Can the shock of the labor market outperform the inflation in the upcoming Macro Bitcoin?

A new wave of demobilization of workers through industries is sweeping in 2025, indicating that the labor market may enter the most turbulent stage since a shrinkage in the epidemic. This adds to the list of American macroeconomic indicators with the effects of encryption.

Job discounts are no longer isolated from technology giants or government agencies, and the real economy is red. Stock markets also take water, and encryption investors cling to the reduction price.

The employment market is encryption eyes where workers’ demobilization extends by 80 % in 2025 – Is inflation no longer the main threat?

Employment and job data gradually acquires the effect as one of the American economic indicators with the impact implications.

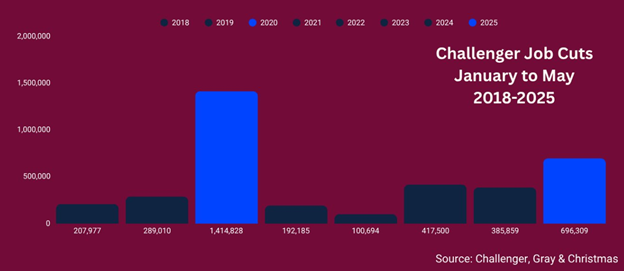

The layoff that shook the markets in 2022-2023 achieved sharp return in 2025.

“Customs tariffs, financing discounts, consumer spending, and comprehensive economic pessimism put extensive pressure on the workforce of companies. Companies spend less, slow employment, and send workers illegal notifications,” books Forex Analytix, quoting Andrew Challenger, Senior Vice President of Challenger, Gray and Christmas Legislation.

Data also shows a deterioration in the American labor market. According to Challenger and Gray & Christmas, job cuts in May 2025 increased by 47 % during the same month last year. One year discounts (YTD) also rises by 80 % during 2024.

“Discounts are spread to sectors other than the government, for reasons other than budget discounts and DOGECOIN accidents” male.

Andrew Challenger, the company’s first vice president, presented an explicit evaluation. He pointed out that Trump’s tariff, financing discounts, consumer spending, and comprehensive economic pessimism put severe pressure on the workforce of companies.

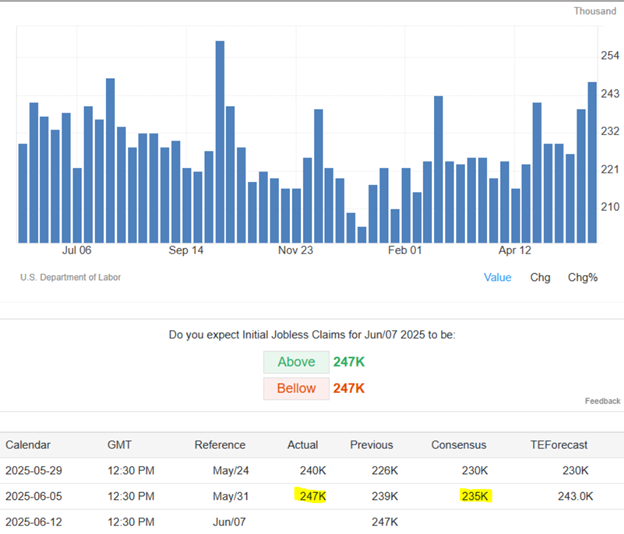

On Thursday, data is strengthened by the trend, as the unemployed demands increased in the United States by 8,000 to 247,000 for the week ending May 31.

This means that US unemployment applications increased unexpected last week. At the same time, BloombergmaleThe American trade deficit was fed up in April more at all, on the largest decline ever in imports.

This is the highest level since early October 2024 and more than 236,000 market expectations. This indicates a softening labor market, with signs of weakness or slowdown, which often indicates low economic activity or confidence.

Meanwhile, Kobeissi’s message has placed a deeper hidden sign, noting that the 3 -month moving average has decreased to 7.36 million in April, the lowest level since 2021.

This is also less than prenatal peak in the fourth quarter of 2018, with the percentage of job opportunities for unemployed workers reached 1.03, the second below since April 2021.

“The job opportunities in the United States are still declining … the labor market is clearly weakening.” books Copy’s message.

However, the May Jobs report showed that the American economy added 139,000 non -agricultural salaries in May, more than 126,000 expected.

“The American labor market has ignored the induction uncertainty that rocked the global stock and bond markets in April and May.

While the federal government continued to get rid of a few jobs, the broader economy has more than the difference, as the United States adds a little more than expected in May. Nicholas Hight, investment manager at Wealth Club, told Beincrypto that wage growth also came higher than expected – indicating that the economy is in a rude health condition.

Artificial intelligence disorder, demand reduction, and VC Retreat exaggeration of labor market stress

The reasons behind this layoff wave are more structural than the league. According to Macro Zakari T. Bravo, the loss of the job may be driven by AI.

“We are in the early roles now; companies are not called on behalf of the Acting (this is unacceptable politically); the important point is that companies are less in size and some of the roles are now outdated.” I mentioned.

Identify four waves of job loss: government hairstyles and government hairstyles, loss of artificial intelligence, companies that interact with the crisis with reduced higher lines with more layoffs with low consumption, and the loss of robot’s jobs.

Accordingly, the commentator expects the government to print money to rid the economic impact.

“Prediction: The government will print money to get us out. Expect public works projects, increase debt to finance them (weak dollar, expensive credit), and (silver lining) some of the best infrastructure,” added Bravo.

The original encoded companies also feel the dance. Beincrypto reported the Ethereum Foundation, which holds the employees as part of a basic team reform. This may mean restructuring internal costs even in important Blockchain institutions.

Meanwhile, the investment capitalist yard (VC) is undergoing a transformation, as the wallet manager Greg Isnberg highlights the broader consequences.

“The layoffs come in the waves, not all of the same. The first round in the second quarter (10-15 %), then again in the fourth quarter (15-25 %) where companies realize that the first pieces were not deep enough. to caution.

ISENberg referred to a “double noise” for consumers emerging companies: customers with less stagnation spend and increase definitions of the cost of sold goods. Direct e -commerce companies reach the consumer (DTC) or e -commerce with thin margins.

“The losers … high -burning brands … startups in the late stage that gave priority to growth on unit economies … winners … profitable companies, individual founders with low burns, startups with pricing power, and artificial intelligence companies solve real business problems.”

With the increase in demobilization, job opportunities shrink, and the investor’s appetite decreased, in the second half of 2025, it may depend on employment beyond inflation and interest rates. This narrative transformation has profound effects on encryption, capital and demand for consumer.

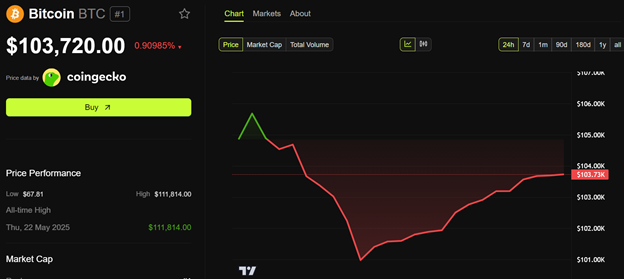

Bitcoin has been traded at $ 103,720 to this writing, a decrease of about 1 % in the past 24 hours.

The shock of the labor market can be out of inflation as the next Macro Bitcoin? He first appeared on Beincrypto.