Cardano (Ada) Bulls stands despite the slowdown

Cardano (ADA) has increased by more than 12 % over the past seven days and is now trading over $ 0.70 for the first time since the end of March. The trading volume also increases, an increase of 33 % in the past 24 hours to reach $ 723 million.

Although price recovery, some technical indicators indicate that the ADA momentum weakens and approaches the main decision points. Here is a closer look at the current Cardano setting with the start of the new week.

Cardano Bbtrend weakens after a positive chain

Cardano Bbtrend is currently at 7.55, a decrease from 13.27 just three days ago. This sharp decline shows that the last prices of expansion have been cooled, although the assets have spread a positive daily closure during the past four days.

The falling Bbtrend notes that although ADA was moving up, the primary momentum of expansion loses severity.

This transformation highlights a possible slowdown that may affect the ADA ability to maintain more gains without renewing the purchase pressure.

The BBTREND trend, or Bollinger Band, measures the strength of the price based on the expansion or shrinkage of Bollegerer.

The emerging BBTRand usually refers to a strong momentum and increased fluctuations, while the falling BBTRand indicates poor momentum or the start of a standardization stage.

With the presence of Ada’s Bbtrend now at 7.55, the indicator still indicates some positive momentum, but at a very weaker pace than earlier this week.

If the BBTREND continues to decrease, you can enter Ada in a standardization stage, but if purchasing pressure returns, the distinctive symbol can extend its current positive plan.

ADA faces frequency with the battle of buyers and sellers for control

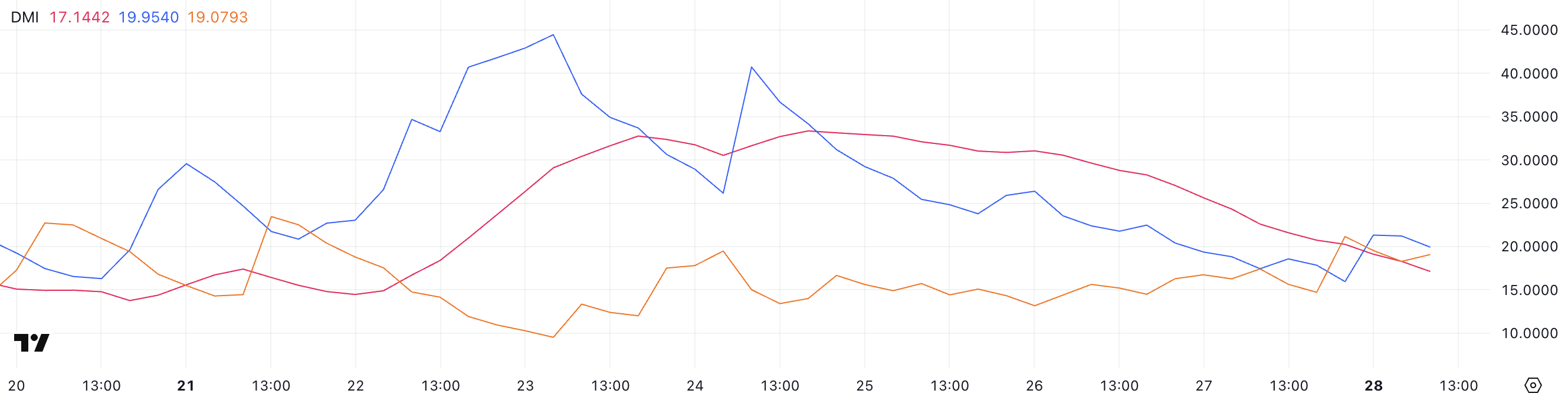

The Cardano Directional (DMI) movement shows the average trend (ADX) currently in 17.14, a noticeable decrease from 31 days ago.

This sharp decrease indicates that the strength of ADA has weakened significantly. Meanwhile, the Di +(the positive trend index) is in 19.95, an altitude of 15.96 a few hours ago but still a decrease from 26 days ago.

-DI sits (the negative trend index) in 19.07, as it decreased slightly from 21.16 early, but the highest compared to 14.49 days ago, reflecting the mixed momentum between buyers and sellers.

ADX measures the strength of the trend without indicating its direction.

The above readings usually suggest a strong direction, while readings of less than 20 indicate a weak market or unification. With Ada’s ADX now at 17.14, the direction strength is weak, and buyers or sellers currently have a clear feature.

The close values between +Di and -Di indicate that Cardano can enter a period of side movement unless bulls or bears are restored to stronger control soon.

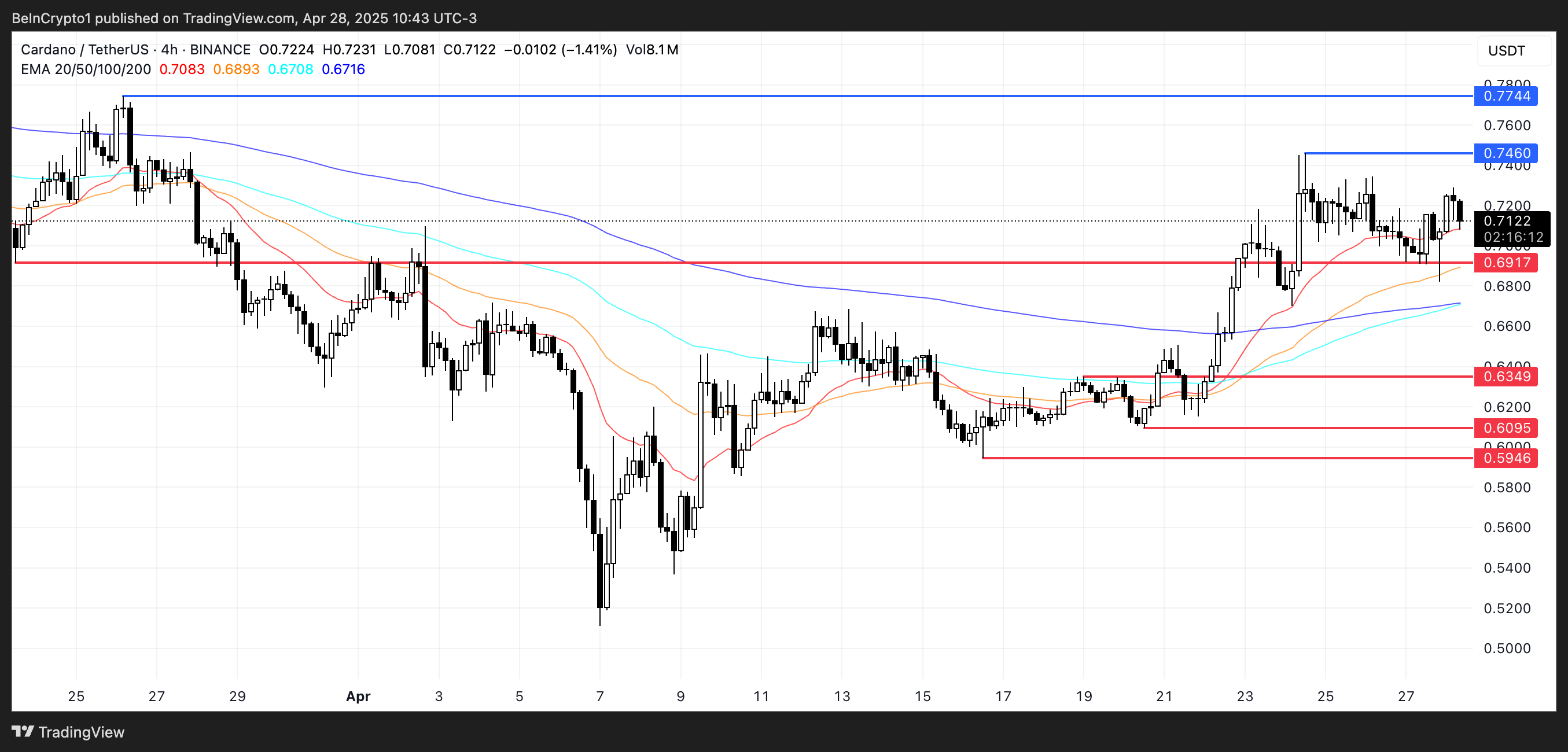

The oud structure of Cardano faces a decisive test near $ 0.69

Cardano’s Cardano averages refer to a bullish direction, where EMAS has been placed in the short term in the long term.

However, Cardano Price has tested the support level over and over again at $ 0.69 and is being traded very soon.

This basic procedure indicates that although the broader trend remains positive, the weakened bullish momentum has become $ 0.69 to a critical area.

If ADA is lost the support of $ 0.69, the following negative goals will be about $ 0.63, followed by $ 0.609 and possibly $ 0.59 if the pressure speeds up.

On the other hand, if buyers retreat and boost the upward trend, ADA may gather to re -test the resistance at $ 0.746.

The collapse of more than $ 0.746 can open the door to move about $ 0.77, providing a strong upward preparation if the momentum is strengthening again.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.