Can Ethereum $ 2000 in May 2025 cross?

After a relatively fame, it was characterized by a decrease in the demand for the network and side prices procedures, the second largest encrypted currency, ETHEREUM (ETH) may be placed, to turn.

ETH holders are optimistic about May. This optimism is fed by enhancing the basics, upgrading the expected Pectra, and renewing the interest from institutional investors through the funds circulating in ETH ETH (ETF).

Ethics fight in April, but May brings a glimmer of hope

In April, the data on the chain showed a decrease in the user’s activity via ETHEREUM, while the broader stagnation in the market kept the ETH trading without the main resistance levels.

According to Artemis, during a 30 -day period, the user’s request decreased on ETHEREUM, which led to a decrease in the number of active addresses, the number of daily transactions, and therefore, network fees and revenues.

The impact of this and the broader shrinkage on the market on the performance of the ETH, causing the pioneering ALTCOIN price to remain less than $ 2000 during April.

However, in an interview with Beincrypto, Gabriel Halam, InteTheblock’s research analyst, said that the price of ETH could penetrate the $ 2000 price sign in May and settle on it.

For Halm, capital flows are improved to the ETHEREUM investment funds in the ETHEREUM dominance in the decentralized financing of the currency (Defi), and the upcoming Pectra upgrade may help achieve this.

ETF, DEFI, and Pectra: ETAREUM triple batch in May

According to Sosovalue, the total monthly flow in ETH ETFS $ 66.25 million in April, indicating a transformation in market morale compared to $ 403.37 million in net external flows recorded in March.

This reflection of heavy output flows indicates modest flows that the investor’s confidence in Altcoin is gradually returning. It indicates that institutional players may be in a long -term recovery mode, especially since the basics of the Ethereum network begin to improve, one of which is the dominance of climbing in the Defi sector.

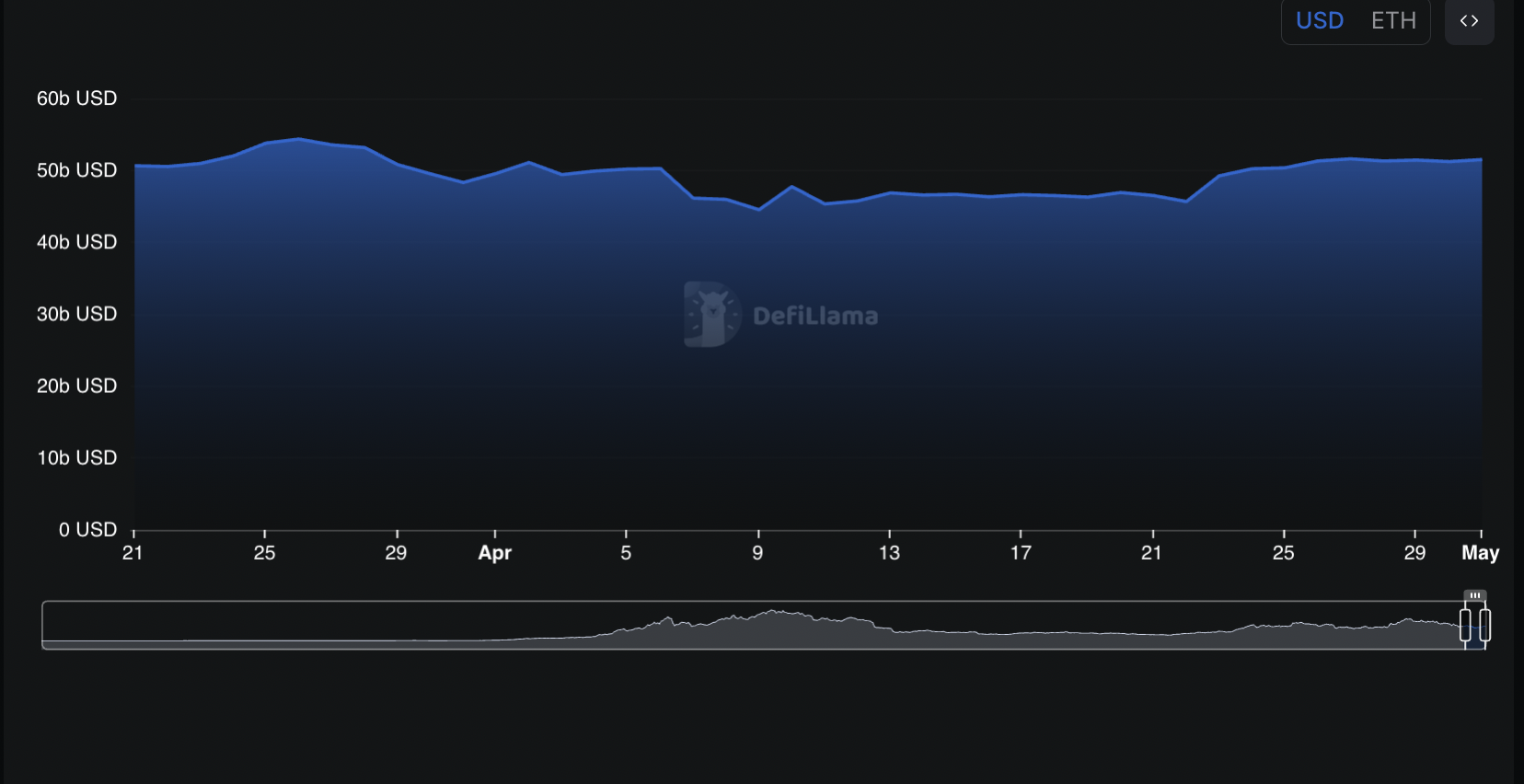

More than 50 % of the total closed value (TVL) in the Defi protocols remain on Ethereum Blockchain. This means that the -1 (L1) layer remains the favorite layer of the settlement of various financial applications, including lending, deception, return agriculture, and decentralized stock exchanges.

Therefore, in May, if the wider market conditions begin to improve, the renewal of capital flows in the Defi sector in Ethereum can, in turn, increase the demand for ETH and support high prices.

Moreover, according to Halm, the upcoming Pectra upgrade from Ethereum, which will be launched on May 7, 2025, can help in performing ETH prices this month. The upgrade is promoting the expansion of the network, reducing transactions fees, improving safety, and introducing smart account functions.

These improvements may feed an increase in the user’s demand throughout May, which may raise the price of ETH, provided that the total economic conditions remain favorable.

ETH growth depends on the stability of the broader market

Nevertheless, the broader economic pressures are a great danger to ETH in May. Halam pointed out that “the report of the upcoming consumer price index on May 13 will be particularly important, and it may affect the morale of the market and contribute to this volatility.”

This is because the signals of sacrifice or charity from the federal reserve can lead to poor morale in the encryption market, which leads to pressure on the price of ETH.

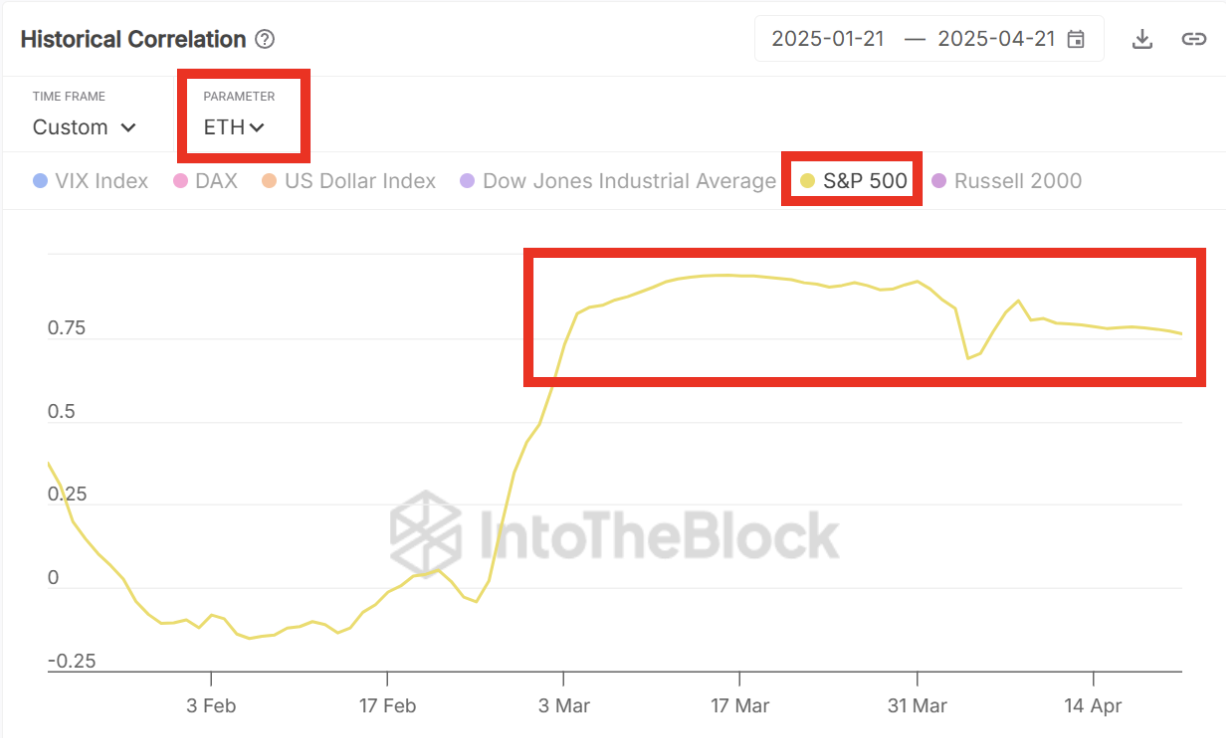

Halam also pointed out that the price of ETH is still closely related to American stocks. Therefore, if the stock markets face renewed pressure this month due to inflation fears or high prices, Altcoin may be under similar pressure.

“We look forward to May, if this high association continues, this means that Ethereum is offered to back down from the market and the pressure associated with inflation, it is likely to be similar to the origins of traditional risks such as those in the S&P 500.

While a continuous batch exceeding $ 2000 is still possible, any march will likely depend on inflation trends, risk feeling in traditional markets, and the extent of ETH tightly related to stocks.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.