Can XRP reach $ 4 by February 2025? The main factors to watch

The price of XRP has decreased by more than 3 % in the past 24 hours, as momentum shows signs of slowdown. While the relative power index fell to less than 40, indicating twice force, the activity of the whale remained stagnant, indicating that adults have no accumulation yet.

In addition, the EMA lines approach the potential death cross, which may lead to more negative aspect in the event of an increase in pressure. However, if XRP breaks the key resistance levels and restores strong bullish momentum, it may be prepared to gather about 4 dollars in February.

XRP RSI is currently neutral, less than 40

XRP RSI is currently 39.5, where it remained in a neutral range since January 28, when it peaked at 58. RSI is an indicator of momentum that measures the power of price movements on a scale from 0 to 100.

Readings that exceed 70 indicate excessive conditions in the peak, and often lead to withdrawal, while levels of less than 30 indicate the sale conditions, where recovery may be. RSI is neutral between 40 and 60 monotheistic signs, as buyers or sellers have no clear domination.

As the RSI approaches XRP to the Overs, it indicates poor momentum, which may lead to more negative side if the purchase pressure does not increase.

However, for the price of XRP to approach 4 dollars in the coming weeks, RSI will need to return to above 50, indicating renewable power. This may happen with more positive developments on traded investment funds, or with a certain withdrawal of the SEC lawsuit.

The collapse above 60 would confirm the bullish momentum, while the past step may indicate a feverish rise. If RSI remains weak, XRP may struggle to maintain their current levels and you may face more unification.

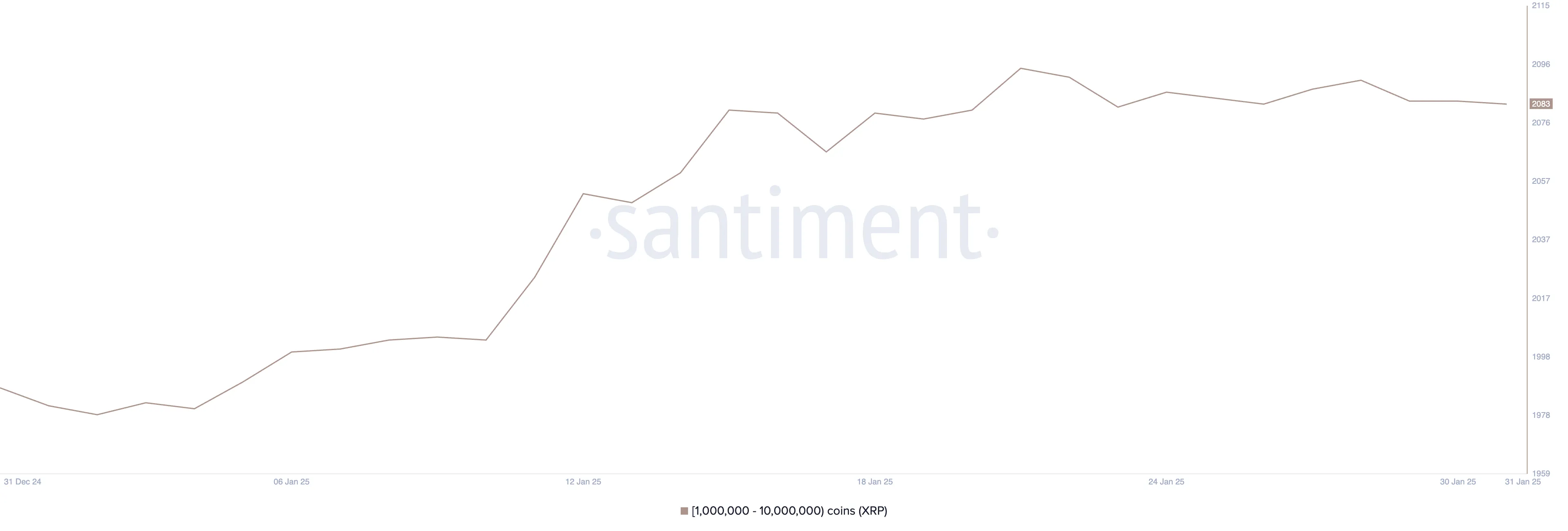

XRP whales have moved side by January 21

The number of XRP whale headlines – those that carry between one million and 10 million XRP – have been stagnant since January 21. It fluctuates between 2095 and 2,082, with the latest number in 2083.

Tracking these big bearers is very important because the accumulation of whales precedes strong price movements, as the purchase or sale activity can significantly affect the liquidity of the market and feeling.

The height of the whale headlines indicates an increase in confidence from large investors, while the decrease may indicate a decrease in condemnation or profits.

In order to restore the price of XRP 4 dollars in February, the accumulation of the whale will need to resume its upward direction, similar to early January, when the number of whales from 1981 on January 4 increased to 2,080 on January 16. During that period, the XRP price jumped from $ 2.41 to $ 3.4, on the occasion of an increase of 41 %.

In the event of a similar pattern of accumulation, it can indicate renewed demand and support another gathering. However, if the number of whales continues to move side, the XRP price may be struggled in order to get the momentum needed for continuous penetration.

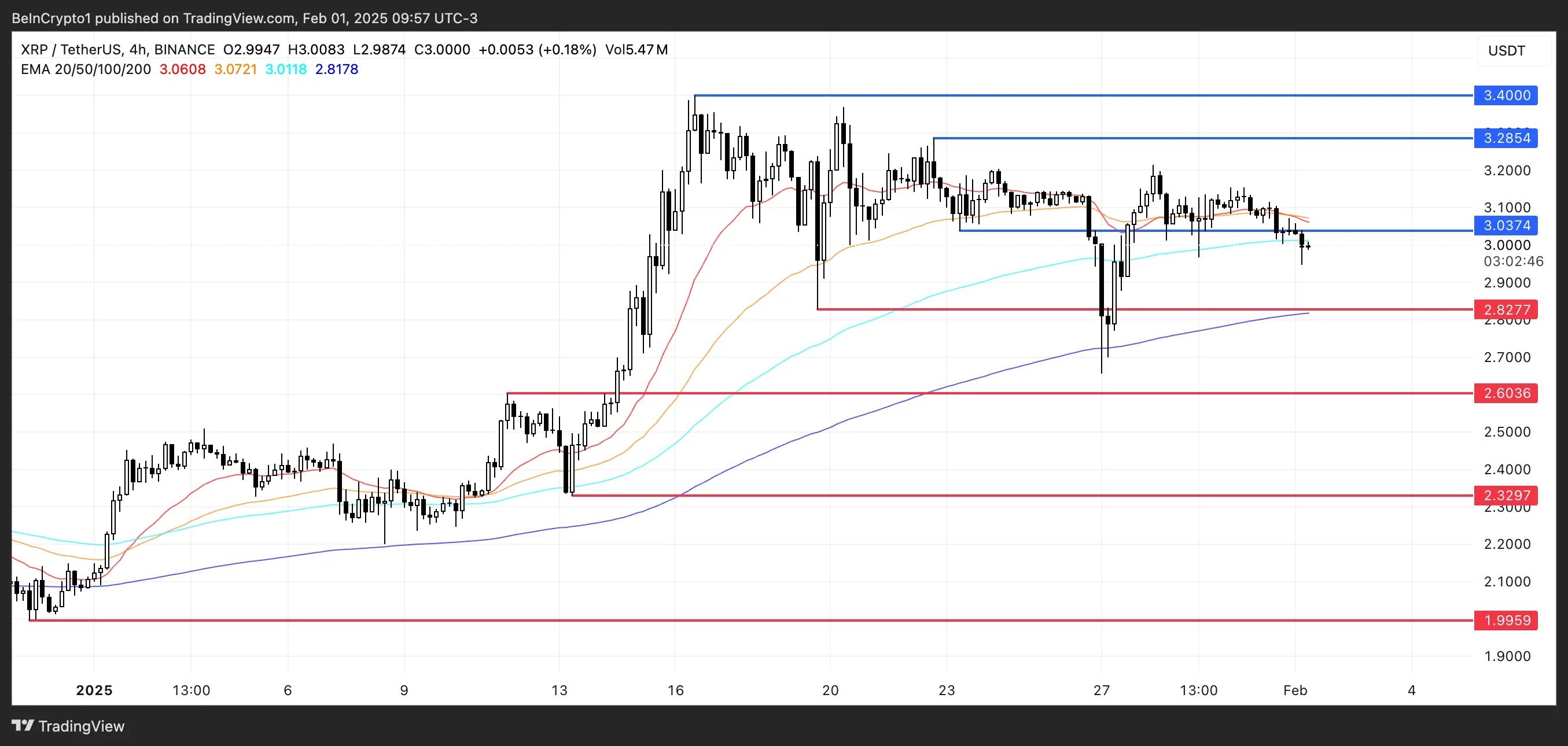

XRP PRICE PROCESSION: Can XRP reach $ 4 in February?

XRP EMA lines indicate that the death cross can be formed soon, indicating a potential negative momentum. If this declining intersection occurs, the XRP price may test support at $ 2.82. If this level fails, a decrease may decrease about $ 2.6 and $ 2.32.

In a more extreme scenario, if the sale pressure remains strong and lost this support, XRP may decrease to $ 1.99, which represents its lowest level in 2025.

On the other hand, if the XRP price and breaking the resistance are tested 3.03 dollars, the bullish momentum may restore and pay it about $ 3.28 and $ 3.4.

It can surpass these levels Allow the XRP price to test 4 dollarsThey represent 33.3 % up from the current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.