Can Solana Price keep $ 130 to the end of Q2?

The famous altcoin Solana threw nearly 10 % of its value during the past week, and it does not seem that the declining pressure has been abandoned. The symbol decreased to $ 129 today, as geopolitical tensions escalate between the United States and Iran.

As the second quarter of 2025 approaches its end, the escalating sales were the price of Solana at the risk of collapse below the decisive support level of $ 130. This analysis explains how.

Sol slides with the main indicators survived

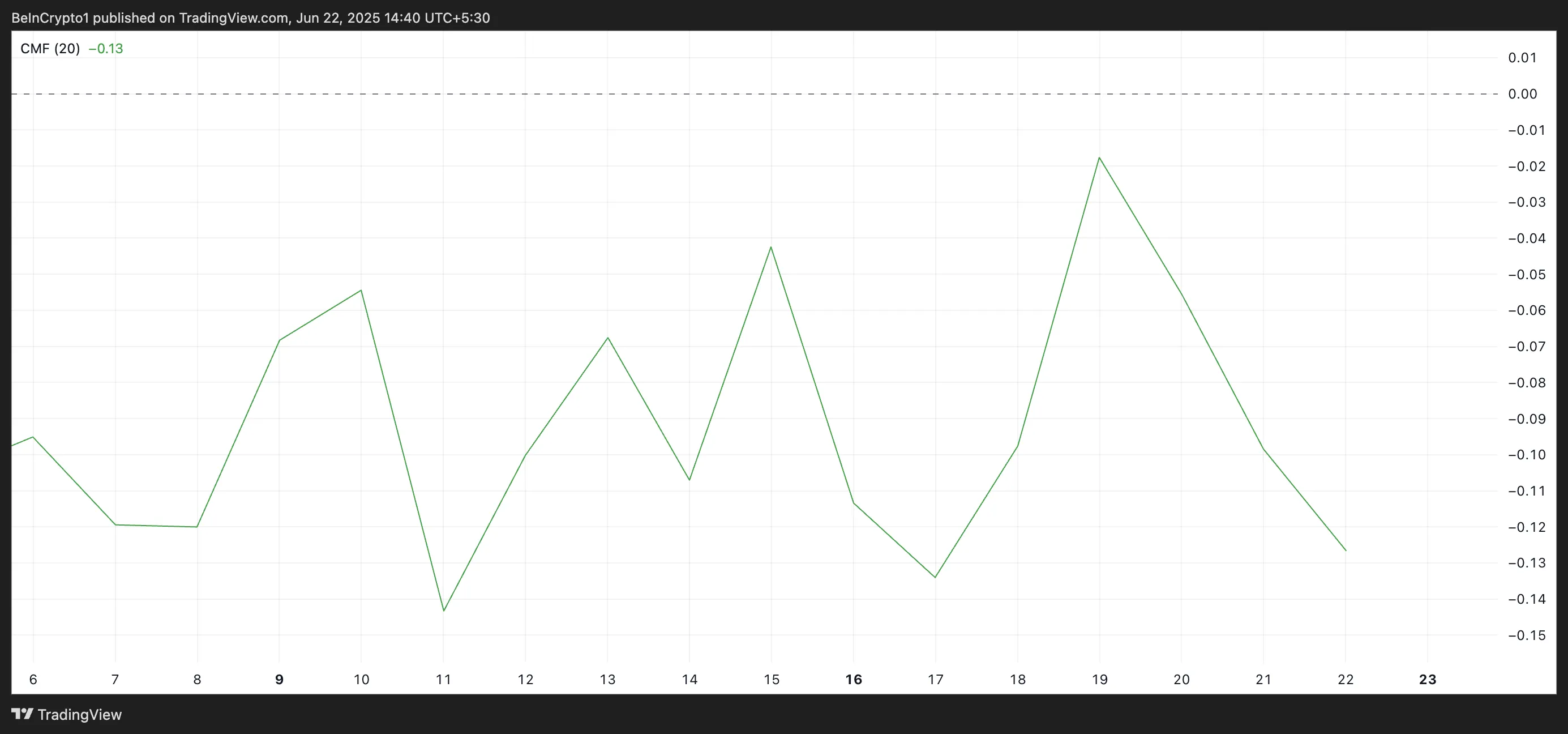

Over the past seven days, the price of Seoul has decreased steadily. This was accompanied by a decline in the flow of CHAIKIN money to the currency (CMF), which decreased to negative lands. As of writing this report, Sol’s CMF was at -0.13.

CMF measures the flow of money inside and outside the original over a specific period, usually 20 or 21 days. It combines price data and size to evaluate and sell purchase pressure. When the CMF for the original is positive, the purchase volume is dominant and the capital flows to the original, indicating a potential upward feeling.

On the contrary, when CMF turns negative, the sales volume exceeds the size of the purchase, which means that the money flows. These signals weaken the demand for Sol, especially if the negative reading deepens while the price decreases.

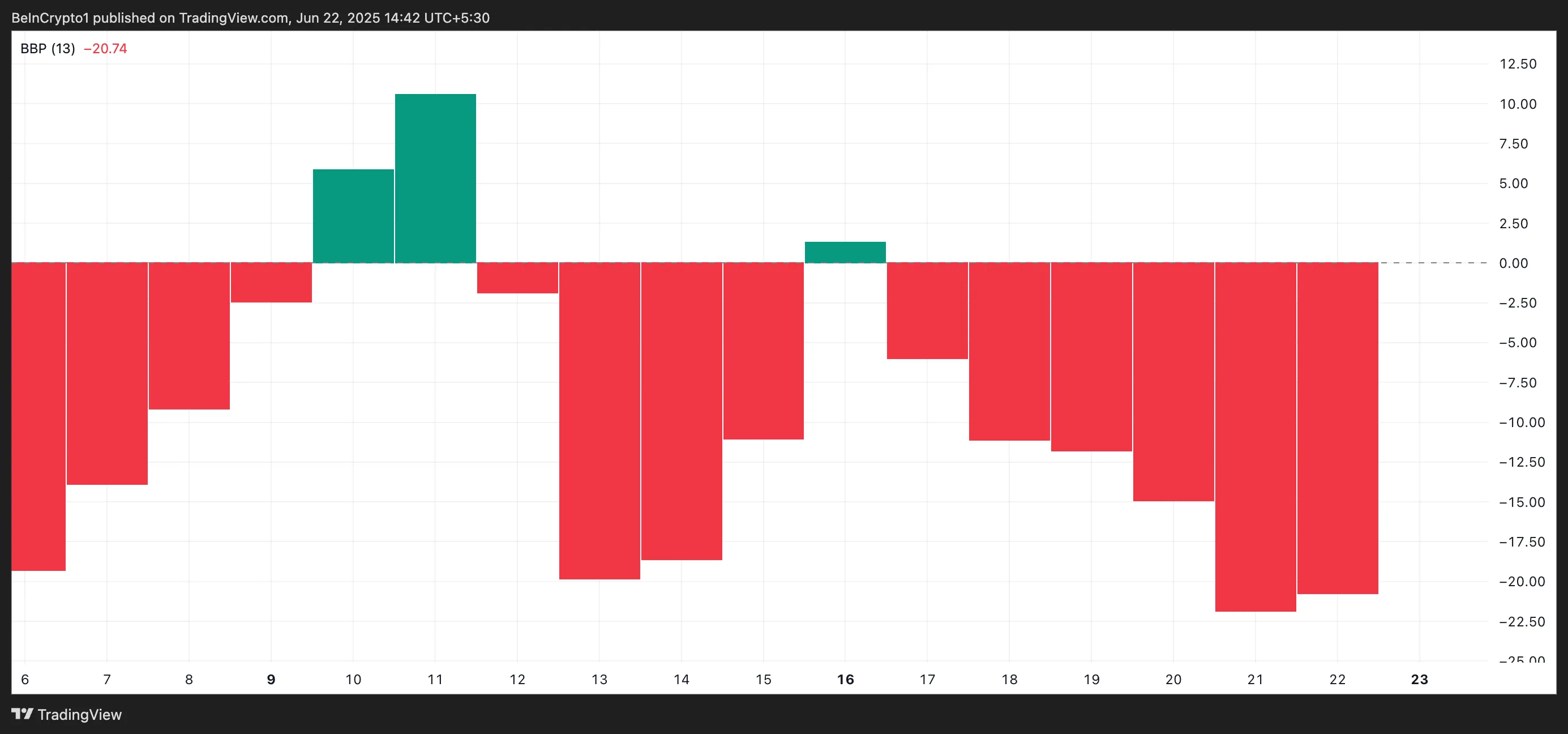

Moreover, the largest ray index of the coin, which measures the balance between buyers and sellers, is 20.74, which indicates the control of the sellers firmly.

This indicator measures the strength of bulls and bears in the market by analyzing the difference between the price of the original and a moving average. When it is negative, the bears are dominated, as prices are constantly decreased than the average, indicating that the pressure pressure exceeds the purchase of interest.

Will Sol recover at $ 130, or will the decline to $ 123 waving on the horizon?

The dominance of the bear reflects this increasing conviction that the Sol price may decrease more, especially if $ 134 fails to keep it as a support floor.

Meanwhile, a collapse below this level can open the door for deeper losses, which is likely to pull Sol about $ 123.49.

However, if Bulls managed to regain control, they can pay the Solana price to $ 142.59.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.