BTC prices are struggling despite Trump’s support for Caesar Caesar

Bitcoin (BTC) remains stuck in a narrow range, struggling to get momentum despite recent attempts to break the resistance. President Trump Trump Charo, David Sachs, who was recently called Bitcoin “an excellent store for value”, yet the statement had no clear impact on price movement.

The sellers seem to be controlled, as the BTC DMI indicates an increase in the declining pressure, while the accumulation of whales remains weak compared to the recent altitudes. With BTC trading between 97,700 dollars in support and $ 99,500 resistance, it is likely that its next main step will be determined whether to review low levels or make another batch of about $ 100,000.

BTC DMI shows sellers who gain control again

The BTC DMI chart explains that ADX has decreased to 25.8, a decrease from 35.8 just three days ago. This decline indicates that the strength of the prevailing trend is weakening, indicating that the recent BTC price movement is losing momentum. BTC tries to recover from the declining direction, but the falling ADX indicates that this recovery lacks the affirmation of the strong direction.

Another decrease less than 25 can indicate that BTC enters a period of monotheism, as the price movement becomes less dire directed and the most in the range unless a new increase in the momentum appears.

ADX is a component of the directional movement index (DMI) that determines the strength of the trend. In general, ADX above 25 indicates a strong direction, while reading less than 20 indicates the weak or non -decisive market conditions. Besides, the BTC’s +Di has decreased from 22.5 to 16.7 over the past two days, reflecting a bullish momentum that fades, while -Di increased from 25.8 to 27.9, indicating an increase in declining pressure.

With -Di now higher than Di +, the market tends to be in favor of the sellers, which makes the bitcoin recovery attempt more difficult. If this trend continues and ADX remains above 25, the BTC may continue to face the downward pressure. However, if ADX decreases further and each of the directional indicators begin to rapprochement, BTC may enter a period of side movement instead of a strong declining direction.

Bitcoin whales accumulate again, but they are still much lower than the last levels

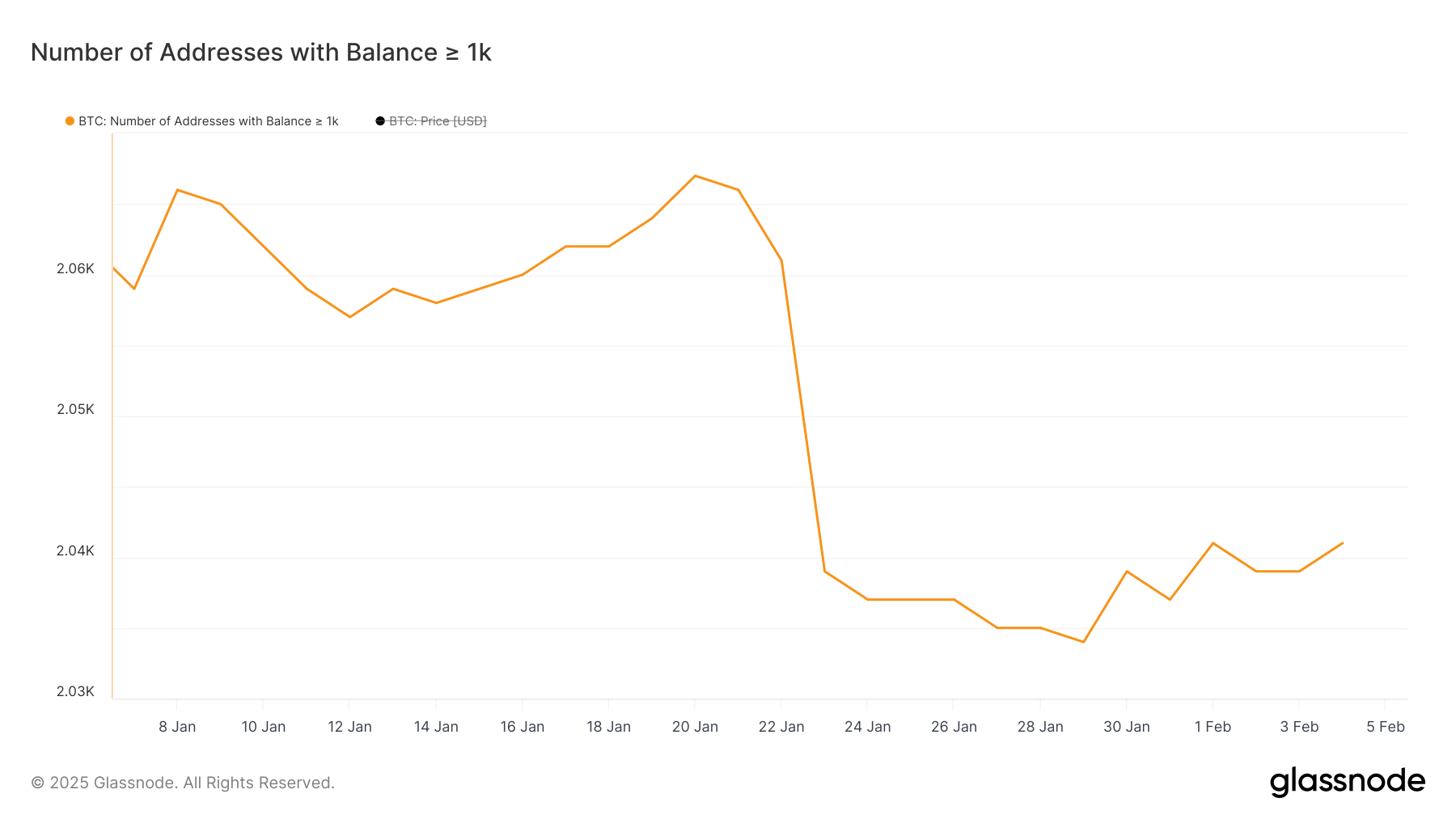

The number of whales BTC- Governor that carries at least 1000 BTC- to 2041, and recovered from 2034 on January 29, which was distinguished by its lowest level since January 2024. He recovered from the sharp decline between January 20 and January 23, when it decreased from 2 , 067 to 2,039 in only three days.

The decline suggested a period of a large distribution, as its great owners reduced their exposure to BTC. While the last height indicates some stability, the total number of the whale remains much lower than its last height, indicating that accumulation on a large scale has not yet been resumed.

BTC whale tracking is very important because these entities have the ability to influence price movements through large purchase or sale transactions. An increasing number of whales usually indicates an institutional investor confidence or its high value, which can help in supporting price stability and even bullish momentum.

Although the number of the current whale has witnessed a simple recovery, it remains much less than the last peak of 2,067, indicating that BTC has not yet seen a wide -ranging accumulation of its main owners.

If the whale numbers continue to rise, this may provide a stronger basis for BTC recovery, but if it focuses or declines again, this may indicate that the largest investors are still hesitating to adhere to the current levels.

BTC Prediction: Will BTC recover $ 100,000 soon?

The Bitcoin price is currently trading within a narrow range, as it faces about 99,500 dollars while it carries support at 97,700 dollars. The preparation remains diligent based on the EMA structure, where the average movement is placed in the short term below that long -term. This pressure indicates the ongoing downside, although President Trump Chair David David Sachs recently announces that Bitcoin is a “excellent store for value”.

If BTC is tested and loses $ 97,700, it may decrease to $ 95,783 as the next key level. The strongest BTC downtom trend can pay somewhat, and it may reach $ 91,266-its lowest price since mid-January-if the declining momentum is accelerating. This would enhance the current market structure as a continuation of the recent decline.

On the other hand, BTC PRICE has tried to break the resistance of $ 99,500 in the past few days, but has failed to stick to it. A successful collapse above this level may change the momentum in favor of buyers, allowing BTC to test 101,300 dollars.

If this level is wiped with strong purchase pressure, BTC may collect about $ 106,300, an important threshold that can open the road to the highest new level ever at about $ 110,000 in February.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.