Brarachain (BERA) is 15 % after a recent increase in

Berrachain (BERA) has decreased by approximately 15 % over the past 24 hours, with the maximum market now at $ 778 million, although its price is still almost 20 % over the past seven days. This sharp decline comes after a strong gathering between February 18 and February, when Bera reached levels of more than $ 8.5.

The BERA (RSI) relative index has decreased from excessive peak levels, indicating the loss of bullish momentum, while the DMI movement indicates the increasing declining pressure. While Bera moves in this correction stage, it faces major support at $ 6.1, with possible resistance levels at $ 8.5, $ 9.1, and $ 10 if the upscale momentum returns.

BERA RSI decreases steadily after touching excessive peak levels

The relative strength index of Brarachain (RSI) is currently 50.6, a sharp decrease from 86.7 only two days ago when its price rose above 8.5 dollars. RSI is a momentum that measures the speed and change of price movements, ranging from 0 to 100.

It is used commonly to determine the excessive conditions in buying or selling, as values of more than 70 indicate levels of peak purchase and less than 30 years indicating the excessive region.

The sharp decline in RSI in BERA reflects a significant loss in the bullish momentum after reaching levels of its arrest above 86, as the correction was likely to be.

With RSI now at 50.6, Beira in a neutral area, indicating that the pressures of purchase and sale are relatively balanced.

This can indicate a period of monotheism with the market digestion of modern gains. If the RSI continues to decrease less than 50, it may indicate an increase in the declining momentum. This can lead to a decrease in the additional prices of Perra.

On the contrary, if the RSI settles and starts to rise, it may indicate the renewal of the purchase and a potential recovery in the price of berachain.

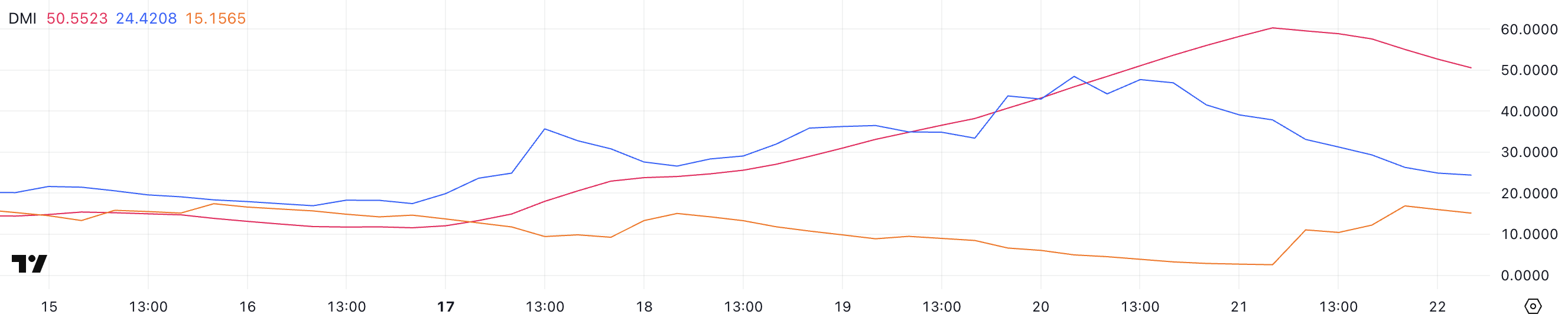

Praira DMI a scheme shows buyers lose control

The directional movement index in Brarachain (DMI) shows the average trend index (ADX) currently at 50.5, after the peak in 60.2 yesterday, an increase of only 13.3 five days ago. ADX is an indicator used to measure directional strength, regardless of its direction, ranges from 0 to 100.

Values of more than 25 usually indicate a strong direction, while values that are less than 20 indicate a weak or side market. The acute height in ADX reflects a significant increase in the strength of the trend, confirming that Bera was suffering from a recent strong directional movement.

Meanwhile, Bera’s +Di is at 24.4, a decrease from 48.4 two days ago, indicating twice the bullish momentum. Meanwhile, -Di rose to 15.1 out of 4.9, indicating an increase in the decline pressure.

This shift indicates that the upward trend that prompted prices to the top is the loss of Steam, and the benefit began to increase.

If -Di continues to rise above +DI, this may indicate a declining intersection, indicating a possible reflection or deeper correction in the price of the bera. However, if +Di stabilizes and moves up again, it may indicate a continuation of the upward trend, albeit with a decrease in momentum.

Will Perchen decrease to less than 6 dollars soon?

Berarachain increased by 53 % between February 18 and February 20, which pushed its price to the top of 8.5 dollars after it struggled with the currency after Airdrop. However, after this acute gathering, BERA has entered a correction phase and has now decreased by approximately 15 % in the past 24 hours.

This withdrawal indicates profits and transformed in the market morale, where buyers hesitate to pay prices up. If the declining direction continues, the BERA can test support soon at 6.1 dollars, and the break without this level may lead to an additional decrease of about $ 5.48, which reflects the increase in the sale pressure.

On the other hand, if Berarashein is able to restore its bullish momentum a few days ago, it may rise more than 8.5 dollars again, which may test the next resistance levels at $ 9.1 or even $ 10.

To confirm this bullish scenario, berachain will need to see a renewed purchase and strong upward momentum. If buyers are able to defend the main support levels and pay the price over the resistance areas, this may indicate the continuation of the upward trend.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.