Bitcoin’s reflection to 128 imminent dollars with approaching accumulation

- summary:

- Bitcoin price decreased by six percent last week amid the morale of Food caused by customs tariff wars. That is why the reflection is imminent.

The price of Bitcoin was to run Torrid in recent days, and lost 6.3 % last week. The decline is not the assets of BTC, but it is widespread across the wider encrypted currency market. The market value of digital operations has decreased by about $ 500 billion in the past seven days.

Bitcoin price is preparing for a strong opposite with a goal of 128 thousand

The market decrease is due to the uncertainty of fear and doubt (FUD) feelings caused by fears of the global trade definition war. This has seen investors reducing their exposure to high -risk assets such as cryptocurrencies. This feeling is reflected in the American ETF Spot market.

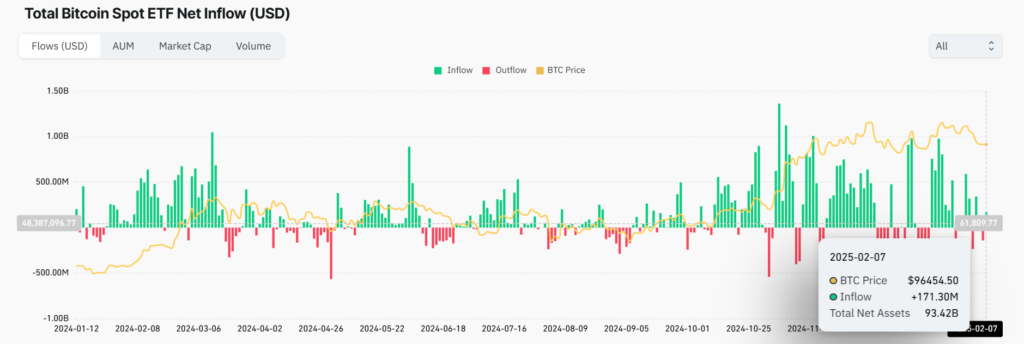

According to data from Coinglass, Spot Bitcoin ETFS recorded $ 140 million in external flows on Thursday. However, there was a major reflection to $ 171.30 million of flows on Friday. The continuation of this trend can provide support for Bitcoin price in the new week.

Also, BTCUSD has collapsed up to the monthly graph after previously formed a bullish style in the cup and cup. Using the depth of the cup as a standard for measuring the target price indicates that the price of BTC can rise to levels above 128,752 dollars in the next few months. This translates into 34 % up to the current price.

Meanwhile, Bloomberg stated this week that Blackrock, the world’s largest asset manager, intends to launch a Bitcoin Stock Exchange trading product (ETP) in Switzerland. This comes on a strong year for the first time in the investment funds circulating in Bitcoin in the United States, with a value of $ 40 billion in flows. The strong institutional interest in Bitcoin confirms, amid a friend of a friend of encryption at the White House.

Elsewhere, Maryland has become the seventeenth country in the United States to submit an application to create a strategic bitcoin reserve. Earlier this week, David Sachs, President Donald Trump, hinted in an interview that Bitcoin could form part of the sovereign wealth fund of the United States. According to the White House, the Trump administration intends to create a 5.7 trillion dollar wealth fund that is directed towards developing the economy, improving financial responsibility and lowering taxes.

Bitcoin price in the short term

Bitcoin price axes at $ 97,010 and resisting at this level is controlled by the sellers. Immediate support is likely to be 95,250 dollars. However, the stretching momentum will lead to the collapse of this level and target the second support at 94,040 dollars.

On the other hand, the fracture above 97,010 dollars will indicate a transformation by momentum to the upward trend. The first resistance is likely to be $ 98,415 in this case. The violation of this level will nullify the narrative of the negative side and may test 99,735 dollars.