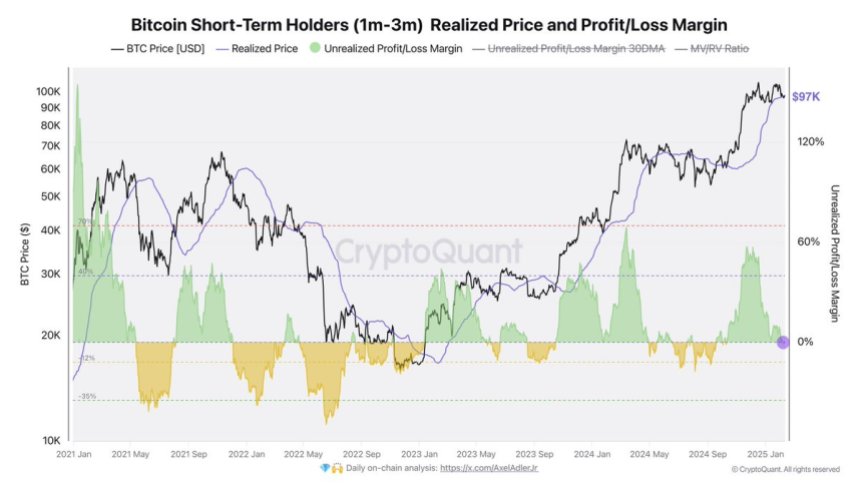

Can bitcoin carry 97 thousand dollars? -1-3 months of data for holders reveal the decisive demand on BTC

Este artículo también está disponible en estñol.

Bitcoin has seen a quiet weekend, with the recession price remaining about 96,500 dollars for five consecutive days. This prolonged period of integration lights on the current non -crucial nature of the market. The bulls were unable to restore control and pay bitcoin over the brand of $ 100,000, while the bears are also struggling to raise the price towards the main demand levels.

Related reading

There is no direction for investors and analysts closely monitoring the next main step signals. The broader feeling of the market is still cautious, as many wonder whether Bitcoin can restore the upscale momentum or if a deeper correction on the horizon.

The main scales shared by the Crypto Axel Adler expert on X provide some insight in the current dynamics. According to Adler, the level of 97 thousand dollars is a strong support area, which represents the average purchase for Bitcoin holders in the short term. This indicates that a large part of the market participants are still confident of Bitcoin’s ability to adhere to this level although there is no escalation momentum.

The demand for bitcoin is still strong, as the market frequency pays

Bitcoin was moving over weeks, and even months, from uncertainty and speculation, leaving investors divided around its short -term direction. He has struggled to pay the price to a sign of $ 100,000, while the bears were unable to storm the main support levels. These bodies have created a frequency market, while continuing fluctuations in controlling price movement.

The absence of a clear trend in frustration among investors, many of whom expected a stronger gathering earlier this year. Instead, Bitcoin was integrated within a domain, increasing between 109 thousand dollars at all and support levels about 90,000 dollars. Currently, the market looks stuck at this stage, with no immediate catalyst for an exit.

The higher analyst Axel Adler presented decisive visions in the current dynamics. According to Adler, the level of 97 thousand dollars works as strong support, as the average purchase price for short -term holders who kept Bitcoin for a month to three months. This data indicates that many market participants are still confident of Bitcoin’s ability to keep this level, even with broader uncertainty.

If Bitcoin is able to maintain this support in the coming days, analysts expect a potential rally to the highest level of about 109 thousand dollars. However, failure to maintain this level can pave the way for more negative aspect and testing low demand areas. Currently, the market remains on the edge of the abyss, waiting for the decisive step coming from Bitcoin.

Related reading

BTC price procedure details: key levels

Bitcoin is currently trading at $ 98,000 after spending last week in a narrow range between psychological resistance worth $ 100,000 and $ 94,500. This procedure related to prices is highlighted in the market frequency in the market, where bulls and bears are struggled for control.

In order for Bitcoin to confirm a short -term reflection and the restoration of the bullish momentum, the bulls need to restore the mark of 98 thousand dollars as a decisive support and payment to the level of 100 thousand dollars. Breaking this resistance and keeping it over this resistance can move towards higher price levels, which is likely to target its highest levels of about 109 thousand dollars. The successful restoration of the level of 100 thousand dollars would indicate renewable strength and trust in the market, which raised optimism among investors.

On the other hand, the failure to stick to the level of support of 95 thousand dollars can open the door for more negative aspect. It may send a decrease less than 95 thousand bitcoin to low demand areas, as it works as a level of 90 thousand dollars as the next main support. Such a move can increase the admiration of the morale and expand the current monotheism.

Related reading

As the market is continuing, investors closely monitor these levels in search of evidence about the next step for Bitcoin. With the bulls test and the bears of its borders, it is possible that the coming days will determine the short -term direction of the BTC price.

Distinctive image from Dall-E, the tradingView graph