Cardano (Ada) Bulls Advance where sellers lose grip

Cardano (ADA) has decreased by approximately 8 % over the past thirty days, but it has gained about 3 % in the past 24 hours with a short -term momentum.

The Token’s market price is 26 billion dollars, while trading volume increased by 30 % last day, reaching 903 million dollars. Technical indicators began to show early signs to reflect the potential trend after a period of declining pressure. Below is a closer look at the main signals and price levels that make up the ADA look this week.

Ada Bbtrend is now positive after 6 days

BBTRand from Cardano has turned positively, where he ended a six -day line in negative lands, which included a decrease of 26.13 on March 12. The index sits now at 0.83, indicating a transformation in the momentum after the last declining direction.

While this is still a relatively low reading, the transition to a positive area can be an early sign of promoting purchase pressure.

BBTRand (Bollinger Band Trend) measures the strength and direction of the price movement for Bollinger. Positive values indicate the bullish direction, while negative values indicate the declining direction.

Since ADA’s BBTREND has not risen above 10 since March 8, the current reading of 0.83 indicates that although the downward pressure has reduced, the momentum remains weak. To get a stronger upscale signal, traders were usually searching for BBTREND to pay above 10, confirming a more decisive upward step.

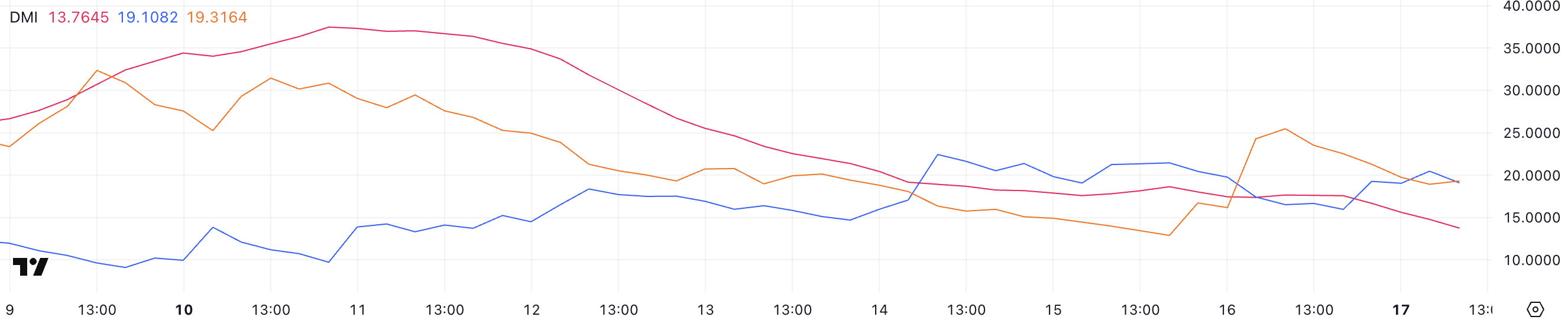

Cardano DMI shows that sellers lose control

The Cardano DMI scheme explains that ADX has decreased to 13.7 out of 17.5 in the past 24 hours, indicating twice the strength of the direction. While ADX still indicates a direction, the bottom reading points are low -momentum compared to the previous day.

The average trend (ADX) measures the strength of the trend, regardless of its direction.

The above readings indicate 25 to a strong direction, while readings of less than 20 often indicate a weak or extent market. Currently, ADA’s +Di rose to 19.1 from 15.96, while -Di decreased to 19.31 out of 25.48, indicating that the declining momentum fades with slowly increasing upward pressure.

With the presence of +Di and -Di lines close to the transit, it appears that ADA is in the early stages of trying to reflect from the declining direction to the potential upward trend, although ADX is stronger it will be needed to confirm the transformation of the solid direction.

Will Cardiano rise above $ 1.10 soon?

ADA EMA lines have shown unification signs during the past few days, although the general structure remains declining. Emas is still in the short term in the long term.

However, modern signals of both BBTREND and DMI indicators indicate that this trend can turn, with early signs to build the upscale momentum.

If the price of Cardano can confirm the upward trend, this may first challenge the resistance at $ 0.77. The penetration above this level may open about $ 1.02 to $ 1.17, which represents the first time that ADA has been trading over one dollar since March 3.

On the negative side, if the declining pressure, ADA can support support at $ 0.64, and this collapse may lead to a decrease in prices to $ 0.58, which leads to a review of levels that have not been seen since February 28.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.