BTC price fixed with low whale activity

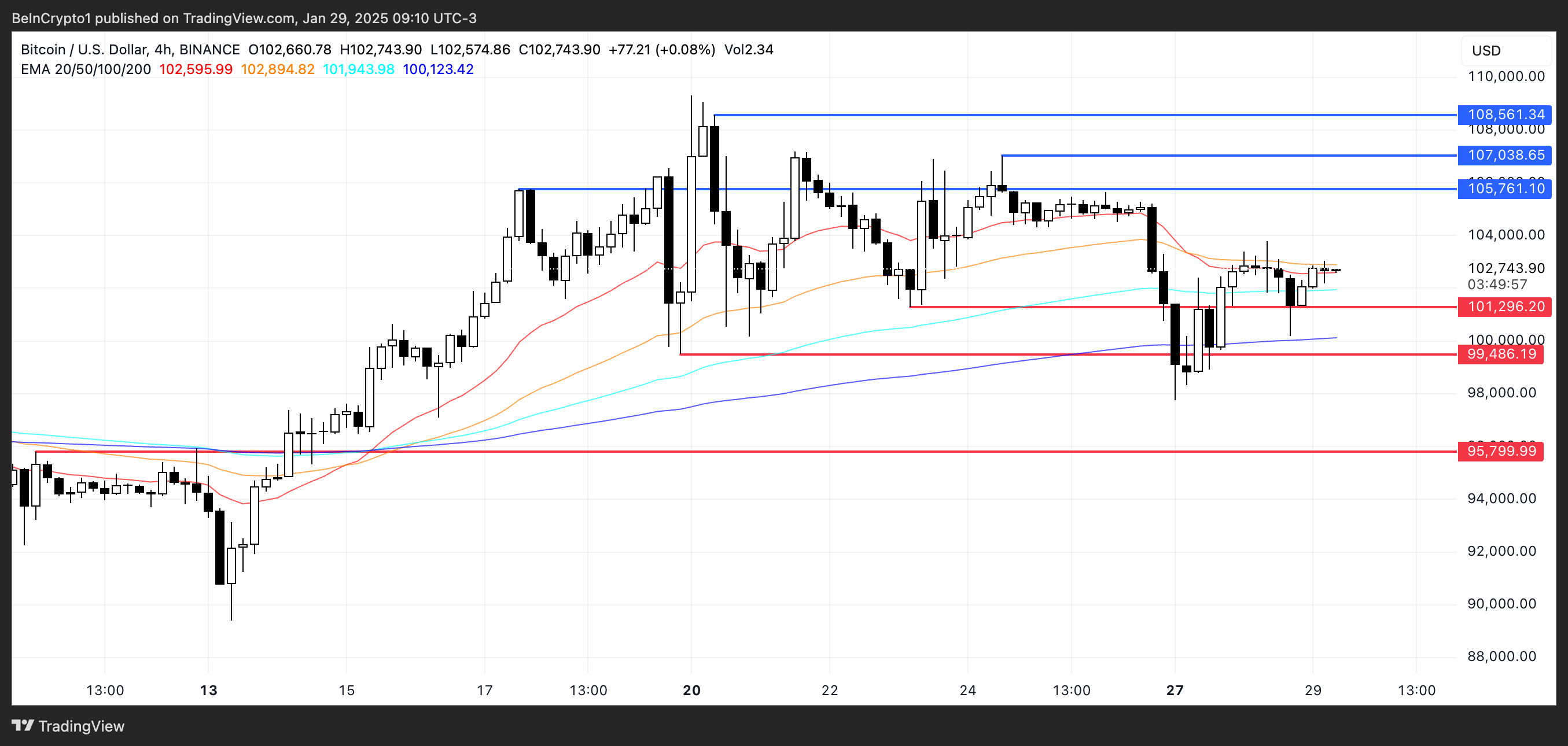

The price of Bitcoin (BTC) was volatile, with 9 % in the last 30 days, but it decreased by 3 % last week, as the market ceiling hovering about $ 2 trillion. Despite the last negative side, it appears that BTC is unified, as EMA lines are closely trading together, and its DMI scheme indicates the strength of the weak direction.

Meanwhile, the number of BTC whales decreased to its lowest level per year, indicating that some of its large owners have removed their coins. With the main support at $ 101,300 and resistant at $ 105,700, the next step for BTC will be it is very important in determining whether to continue to unify or attempts to pay about $ 110,000.

Bitcoin DMI indicates uncertainty

The Bitcoin DMI ADX chart appears at 16.6, fluctuating between 15 and 19 during the past two days, indicating the strength of the weak direction. ADX measures the strength of the trend, with values less than 20 indicating monotheism and above 25 indicating a stronger direction. Currently, BTC lacks a clear momentum in either direction.

The DMI +Di scheme also appears in 17.5 and -Di decreases to 23.8 out of 27.2. It is worth noting that -Di reached its peak at 40.9 days ago when BTC fell from $ 105,000 to $ 98,600 within a few hours. This indicates that the declining pressure has reduced, and BTC is now standardized.

If +Di crosses above -DI with ADX height, the upward trend can form. Otherwise, the BTC price may remain linked to the group or follow the previous lower direction.

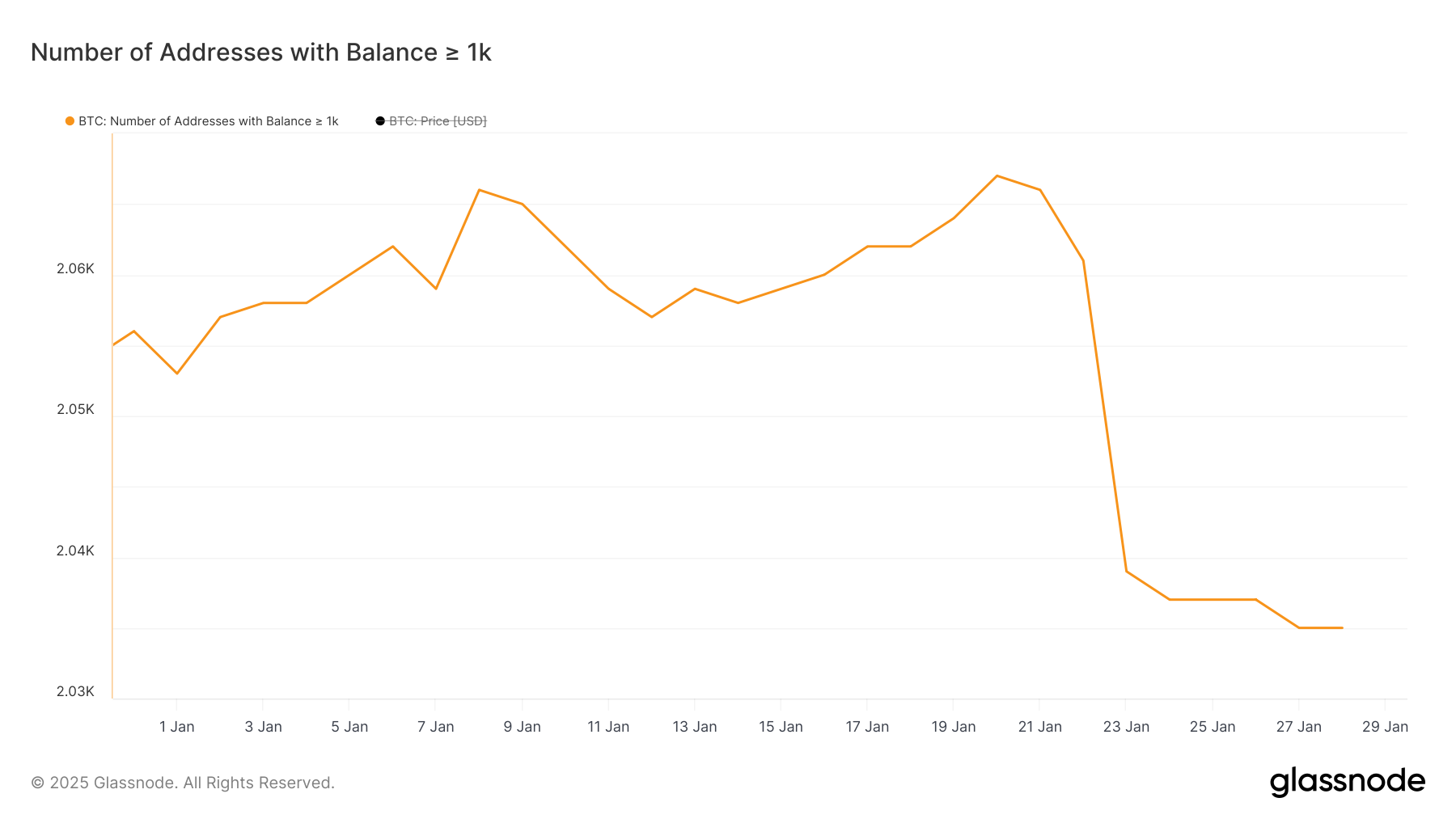

Bitcoin whales drop to the lowest level per year

The number of BTC whales – titles with at least 1000 BTC – has decreased to 2035, the lowest level since January 2024. a significant decrease occurred between January 20 and January 24, when the number decreased from 2067 to 2,037.

This sharp decrease indicates that some of the big bearers have unloaded BTC, and they may rotate in other metal currencies or hold their money waiting for new movements.

BTC whale tracking is important because it carries a large share of Bitcoin supplies and can affect market trends. The decrease in the whale headlines may indicate the distribution, which means that its large owners sell instead of accumulation.

With the presence of whale numbers at the lowest level in one year, the BTC price may have increased sale pressure, making it difficult for the price to maintain a strong upward momentum. However, if a new accumulation begins, it can provide support and help in the stability of the market.

BTC Price Procent: Will you finally reach $ 110,000 in February?

Bitcoin EMA lines indicate a standardization stage, where they are closely circulated. The current support level is about $ 101,300, which has been held so far.

However, if bitcoin prices are tested and this support is lost, it may decrease to 99,400 dollars, with a deeper decrease of up to $ 95,800.

On the upper side, if BTC gains momentum, the resistance may test $ 105,700. The collapse above this level may pay the BTC price to 107,000 dollars and 108,500 dollars, which may pave the way to move to $ 110,000 for the first time.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.