Bitcoin’s filtering data shows that the price can bounce to $ 109,000

Bitcoin was the leader in a corrective stage since it reached its highest level at $ 111,968 on May 22. The King Coin has decreased to less than the main support level of $ 105,000 to trade at $ 104,536 at the time of the press, reflecting the sale pressure.

However, the data on the chain indicates a possible recovery above this decisive support level, with the possibility of a BTC re -testing high on the horizon. This analysis breaks the main visions.

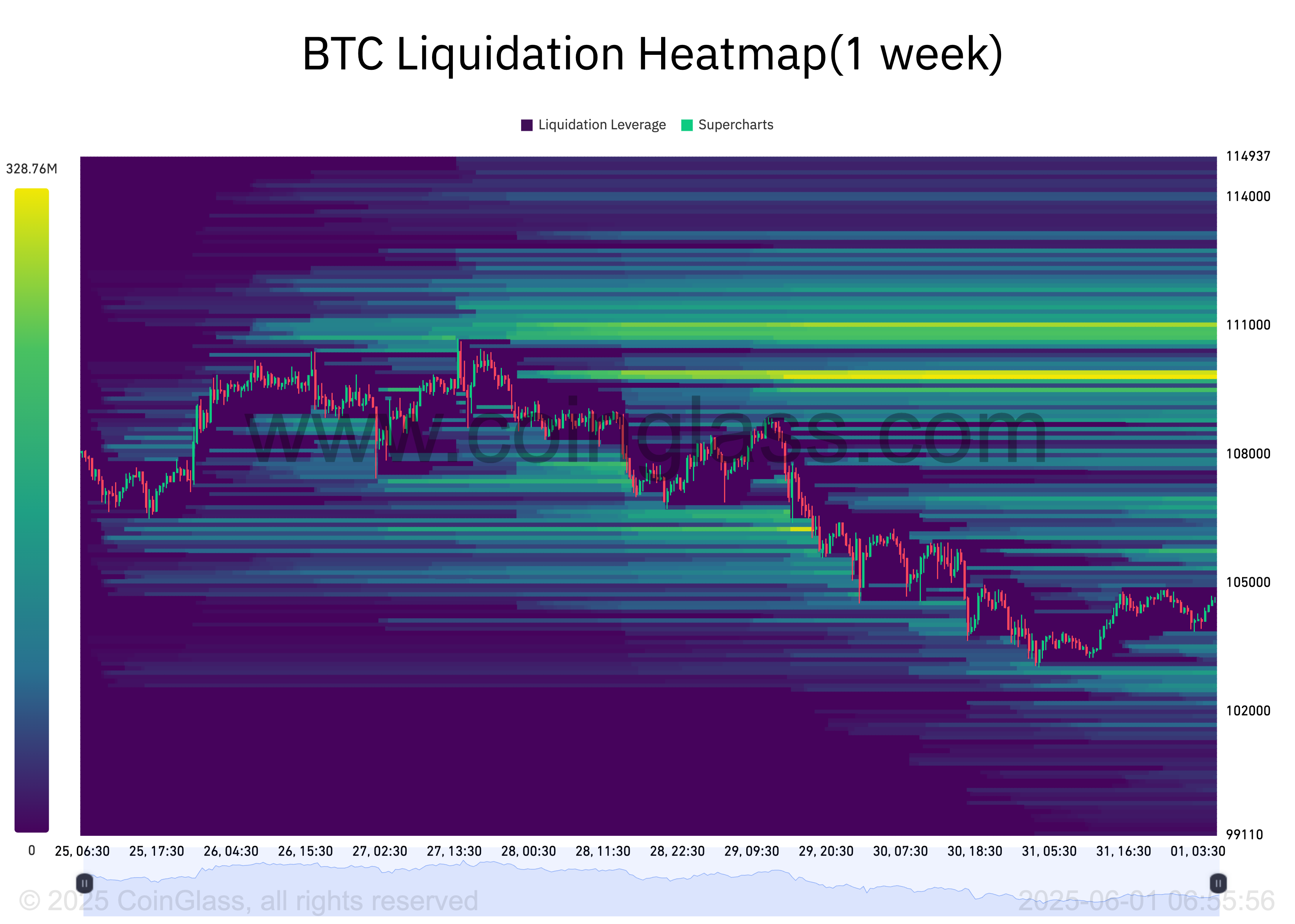

BTC Cilluid Colusters Narders Tower $ 109,000

The evaluation of the Heat Mapiance map in BTC shows a remarkable focus of liquidity around the price area of $ 109,933.

Filtering temperature maps determine price levels as large groups of summons are likely to be filtered. These maps highlight high -liquidity areas, often coded in color to show intensity, with brighter (yellow) areas representing larger liquidation potential.

These cluster areas are usually working as a magnet for prices, as the market tends to move towards these areas to create references and open fresh parking.

Therefore, for BTC, the convergence of a large volume of liquidity at the price level 109,933 dollars indicates a strong interest in buying or closing short positions at this price. It creates space for a rise towards a sign of $ 109,000.

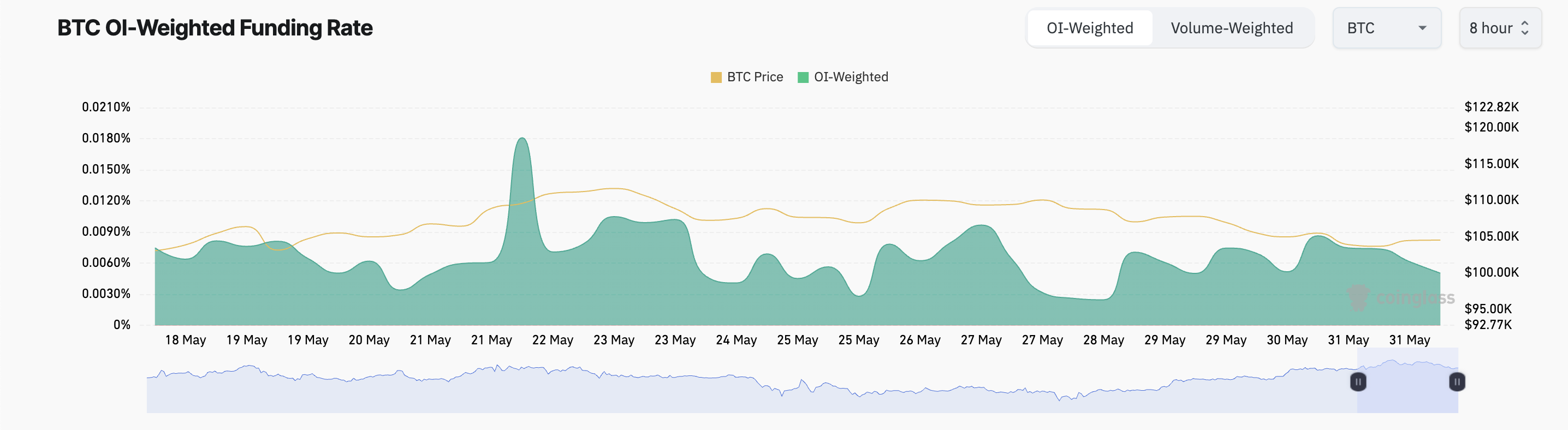

Moreover, the currency financing has remained positive despite the recent withdrawal. At the time of the press, this is 0.005 %, for each coinglass.

The financing rate is a periodic payment between traders in permanent future contracts to maintain the contract price with the immediate price. When the financing rate is positive, there is a higher demand for long jobs.

This means that more traders continue to bet on the high price of BTC, even in the face of strengthening the landfill.

BTC PRICE TIEERS between $ 103,000 support and $ 109,000 liquidity zone

BTC recorded a 1 % modest profit over the past 24 hours, wore support level 103,952 dollars. If the demand rises, this support hall can maintain prices and pay prices over the psychological barrier at $ 105,000, which is likely to target 106,307 dollars.

A clean break over this area may open the door to 109,000 dollars with a thick dollar, with the positions of benefit.

However, increasing profits can withdraw BTC to less than $ 103,952, with an additional decrease of about 102,590 dollars.

Post -Bitcoin filtering data shows that the price may date back to $ 109,000 first appeared on Beincrypto.