

Tenkan-Sen (the transfer line) is placed under Orange Kijun-Sen, which indicates that the short-term momentum remains weak. ADA’s ability to stay inside the cloud indicates that it is not in a certain upward trend or in the declining direction, which makes the next penetration a very important thing to determine its direction.

The green Chikou extension (late line) slightly exceeds some of the price procedures, which hints to a potential shift towards the upscale momentum, but there is still a need to confirm.

If the Ada price is able to break the cloud and establish itself over Orange Kijun-Sen, it may indicate the reflection of the direction and the transition to the upward lands.

However, if the price fails to keep it inside the cloud and lower below, it may undertake the declining pressure again, which leads to more negative side. The current Ichimoku setting indicates that ADA is at a main turning point, with its next movement determined the broader direction for the coming days.

Cardano can test $ 0.83 soon

Cardano is currently trading within a specific range, with resistance at $ 0.83 and support at $ 0.65.

The short -term moving averages are closely assembled together but remain less than long -term rates, which indicates that although there is some monotheism, the general trend still lacks the upper momentum. If ADA is able to ignite the continuous upward trend, this may be up to test the resistance level of $ 0.83.

A successful break on this barrier may pave the way for more gains, and it may reach $ 0.9 and then climb up to $ 0.98, which represents its highest level since the end of January.

On the contrary, if the current momentum fails to achieve it in a strong upward and strong upward direction, Ada may lose its support at $ 0.65.

The collapse of this main level ADA can be offered for more declines, with a decrease in the price to about $ 0.5, which represents a potential correction of 34 % of the current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.