Bitcoin’s investment funds attract $ 319 million in flows

On Wednesday, the flows to the US -bitcoin investment funds in the United States exceeded $ 315 million, which represents a sharp reflection of $ 96 million in the external flows recorded the day before.

The increase in demand reflects a bullish shift in investor morale despite the modest decline in the BTC price on Wednesday.

319 million dollars flowing to the BTC investment funds in one day

On Wednesday, none of the BTC -backed investment funds were reported. According to Sosovalue, the total flows in these boxes amounted to 319.56 million dollars, which represents one of the strongest offers in one day in recent weeks.

The shift in feelings indicates the renewal of interest from investors from retail and institutions, which are likely to be driven by an opportunity to purchase decline and increased confidence in BTC’s long -term capabilities, despite short -term fluctuations.

Yesterday, the Blackrock ETF IBICK witnessed the highest net flow, amounted to 232.89 million dollars. As of the writing of these lines, the total historical net flow is 45.01 billion dollars.

FBTC of Fidelity saw the second highest daily flow, reaching $ 36.13 million, thus reaching $ 11.65 billion.

BTC declined a little, but the derivatives show that the bulls do not retreat

BTC is currently trading at 102,413 dollars, indicating 1 % withdrawal of modest prices during the past day. However, market data indicates continuous upwards while immediate prices decline.

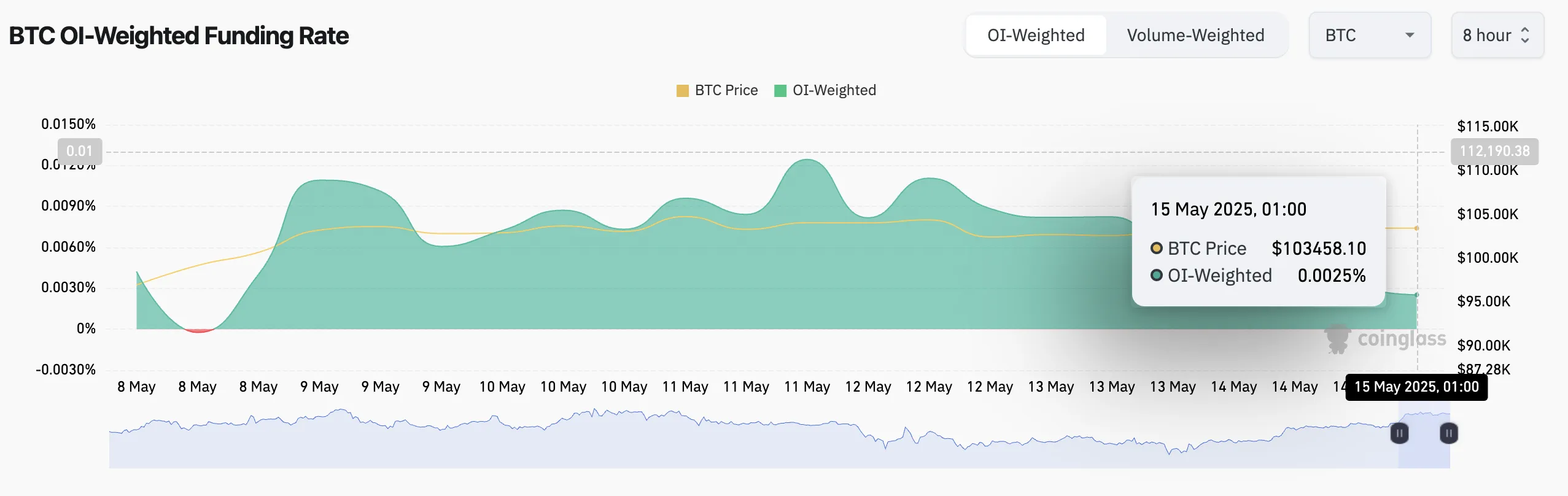

For example, the currency financing rate is still positive, indicating that merchants are still ready to pay a premium to maintain long jobs in permanent future contracts. At the time of the press, this is at 0.0025 %.

The financing rate is a periodic payment that is exchanged between traders in permanent future contracts to maintain prices in accordance with the immediate market.

When its value is positive like this, it indicates a bullish feeling and high demand for phase. This means that traders who hold long BTC sites pay those who occupy short positions, a trend that can increase the value of the currency.

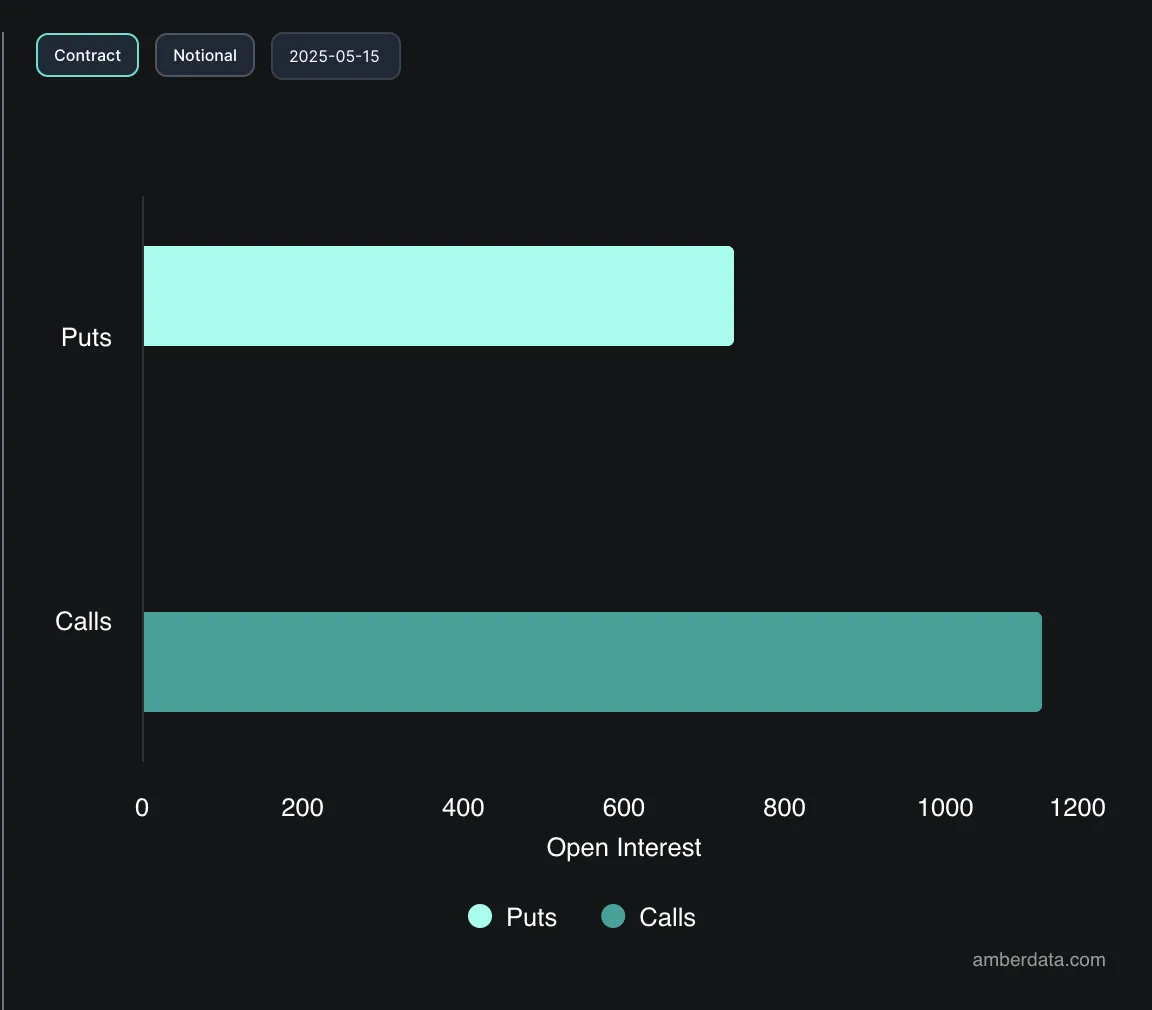

In addition, options activity shows greater demand for calls, indicating that traders define the potential upward trend in the near term.

In conclusion, flows indicate that institutional investors may buy a decrease, betting on a long -term recovery in the BTC price.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.