Bitco’s Bitcoin (BTC) in Kucoin retains a 77 % decline as an mandatory user user EXDUS

Rumors of Cocoin’s implementation of the implementation of a compulsory policy began for you in June 2023.

the June 28 confirmation The number of discussions increased through encryption forums and social media, which led to visual changes at the stock market user base.

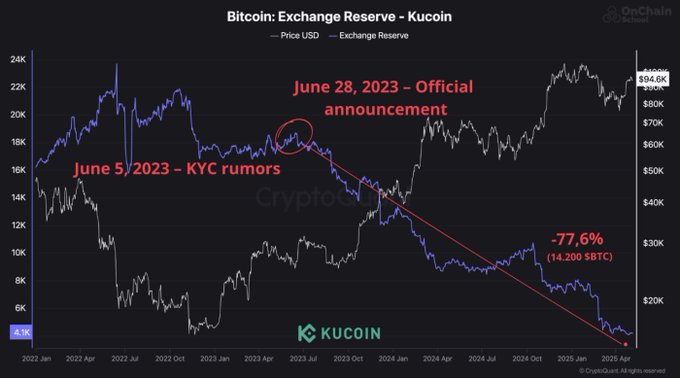

Cryptoquant data shows that the Kucoin BTC reserves began to decrease after the advertisement.

This trend continues, reflecting the user’s concerns about privacy, money safety and organization.

The scale fell from 18300 BTC in June 2023 to 4,100 BTC in April 2025, which translated into an external flow of 14200 BTC or 77.6 %.

Kucoin loses more than 77 % of BTC reserves after KYC’s mandatory advertisement, “Data on the series appears from 18300 BTC to only 4,100 BTC, which represents a net flow of 14200 BTC-by 77.6 %.” – By Onchainschool

The conversion of the Cocoin policy leads to the user’s exit

The trading platform confirmed the updated KYC requirements, which demanded the identification of any person who uses its services, including deposit, local trade and futures.

Cocoin emphasized that the step was necessary to ensure the safety of the user and compliance.

The most prominent press statement:

From July 15, 2023, all newly registered users must complete KYC to access a set of comprehensive products and services for Kucoin. This requirement guarantees a high level of accountability and transparency within the statute. For users who were recorded before July 15, 2023, the failure to complete the Kyc process will restrict their access to certain features.

However, society responded by quitting smoking, stimulating significant decreases in the BTC reserves in Kucoin.

Users have withdrawn 14200 Bitcoin origin since the updated KYC requirements.

Moving to self -monopoly?

The amazing Bitcoin flowing from Kucoin highlights a wider change in the user’s preference.

Since Central exchanges (CEXS) tighten compliance and KYC policies, it seems that individuals are turning into platforms and promised more control of user assets and data.

Most people, especially in the judicial states, with the most solid digital assets laws or privacy concerns, are transmitted to decentralized exchanges (Dexs) and guard governor.

Unwanted accidents such as fraud in encryption have made users hesitant to share their details unless this is necessary.

These feelings reflect the increasing trend towards privacy -focused currency tools (Defi).

Impact on Cocoin

While Cocoin emphasized that KYC changes aim to prevent illegal activities and ensure a safe investment space for users, low reserves represent major challenges.

Low reserves can affect the user confidence, depletion of liquidity, and bankruptcy speculation, which are decisive to any entity to survive in the competitive exchange market significantly.

This explains why some platforms have chosen, including OKX and Binance, delaying KYC’s delegations.

Meanwhile, the Cocoin incident reminds us of the benefits of confidence in the world of technology.

While the participation of governments made the regulations unavoidable, the exchanges should be balanced in the independence of the user and compliance.

The huge reserve decline reflects the effect of the isolation of users who give privacy to privacy.

The situation shows that users will choose to control comfort in the world of encryption.

Meanwhile, Kucoin and other trading platforms should consider restoring user confidence without sacrificing compliance.

Post Kucoin’s Bitcoin (BTC) maintains a 77 % decrease as the mandatory user exit appeared for Kyc Sparks first on Invezz