Can Cardano (ADA) reach one dollar in April?

Cardano (ADA) faces renewed pressure, as it fell about 5 % on Wednesday. The ADA trading volume decreased by 19 % to $ 751 million. Despite this decline, some indicators began to flash early signs of potential trend transformations.

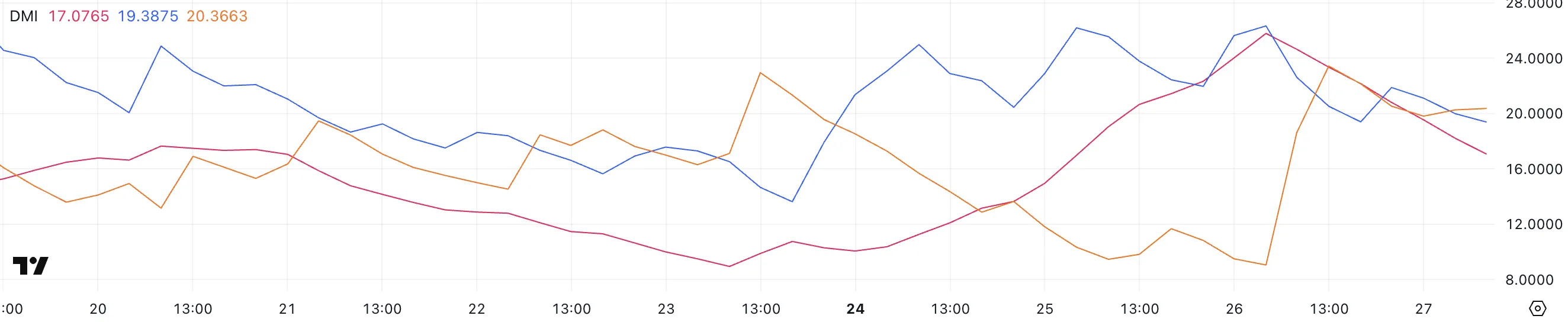

Bbtrend turned into a positive for the first time in more than a week, which hints to a potential change in the momentum, while DMI shows that Ada may be unified after a sharp step.

Cardano Bbtrend is now positive, but still at low levels

Cardano’s BBTRENO index is currently 2.25, which represents its highest reading since March 8. Over the past nine days, since March 18, BBTRand has been negative or hovered near zero, until it reached the lowest level in -2.14 on March 19.

This recent height indicates a shift in the behavior of the market, as the index moves from a neutral area to a structure to a more positive direction structure.

Although 2.25 is not an extremist reading, it indicates that the momentum began to tend to buy buyers after a long period of hesitation or weakness.

The BBTREND, or Bollen Band Band, measures the strength and trend of direction based on price behavior for Bollinger.

Values above zero generally indicate the upward conditions, while the values of zero indicate a declining feeling. Reading 2.25 indicates that the price began in the upward direction with the expansion of the increased volatility – although it has not yet been done in strong direction levels, it represents a remarkable improvement.

If BBTRand continues to rise, it may support the development of a more sustainable upward trend for ADA, especially if it is accompanied by an increase in size and a fracture over the main resistance levels.

Ada DMI shows that monotheism may end soon

The Cardano DMI chart explains that the average trend index (ADX) decreased to 17, which is a sharp decrease from 25.79 just one day ago. This indicates a significant weakening of the direction of the direction after the rapid price increased yesterday and a later decrease.

ADX is a major component of the DMI system and is used to measure trend strength – unlucky for direction.

ADX usually refers less than 20 to the lack of a strong trend or unification, while readings that exceed 25 indicate a more firm trend that is gained.

Besides ADX, Di (positive trend index) and -di (negative trend index) provides an insight into momentum. Currently, Di +decreased to 19.38 from 26.33, while -Di rose to 20.36 out of 9.

This intersection indicates that the sellers began to control, even with weakening the general direction.

With each of ADX heading down and crossing Di lines in favor of bears, this indicates a market in integration but with increased negative pressure. Unless the momentum turns again, ADA may struggle to restore upward traction in the short term.

Can Cardano return to one dollar before April?

Cardano’s DMI lines indicate that the original is subject to correction after a failed attempt to fracture above the key resistance level at $ 0.77.

This refusal has turned away from momentum, and if the price of Cardano continues to decline, then the next area that must be seen is the support is about $ 0.69. If this level fails to keep, this may increase the movement of the negative side, which may push the Ada to a range of $ 0.64.

DMI’s shift in DMI supports this short term in the short term, as sellers gradually gain strength as buyers lose momentum.

However, if ADA is able to restore its upward momentum, there is still room for a bullish reflection. A renewed payment towards the level of resistance of $ 0.77 can restore the scenario of collapse to play.

If this level is violated with a strong size, it can open the door to a gathering towards a $ 1.02 region – which increases the Cardano mark on one dollar sign for the first time since early March.

Such penetration is likely to support Cross Soudi in DMI and ADX lines, which confirms a new upward trend.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.