Cardano (ADA) rises by 8 % with bulls for penetration

Cardano (ADA) showcase life marks despite a 3 % decrease over the past 24 hours, as traders weigh the possibility of wider recovery. Technical indicators like BBTREND and DMI are mixed with mixed signals, which hints that momentum may fade after a short increase.

Ada’s Bbtrend has turned into a negative area, while DMI indicates that the bulls acquire the ground but not completely control. With ADA hovering a little higher than the main support levels, the following few sessions will be decisive in determining whether this gathering contains legs or if another correction is just around the corner or lower.

Ada Bbtrend fades after reaching levels above 5 yesterday

Cardano’s BBTRando index turned into a negative area, currently sitting at -0.02 after reaching a positive peak of 5.28 just one day ago.

This sharp reflection highlights a potential transformation in the market morale, indicating that the bullish momentum may lose strength.

The sudden decrease adds to the increasing concerns between ADA holders, especially with the broader Altcoin market showing signs of weakness.

BBTREND (Bull and Bear) measures the strength and direction of the price. Values above +1 usually indicate a strong upward trend, while the readings below indicate a strong declining direction.

Value near scratch, such as the current -0.02, indicates the frequency or a possible reflection of the direction.

For Cardano, this neutral reading may mean negativity that the bullish momentum fades, which increases the risk of increasing the negative side if the pressure is adopted in the next sessions.

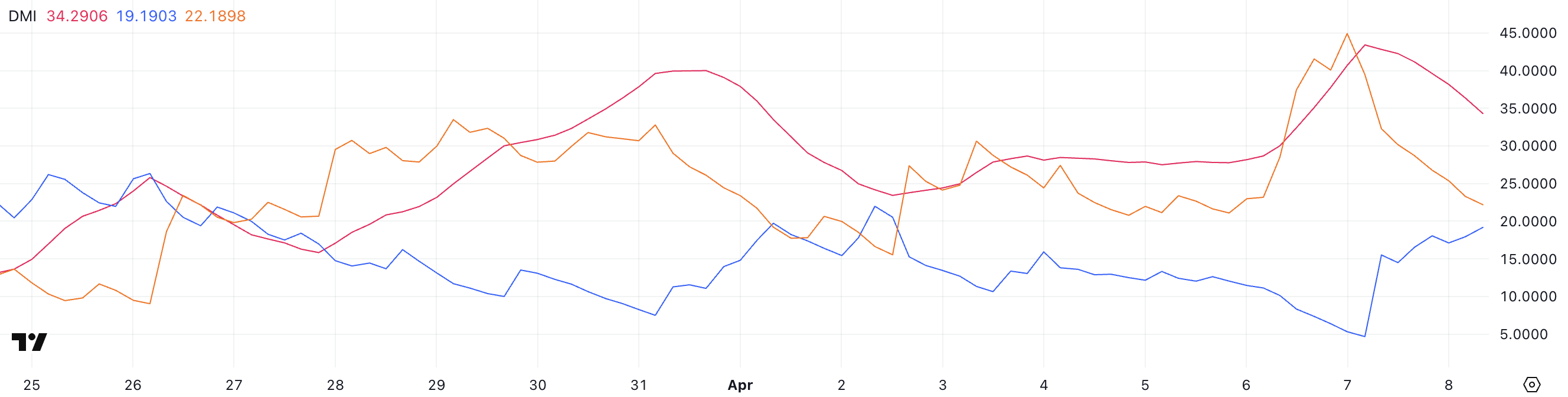

Cardano DMI appears almost controlling

Cardano DMI (direction movement index) explains that ADX, which measures the strength of trend, has decreased to 34.29 from 43.41 yesterday.

Although this indicates that the current trend is weakening, ADX is still much higher than the 25th key threshold, which means that the market remains in a strong directional step.

The shift indicates that although the momentum cools, the decline currently has not yet lost control.

ADX is part of the DMI system, which includes +DI (positive trend index) and -di (negative direction index).

+Di rose from 4.68 to 19.19, indicating the growing bullish interest, while -Di decreased sharply from 44.92 to 22.18. This narrow gap hints to the opposite of the potential trend or at least the slowdown of the declining momentum.

However, since the -Di is still a little higher than +Di and ADX, ADA is still high, ADA is still in a declining direction -although the bulls may start to restore some land.

Is Kardano preparing to recover?

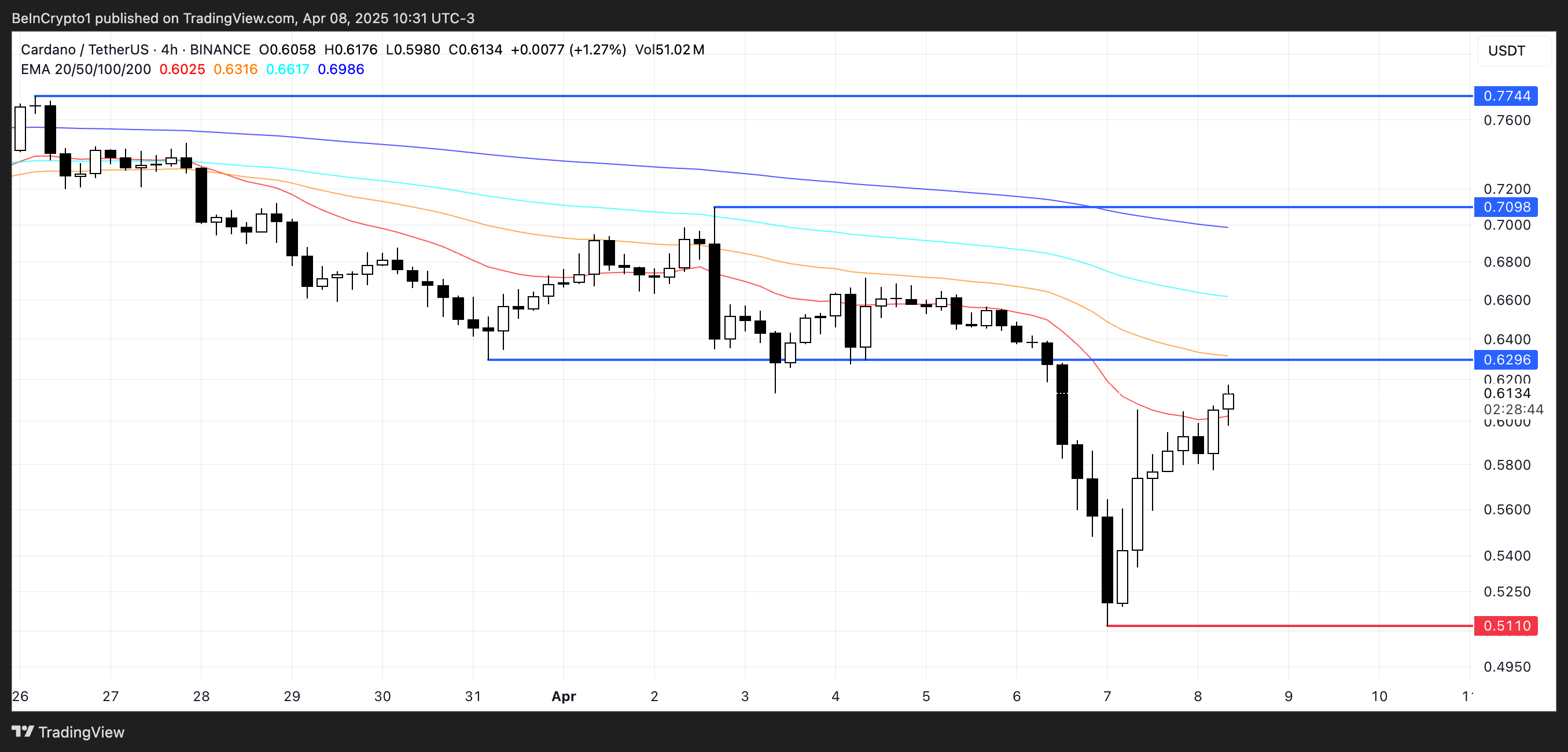

Cardano Price is currently trying to recover after declining below $ 0.52, a major support level in recent weeks. If buyers can confirm their strength and maintain the upscale momentum, ADA can first test the resistance at $ 0.629.

The successful collapse above may open the path about $ 0.70, and if the upward pressure continues, there may be an additional height to $ 0.77 on the table – levels that have not been seen since early 2024.

However, if ADA fails to keep its current land and the revenue of the landfill, the distinctive symbol risk slipping up to below $ 0.52.

The move will be about $ 0.51, the first decisive test, and the loss of this level can push Cardano below the threshold of $ 0.50 for the first time since November 2024.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.