Bitcoin’s strongest support now at $ 83,440 – will you keep?

After the price collapsed to less than 80,000 dollars last week, Bitcoin has witnessed some recovery in the market over the past 48 hours, as it rose by more than 7.5 % to trade over $ 86,000. Amid the recovery of this market, Ali Martinez, the encryption market expert, discovered the most important support level in the encrypted currency at the present time.

Bitcoin faces “air gap” less than 83 thousand dollars – it can be a brutal collapse

in X post On Saturday, Martinez shared an insight into the Bitcoin Market. Using UTXO (URPD) price distribution scale, it was divided at its highest level ever, and the analyst has set $ 83,440 as the most vibrant Bitcoin support zone.

In general, URPD is a scale on the series that shows the price levels at which the outputs of the unsuccessful transactions (UTXOS) moved, thus measuring the amount of treatment at different price levels. Each tape on the URPD chart represents the price of the price, and the height of the tape indicates the treatment of the processed BTC at this level.

Therefore, URPD can be used to determine potential support and resistance levels and can show whether a large amount of BTC has been obtained or sold at a specific price level.

According to the Martinez analysis, the URPD data from Glassnode shows that investors got 171,693 BTC (0.87 % of the total offer) at 83,440.72 dollars, and this price level converts to a strong support zone. This is because Bitcoin Bulls is likely to enter and gain more BTC at this level in any case of re -testing.

However, there is a noticeable air gap ranging between $ 72,000 – $ 82,000 with low levels of UTXO registered in this price range. Consequently, the decisive decrease to less than 83,440 dollars will lead to a decrease in prices due to a lack of demand in immediate low ranges.

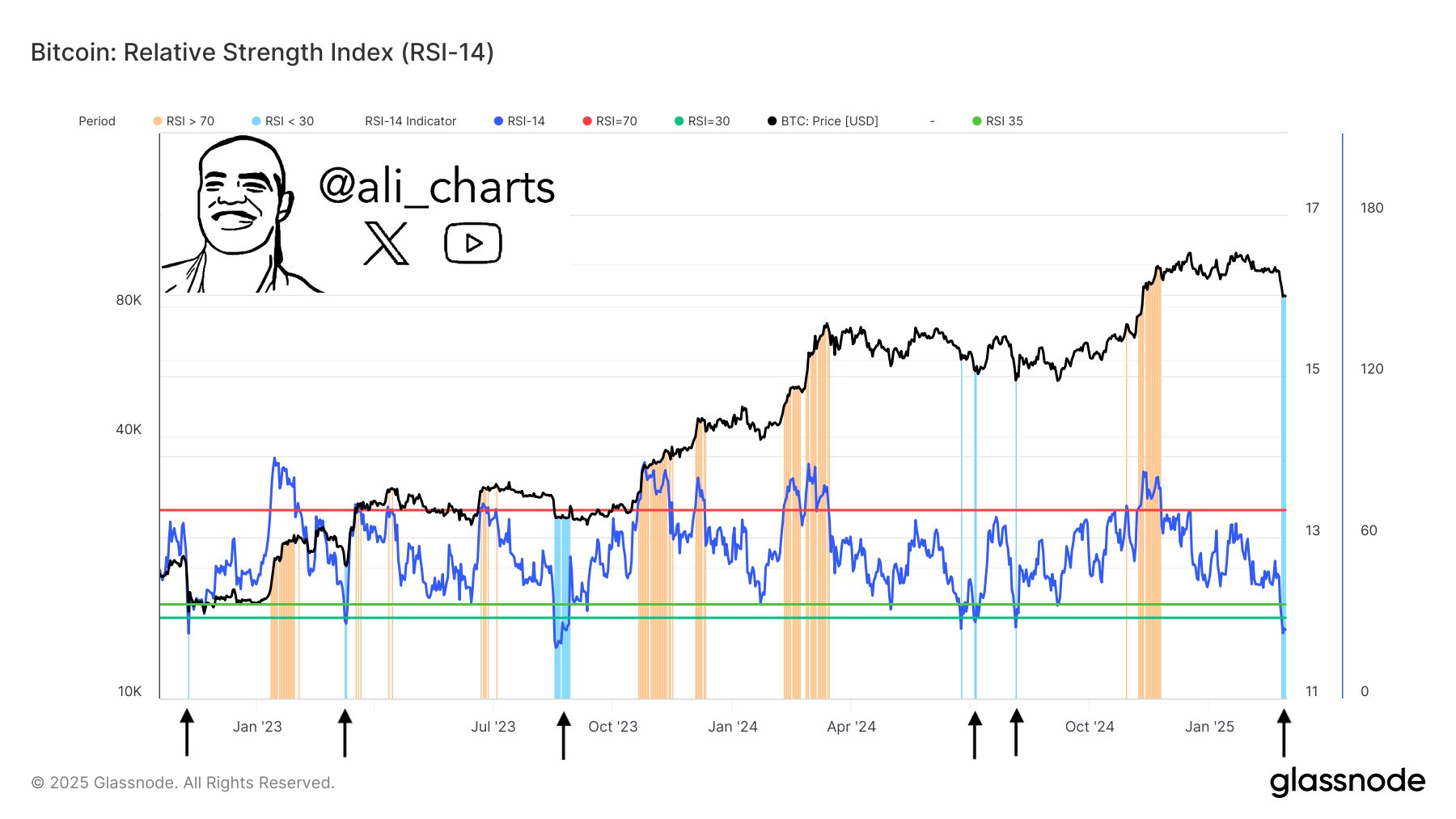

Bitcoin Rsi Rebound Quest – More gains in the future?

In another Another analysis In BTC Market, Martinez hinted that more price gains can be obtained amid continuous price recovery. According to the encryption expert, Bitcoin historically recorded a recovery of prices after the RSI index rose to less than 30.

The relative strength index measures the momentum of price movements and determines whether the original was above the peak (higher than 70) or increasing the sale (less than 30). Martinez states that Bitcoin’s relative index has recently touched 24 in the sale area, indicating that the bounce to restore previous high prices may occur according to historical data.

At the time of the press, Bitcoin is trading at $ 86,383 after an increase of 2.32 % over the past 24 hours. After correcting prices last week, BTC is still 21.02 % from its time at 109,114 dollars.

Distinctive image from Istock, tradingvief chart