Bybit Report: Gold is scheduled to exceed $ 3,000 in 2025

Dubai, United Arab Emirates, 3 March 2025 / PRNEWSWIRE / – PipeThe second largest exchange of cryptocurrency in the world through trading, the latest Priest Insight Report bybit. The report provides basic visions on the economic and geopolitical trends that lead the ups of the upward gold, and the analysis of factors that can push the precious metal to the highest level ever.

The most prominent major events:

- Upgrade expectations: Gold is expected to exceed $ 3,000 an ounce in 2025, with the support of strong macroeconomic and geopolitical economics.

- Expl for inflation: Constant inflation above the Federal Reserve’s goal enhances the role of gold as a hedge against the reduction of the currency.

- Monetary policy transformations: The expected US interest rate discounts can increase the resumption of gold on the assets that carry the benefits.

- Geopolitical tensions: Global conflicts, including US-Chinese tensions and the Russia-Ukraine war, pays demand for safe assets.

- The demand for the central bank: The purchases of gold, which are recorded, especially by China and Russia, provide structural support for higher prices.

- Technical momentum: Breaking 3000 dollars may speed up the gains about 3,200 dollars – $ 3500.

- Investor confidence: Strong ETF flows and GPS indicating the ups of the upward market.

Overal economy drivers

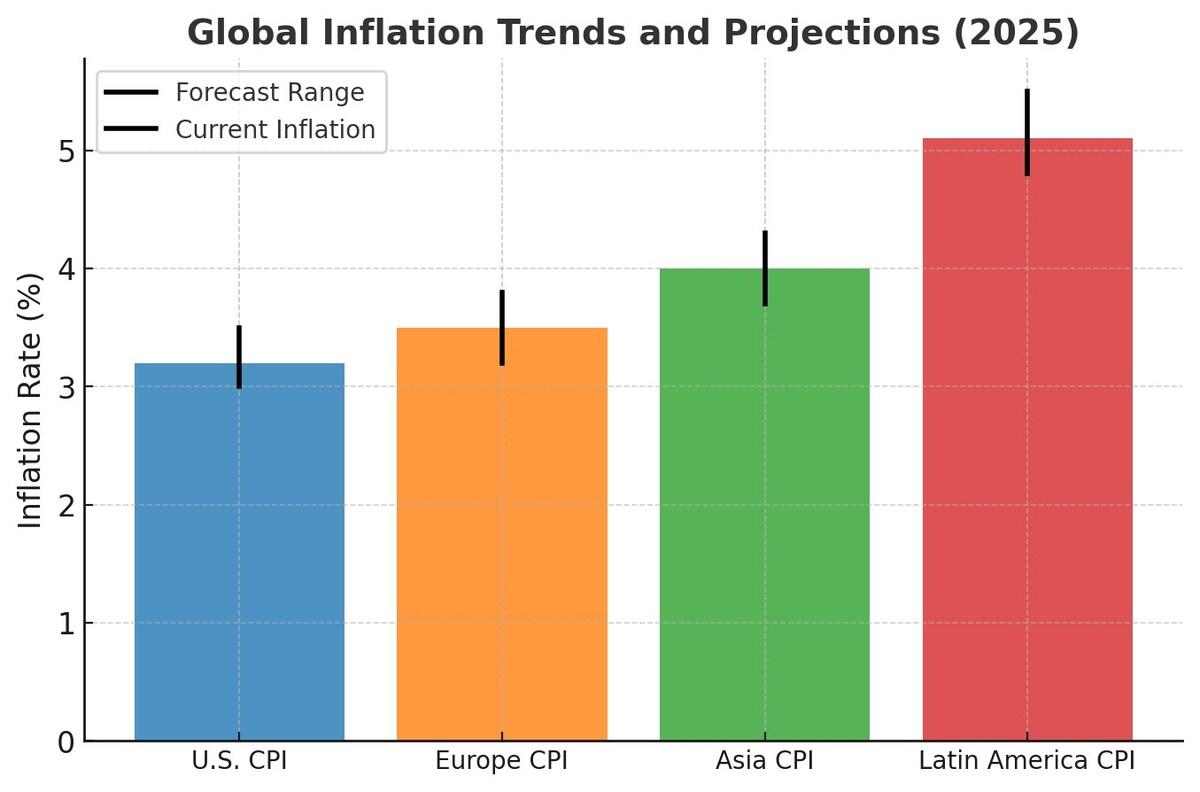

With inflation remains above 2 %, gold continues to work as a hedge against low purchase. The expected discounts of the Federal Reserve may increase demand, as the low low interest rates make gold more attractive than fixed income assets.

Geopolitical uncertainty

Constant conflict and global instability enhances the gravity of safe gold. Historically, gold excelled during periods of geopolitical stress, as investors turned to it as a hedge against uncertainty. The current environment indicates that this trend will continue.

Central bank accumulation

Central banks bought more than 1,000 metric tons of gold in 2024, a trend that is expected to continue with the diversity of countries like China and Russia away from the US dollar. This fixed accumulation supports prices and borders negative risks.

Technical strength and morale in the market

Gold remains in a strong upward direction, with the concentration of the main resistance levels. A break above $ 3000 may increase the gains, while ETF flows and high future contract functions indicate strong confidence in the investor.

conclusion

Gold’s path to $ 3000 is made by inflation, demand for the central bank, geopolitical uncertainty, and positive technical indicators. As global instability continues, it is expected to enhance gold mode as a safe origin.

For a deeper analysis of these trends, and to reach complete Priest Insight Report bybit From bybit.

Like

About bybit

Pipe It is the second largest exchange of encrypted currencies in the world through trading size, as it serves a global community of more than 60 million users. Founded in 2018, bybit redefines openness in the decentralized world by creating a simpler and equal environmental system for all. With a strong focus on Web3, Bybit is strategically inconsistent with the leading Blockchain protocols to provide a strong infrastructure and drive innovation on the chain. She is famous for her safe custody, various markets, anchor user experience, advanced Blockchain tools, embodies the gap between Trafi and Defi, empowering builders, creators, and lovers to cancel the full capabilities of Web3. Discover the future of decentralized financing in Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Societies bybit and social media

dispute | Facebook | Instagram | LinkedIn | I responded | cable | Tikhak | x | YouTube