Bitcoin’s investment funds recovery with a weekly flow of $ 744 million

After five weeks of consecutive external flows, the investment funds circulated in the United States in Bitcoin wore $ 744 million of net flow this week. On Monday, March 17, the circulating investment funds witnessed a $ 274 million flow, which is the highest daily number in more than a month.

This recovery indicates that institutional investors are returning to the Bitcoin market, where macroeconomic factors have been priced. However, BTC is still less than $ 90,000.

Bitcoin’s investment funds begin to recover from a $ 5 billion losses

ETFS in the United States has lost more than $ 5.3 billion since the second week of February. The month was particularly brutal for the circulating investment funds, as it recorded $ 3.5 billion of external flows.

The sharp sale process is attributed to institutional investors who liquidate their property amid market fluctuations and change the conditions of macroeconomics. However, March referred to a transformation, with stabilizer flows increased during the past week.

With the alleviation of total economic concerns, institutional investors appear to be preparing confidence in the market. The week began with a strong note, as Bitcoin’s investment funds recorded $ 274 million in flows on Monday.

Positive momentum continued, and its climax reached six consecutive days of net flow. On March 21 alone, the circulating investment funds witnessed a total flow of $ 83.09 million.

IBIT has led Blackrock the road, as it recorded up to $ 150 million in positive flows on Friday. Meanwhile, all the other sources remained stagnant. The only Outlier was GBTC from Grayscale, who continued its direction in external flows, and lost $ 21.9 million that day.

This shift indicates that institutional players may put themselves to recover the potential market. The encrypted effects and the founder Open4profit Zia UL Haque have indicated this recovery, and wondering whether the founding investors are acting on internal knowledge.

“The institutes began to accumulate again: Do they know anything? books.

His observation is in line with the steady recovery in ETF flows and bitcoin price actions, which continue to defend against the additional downside.

However, despite the positive ETF flows, not everyone shares the bullish look and optimism to recover the Bitcoin prices. Some analysts believe that Bitcoin ETF flows clearly do not clearly reflect the interest of the appellate buyer.

Institutional trading strategies may suffer from structural transformations. Hedge funds often benefit from a low -risk arbitration strategy that involves investment funds circulating in Bitcoin and CME future.

ETF was real, but some were pure for arbitration. There was a real demand for BTC, not as much as we thought. Until true buyers intervene, this fluctuation and fluctuations will continue, ” Make up.

If this structural shift continues, this may affect the stability of the market despite the return of the last ETF flows.

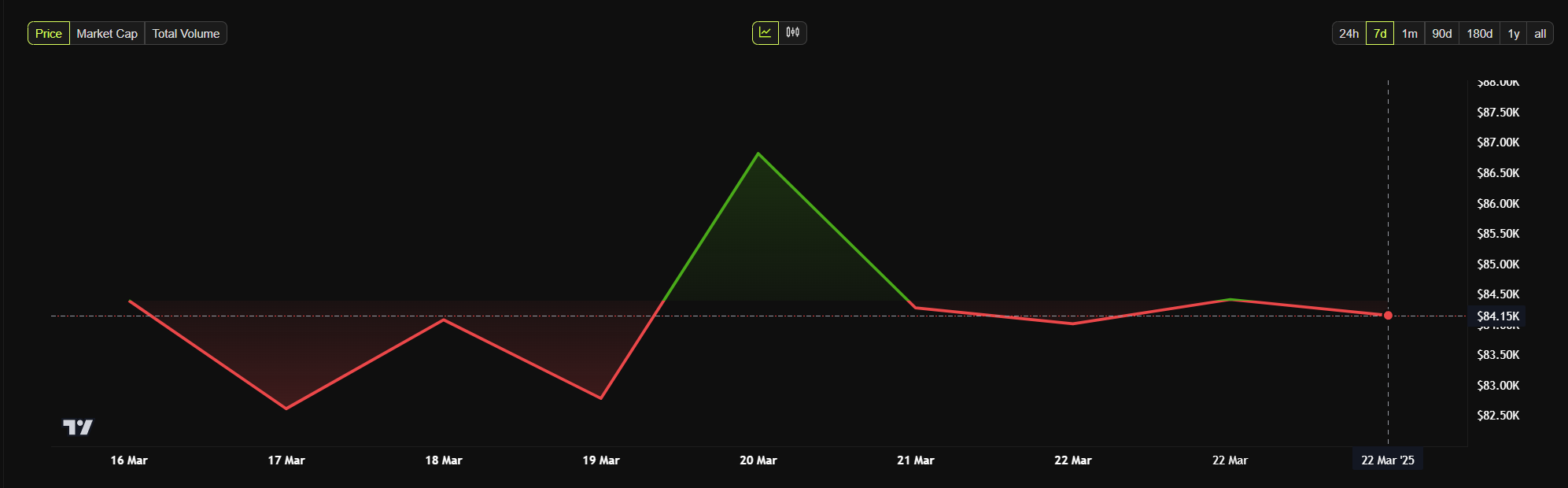

As of this writing, Bitcoin is traded at $ 84,148. It has decreased by 0.46 % in the past 24 hours, and has failed in contrast to optimism amid the last rise in Bitcoin ETF investments.

Meanwhile, Ethereum ETFS continues to spread negative flows, with net flows in 12 consecutive trading (over two weeks).

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.