Can Xag/USD extend the gains about $ 35?

Silver (xag/USD) is pushing up, trading about $ 32.98 an ounce, while continuing the bullish momentum. The precious metal benefited from the strong demand for investors, geopolitical doubts, and the increasing expectations of the federal reserve rate later in 2025.

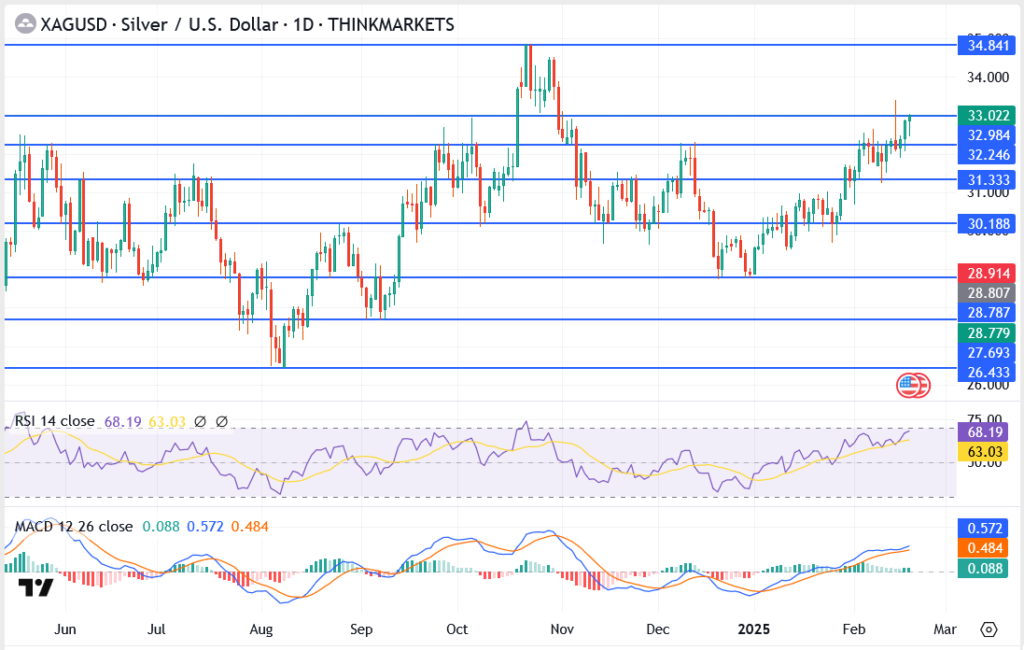

However, silver is still volatile, which recently extends to $ 34.00 before restoring. The question now is whether Xag/USD can extend its ravage for 10 years of $ 35, or if the sellers will regain control.

Silver price drivers

Silver prices are increased due to speculation of reducing interest rates, which weakens the US dollar, which enhances the demand for minerals. Geopolitical tensions between the United States and Russia increase more attention to safe mit, while the industrial demand from the EV and solar sectors adds support amid predictions of a deficit in the 2025 show.

Xag/USD Technical Analysis

- Silver resistance levels

- $ 33.02 – immediate resistance

- $ 34.00 – February above

- $ 34.84-peak 10 months

- 35.00 dollars – the main psychological level

- Silver support levels

- 32.24 dollars – simple support

- 31.33 dollars – the main demand zone

- $ 30.18 – decisive support

Outlook Silver Price Outlook – Will Xag/USD break $ 35?

The next step from Silver depends on the federal reserve policy, economic data and global tensions. If buyers XAG/USD pay after $ 34, the next goal is $ 35, which is the level that was last seen in 2012. The penetration can attract more momentum traders, which leads to high prices.

On the other hand, if the silver is struggling to get more than 32.98 dollars, we may see a decline of about $ 31.33, where buyers can intervene again. The relative strength index approaches peak levels, so cooling will not be sudden.

Final ideas

Silver looks strong, but merchants must monitor the signs of fatigue. If $ 34 is scanned, we may see more upward trend. If not, the decline may be about $ 31.33 after that. Either way, it is formed to be an interesting week for Xag/USD.